| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

Market Summary

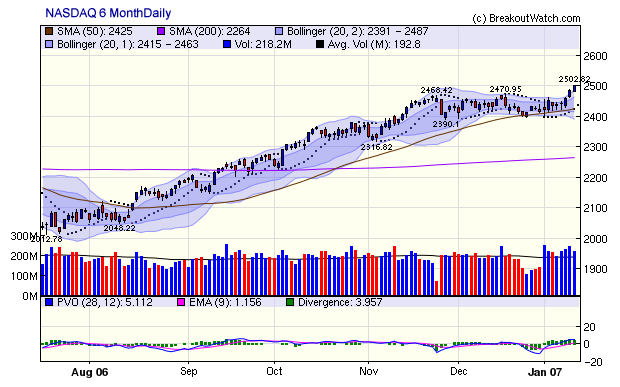

Expectations of an early cut in interest rates to stimulate a flagging economy are now almost extinguished. This expectation helped sustain stock prices in recent weeks but a different dynamic is now fueling the New Year rally. Retail sales in December announced on Friday were markedly higher than expected showing that consumer spending is still strong. With energy prices falling, it is likely that spending will remain strong as consumers have more disposable income to spend on other goods and services. Lower jobless claims announced on Thursday showed that employment is also holding up, and although there is a potential for wage push inflation stemming from full employment, lower energy prices will provide an offsetting effect. The indications are that the economy is robust and investors are now betting that corporate earnings will remain healthy through 2007, particularly the new economy stocks represented on the NASDAQ. The DJI closed at new highs on Thursday and Friday to gain 0.75% for the week. The NASDAQ was by far the stronger performer, though, with a 2.82% gain for the week as it moved higher each day racking up three accumulation days in succession. The S&P 500 closed 0.88% higher.

Last week we saw a potential head and shoulders pattern developing on the NASDAQ. This pattern is bearish, if completed, but this weeks action first took out the right shoulder resistance on Wednesday and then the head on Friday to set a new 6-year high. The index is now tracking the upper Bollinger Band, and although we might expect a pullback to within the band, the Percent Volume Oscillator (PVO) is above zero indicating that the current upward trend will be maintained in the short term.

The number of breakouts shot up to 40 this week from just 12 last week. Incyte Corp. (INCY) broke out from cup-with-handle formation on Tuesday and gained 18% by Friday's close. INCY was also a pick on our TradeWatch Buy at Open list. Shaw Communications (SJR) also made double digit gains after a cup-with-handle breakout on Wednesday and closed 13.5% higher.

| Get a 14 day Trial of our premium 'Platinum'

service and TradeWatch for just $9.95 and if you subsequently subscribe

to any subscription level we will credit your $9.95 to your subscription.

14

Day Platinum Trial |

There were no new features added this week.

Which Technical and Fundamental Factors have the Most Influence on Maximum Gains?

This week, we look at the factors having the most impact on breakout success. Once again, this topic was suggested by a subscriber and we encourage suggestions for this section of our newsletter.

Recognizing that our subscribers have different investment time frames and that there could be different factors at work in the short, medium and long term, we looked at those factors which were the best predictor of gains achieved over 1 week, 1 month and 1 year. As you might expect, there is some variation in the factors that are important as we look at these different time frames. Technical factors and pattern characteristics tend to be very import in the short term, while fundamental factors begin to have an influence over the medium term although it is the initial boost given by technical factors that are always the most important predictor of the best gains.

The methodology we used for this analysis was a technique called 'stepwise regression'. This is a multiple regression technique which selects the best explanatory variables for a statistical model when there is a large number of potential variables that could influence the dependant variable (see Wikipedia). In our case we have 34 possible explanatory variables to choose. These are listed at the end of this article.

We looked at all cup-with-handle breakouts in the two years 1/2/04 to 12/30/05 and measured the maximum intra-day high achieved within 1 week after breakout, 1 month after breakout and 1 year after breakout. If a breakout failed, that is fell by at least 8% from its breakout price, then it wasn't considered beyond the date on which it failed. For example, if a breakout failed two weeks after its breakout date, then the maximum gain for the 1 month and 1 year time frames was limited to that obtained in the first week. This was so as to exclude cases where a failure subsequently went on to make significant gains over a longer period.

In order of importance, the stepwise regression selected variables in order of importance as follows. Variables not shown were not statistically significant and were excluded by the stepwise process.

| Dependant Variable | Explanatory Variables* Selected by the Regression |

Explanatory Power |

|---|---|---|

1 Week Max. Gain % |

RS Rank, BOvolRatio, Handle Depth, Handle Length, Inverse BoP, VADVR, CET1, CEF3, Cup Length, Cup Depth |

61% |

1 Month Max. Gain % |

RS Rank , BOvolRatio, inverse BoP, CET1, Handle Depth, CEF1, Handle Length, VADVR, CEF7, M_SPX, RCQ |

60% |

| 1 Year Max. Gain % (Mean:45.6; S.D: 48.4) |

RS Rank, Inverse BoP, CEF3, M_SPX, CET1, BOvolRatio, Handle Depth, CEF2, HQ, industryRankCT |

52% |

As you can understand, the range of gains for each period is quite large as the mean and standard deviation (S.D.) numbers show. The 'Explanatory Power' is a measure of how much variability in the range of gains is explained by the model. We find the following points of most interest:

- Over all time frames, Relative Strength Rank is by far the most important variable. For the 1 week gain, it explained 51% of the 61% that all variables together explained. For the 1 month gain, its importance rose to explaining 54% and for 1 year it explained 48% out of the 52% explanatory power of the regression model.

- Note that the volume on breakout day (BOvolRatio) is the second most important variable in the 1 week and 1 month cases, but is much less significant over a year.

- The model found inverse breakout price useful, particularly over the 1 year horizon where it moved into second pace. In other words, lower priced stocks will make the biggest gains.

*Possible Explanatory Variables

Cup with Handle Indicators

Breakout Price (BOP), Inverse Breakout Price (Inverse BoP), Pivot Depth, Handle

Length, Cup Length, Handle Depth, Cup Depth, RCQ (Right Cup Quality), HQ

(Handle Quality), CQ (Chart Quality), PVI (price/Volume Indicator), VADVR

(Volume to average volume ratio on day before breakout), BOvolRatio (Volume

to average volume ratio on day of breakout), Retracement (from base low)

Technical Indicators

CET1 (price relative to 50 and 200 dma), CET2 (Relative Strength Rank), CET3

(Rank in Industry), CET4 (% off 52 week high), CET5 (Up/Down Ratio), industryRankCT

(Industry Technical Rank)

Fundamental Indicators

CEF1 (Q to Q Earnings Growth), CEF2 (Positive Quarterly Earnings), CEF3 (Q

earnings Growth Acceleration), CEF4 (Y on Y Earnings Growth), CEF5 (Q on Q

Sales Growth), CEF6 (Q Sales Growth Acceleration), CEF7 (Forward Earnings Growth),

CEF8 (Institutional Ownership), CEF9 (Return on Equity), CEF10 (Cash Flow),

CEF11 (Net Margins)

Market Conditions

NASDAQ Market Signal, M_IXIC (M indicator for NASDAQ), M_SPX (M indicator for

S&P 500)

Investment Advisors Using our Service

TradeRight Securities, located in a suburb of Chicago, is a full services investment management company and broker/dealer. They have been a subscriber, and user, of BreakoutWatch.com for some time now. They practice CANTATA and use Breakoutwatch.com as a “research analyst”. You can learn more about TradeRight Securities at: www.traderightsecurities.com. If you’re interested in speaking to a representative, simply call them toll-free at 1-800-308-3938 or e-mail gdragel@traderightsecurities.com.

PivotPoint Advisors, LLC takes a technical approach to investment planning and management. A breakoutwatch.com subscriber since May, 2004, they use breakouts, market signals, and now TradeWatch to enhance returns for their clients. Learn more at http://pivotpointadvisors.net or contact John Norquay at 608-826-0840 or by email at john.norquay@pivotpointadvisors.net.

Note to advisors: If you would like to be listed here, please contact us. As a service to those who subscribe to us, there is no additional charge to be listed here.

| Get a 14 day Trial of

our premium 'Platinum' service and TradeWatch for just $9.95 and

if you subsequently subscribe to any subscription

level we will credit your $9.95 to your subscription.

14

Day Platinum Trial |

| Index | Value | Change Week | Change YTD | Market1 Signal |

||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | 12556.1 | 1.28% | 0.75% | enter | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 2502.82 | 2.82% | 3.62% | enter | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 1430.73 | 1.49% | 0.88% | enter | ||||||||||||||||||||||||||||||||||||

1The Market Signal is derived from our proprietary

market model. The market model is described on the site. 2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone (similar to IBD). The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

# of Breakouts

|

Period Average1

|

Max. Gain During Period2

|

Gain at Period Close3

|

|

|---|---|---|---|---|

| This Week | 40 | 28.62 | 2.21% | 0.91% |

| Last Week | 12 | 30.54 | 2.09% | -3.19% |

| 13 Weeks | 424 | 32.85 | 13.02% |

5.41% |

Sector

|

Industry

|

Breakout Count for Week

|

|---|---|---|

FINANCIAL SERVICES

|

Closed-End Fund - Equity

|

7

|

INSURANCE

|

Property & Casualty Insurance

|

4

|

COMPUTER SOFTWARE & SERVICES

|

Information Technology

|

2

|

DRUGS

|

Biotechnology

|

2

|

ELECTRONICS

|

Diversified Electronics

|

2

|

AEROSPACE/DEFENSE

|

Aerospace/Defense Products & Services

|

1

|

BANKING

|

Savings & Loans

|

1

|

BANKING

|

Regional - Pacific Banks

|

1

|

CHEMICALS

|

Specialty Chemicals

|

1

|

CHEMICALS

|

Chemicals - Major Diversified

|

1

|

COMPUTER SOFTWARE & SERVICES

|

Multimedia & Graphics Software

|

1

|

CONSUMER NON-DURABLES

|

Paper & Paper Products

|

1

|

DIVERSIFIED SERVICES

|

Management Services

|

1

|

ELECTRONICS

|

Semiconductor - Broad Line

|

1

|

ELECTRONICS

|

Scientific & Technical Instruments

|

1

|

FINANCIAL SERVICES

|

Asset Management

|

1

|

FINANCIAL SERVICES

|

Closed-End Fund - Foreign

|

1

|

FINANCIAL SERVICES

|

Closed-End Fund - Debt

|

1

|

FOOD & BEVERAGE

|

Processed & Packaged Goods

|

1

|

HEALTH SERVICES

|

Medical Instruments & Supplies

|

1

|

MEDIA

|

CATV Systems

|

1

|

MEDIA

|

Broadcasting - TV

|

1

|

REAL ESTATE

|

REIT - Residential

|

1

|

RETAIL

|

Grocery Stores

|

1

|

TELECOMMUNICATIONS

|

Diversified Communication Services

|

1

|

TELECOMMUNICATIONS

|

Wireless Communications

|

1

|

TRANSPORTATION

|

Regional Airlines

|

1

|

TRANSPORTATION

|

Shipping

|

1

|

2This represents the return if each stock were bought at its breakout price and sold at its intraday high.

3This represents the return if each stock were bought at its breakout price and sold at the most recent close.

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | SWKS | Skyworks Solutions Inc | 88 |

| Top Technical | PRGX | Prg-schultz Intl Inc | 57 |

| Top Fundamental | WRLD | World Acceptance Corp | 31 |

| Top Tech. & Fund. | WRLD | World Acceptance Corp | 31 |

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | DTPI | Diamondcluster Intl Inc | 67 |

| Top Technical | ONNN | On Semiconductor Corp | 63 |

| Top Fundamental | STP | Suntech Power Holdings Co Ltd | 35 |

| Top Tech. & Fund. | STP | Suntech Power Holdings Co Ltd | 35 |

If you received this newletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2007 NBIcharts, LLC dba BreakoutWatch.com. All rights reserved.

" BreakoutWatch," the BreakoutWatch.com "eye" logo, and the slogan "tomorrow's breakouts today" are service marks of NBIcharts LLC. All other marks are the property of their respective owners, and are used for descriptive purposes only.