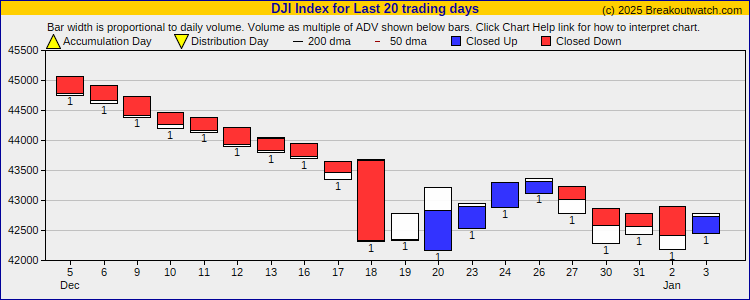

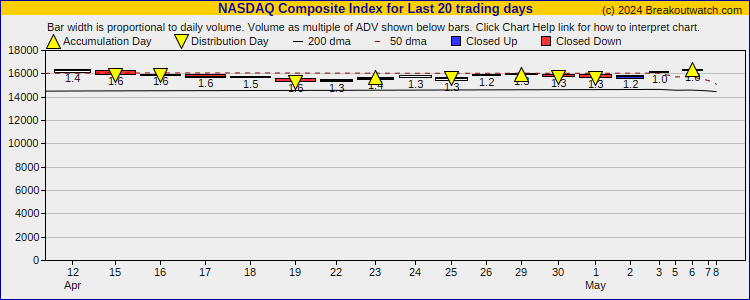

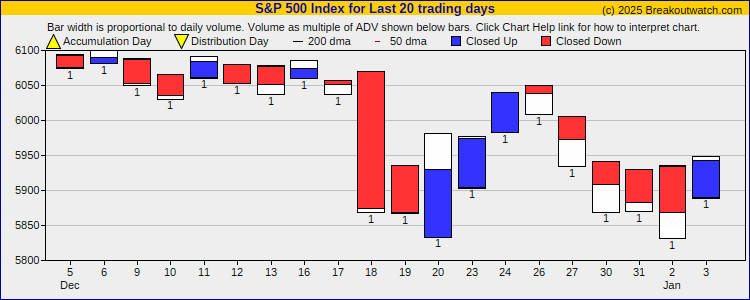

*Accumulation/Distribution Day count over

last 20 days

| Performance | 1 Week | 13 Weeks | 26 Weeks | Year-to-Date |

|---|---|---|---|---|

| Best Index | S&P 500 195.96 % |

S&P 500 209.79 % |

S&P 500 254.22 % |

S&P 500 214.71 % |

| 1 Day | 1 Week | 3 Weeks | 13 Weeks | |

| Industry | Networking & Communication Devices | Networking & Communication Devices | Furnishings | Networking & Communication Devices |

| Most Improved Industry | Silver + -1 |

Silver + -1 |

Silver + -1 |

Silver + -1 |

| No of breakout attempts: | 23 |

| No. of successful breakouts: | 15 |

| Symbol | Chart Pattern |

Gain above BoP |

Vol as % ADV |

Group |

Industry |

|---|---|---|---|---|---|

| GNK | CWH | 0.65 % | -0.13 % | Industrials | Marine Shipping |

| ALKT | SQZ | 1.33 % | 0.64 % | Technology | Software - Application |

| BAND | SQZ | 2.97 % | -0.11 % | Technology | Software - Infrastructure |

| BMA | SQZ | 0.92 % | -0.35 % | Financial Services | Banks - Regional |

| BPMC | SQZ | 3.84 % | 0.07 % | Healthcare | Biotechnology |

| GIII | SQZ | 0.43 % | -0.52 % | Consumer Cyclical | Apparel Manufacturing |

| GLP | SQZ | 0.13 % | -0.29 % | Technology | Information Technology Services |

| HCI | SQZ | 0.06 % | -0.08 % | Industrials | Waste Management |

| MAX | SQZ | 3.95 % | 0.33 % | Financial Services | Asset Management |

| NAMS | SQZ | 0.69 % | 0.3 % | Healthcare | Biotechnology |

| NEXA | SQZ | 1.23 % | -0.76 % | Financial Services | Banks - Regional |

| RACE | SQZ | 0.06 % | -0.57 % | Consumer Cyclical | Auto Manufacturers |

| SILK | SQZ | 3.65 % | 0.98 % | Healthcare | Medical Devices |

| SWTX | SQZ | 0.3 % | 0.16 % | Healthcare | Biotechnology |

| UVE | SQZ | 2.66 % | -0.12 % | Energy | Uranium |