| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

Market Summary

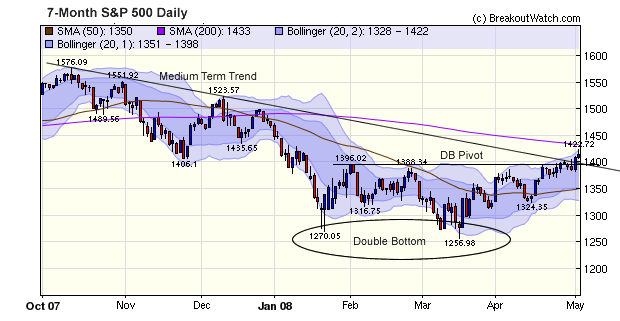

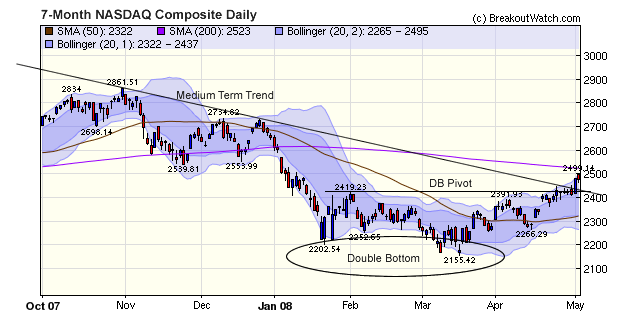

S&P 500 and NASDAQ Break Through Resistance

Both the NASDAQ Composite and S&P 500 broke out from their double-bottom bases this week and simultaneously broke the medium term downward trend line. Both indexes gained for the third week in succession and have gained in four out of the last six weeks. The NASDAQ is approaching its 200 day moving average, which is the level needed before our market model signals an 'enter' for that index.

Why are the markets rising while the economic fundamentals continue to deteriorate and will the trend continue?

Firstly, we think the economic fundamentals are deteriorating despite the loss of fewer jobs than expected and the supposed fall in unemployment. The Fed's statement on Tuesday confirmed that further weakening can be expected and their move on Friday to increase the Term Auction Facility funds by 50% and relax standards for the Term Securities Lending Facility (TSLF) to include AAA/Aaa-rated asset-backed securities shows they expect the liquidity situation to get worse before it gets better. We have long held that the Administration and Fed would do everything in their power to support the markets this year and Bernanke seems to have found the silver bullet with the combination of interest rate and discount window rate cuts together with the TAF and TSLF loans. Loans under these facilities mounted to $413 billion by April 30 and will clearly go higher. Acknowledged writedowns on mortgage losses amount to at most $250 billion so there is a comfortable surplus of capital that can be put to work. It was intended that these loans be used to relieve the credit crunch but there is little evidence that is happening (in fact it seems to be getting worse so it's reasonable to assume that this excess is being invested in the equity markets rather than to expand credit. If this reasoning is correct, then we can expect markets to move higher until the perceived risk of lending money is lower than the perceived risk of equity investments.

The number of breakouts (42) and the gains they make (3.6% for the week) continues to improve so we are taking the unusual step of sharing with our newsletter subscribers the full list of breakouts in the last week. This list is normally only available to our subscribers. You will note that the breakouts all came from a cup-with-handle pattern and were all market leaders (as measured by their high RS Rank values showing that they mostly outperformed over 90% of the market over the last 12 months) .

BreakoutWatch

Sustained Breakouts for Week Ending 05/02/08 | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| B'out Date |

Symbol | Base | B'Out Price |

B'out Day Close |

B'out RS |

Last Close |

Current

% off BOP |

*Gain at Intraday High |

Expected Gain % |

| 05/02/08 | SPN | CwH | 46.97 | 47.33 | 92.00 | 47.33 | 0.77% | 1.66% | 58 |

| 05/02/08 | SM | CwH | 45.00 | 45.30 | 90.00 | 45.3 | 0.67% | 1.11% | 54 |

| 05/02/08 | SIRT | CwH | 22.35 | 22.39 | 98.00 | 22.39 | 0.18% | 0.67% | 64 |

| 05/02/08 | NUVA | CwH | 40.63 | 40.74 | 90.00 | 40.74 | 0.27% | 1.48% | 44 |

| 05/02/08 | MVL | CwH | 30.00 | 30.25 | 86.00 | 30.25 | 0.83% | 2.17% | 48 |

| 05/02/08 | CDS | CwH | 9.40 | 9.50 | 99.00 | 9.5 | 1.06% | 3.19% | 99 |

| 05/01/08 | VIT | CwH | 9.18 | 9.24 | 98.00 | 8.79 | -4.25% | 5.66% | 100 |

| 05/01/08 | ULTI | CwH | 33.24 | 35.30 | 90.00 | 35.85 | 7.85% | 9.99% | 47 |

| 05/01/08 | STD | CwH | 21.81 | 21.89 | 87.00 | 21.77 | -0.18% | 0.96% | 56 |

| 05/01/08 | SBS | CwH | 51.87 | 52.90 | 90.00 | 54.08 | 4.26% | 5.07% | 45 |

| 05/01/08 | PVTB | CwH | 35.82 | 35.86 | 81.00 | 38.17 | 6.56% | 7.34% | 40 |

| 05/01/08 | OTTR | CwH | 37.81 | 38.70 | 88.00 | 37.7 | -0.29% | 8.41% | 32 |

| 05/01/08 | ORIT | CwH | 15.25 | 15.82 | 86.00 | 16.23 | 6.43% | 12.46% | 56 |

| 05/01/08 | NPO | CwH | 37.68 | 38.32 | 82.00 | 37.88 | 0.53% | 6.69% | 42 |

| 05/01/08 | MANT | CwH | 48.66 | 49.53 | 95.00 | 48.44 | -0.45% | 4.81% | 52 |

| 05/01/08 | GTI | CwH | 20.70 | 21.68 | 96.00 | 21.64 | 4.54% | 6.09% | 73 |

| 05/01/08 | CNQR | CwH | 35.85 | 36.76 | 95.00 | 38.6 | 7.67% | 10.66% | 63 |

| 05/01/08 | CIR | CwH | 50.75 | 51.05 | 90.00 | 49.91 | -1.66% | 1.85% | 50 |

| 05/01/08 | CEDC | CwH | 63.69 | 65.32 | 97.00 | 64.91 | 1.92% | 4.8% | 55 |

| 05/01/08 | BMR | CwH | 26.88 | 27.44 | 86.00 | 27.24 | 1.34% | 3.24% | 37 |

| 05/01/08 | BABY | CwH | 19.95 | 20.98 | 88.00 | 21.4 | 7.27% | 8.02% | 62 |

| 05/01/08 | ATK | CwH | 110.95 | 113.29 | 83.00 | 113.69 | 2.47% | 3.01% | 30 |

| 04/30/08 | VIV | CwH | 6.68 | 6.75 | 94.00 | 7.37 | 10.33% | 17.07% | 107 |

| 04/30/08 | SPSS | CwH | 42.46 | 42.64 | 83.00 | 41.73 | -1.72% | 2.12% | 52 |

| 04/30/08 | PDA | CwH | 54.46 | 55.12 | 93.00 | 58.8 | 7.97% | 11.4% | 54 |

| 04/30/08 | OTEX | CwH | 35.74 | 37.16 | 95.00 | 37.81 | 5.79% | 6.97% | 61 |

| 04/30/08 | OIS | CwH | 49.58 | 50.06 | 93.00 | 49.29 | -0.58% | 4.76% | 64 |

| 04/30/08 | MPWR | CwH | 21.91 | 22.63 | 94.00 | 23.9 | 9.08% | 11.27% | 58 |

| 04/30/08 | LFUS | CwH | 37.73 | 37.77 | 85.00 | 35.61 | -5.62% | 1.91% | 34 |

| 04/30/08 | ITU | CwH | 26.97 | 28.05 | 87.00 | 29.96 | 11.09% | 19.95% | 58 |

| 04/29/08 | TECH | CwH | 70.50 | 70.78 | 84.00 | 71.99 | 2.11% | 8.09% | 40 |

| 04/29/08 | GLW | CwH | 26.30 | 26.53 | 83.00 | 27 | 2.66% | 3.8% | 47 |

| 04/29/08 | CGNX | CwH | 23.34 | 25.84 | 93.00 | 25.02 | 7.20% | 13.32% | 60 |

| 04/28/08 | WWY | CwH | 64.23 | 76.91 | 83.00 | 75.99 | 18.31% | 24.82% | 45 |

| 04/28/08 | SIRT | CwH | 22.34 | 22.35 | 98.00 | 22.39 | 0.22% | 0.72% | 66 |

| 04/28/08 | NTES | CwH | 20.88 | 21.56 | 84.00 | 23.5 | 12.55% | 15.8% | 60 |

| 04/28/08 | GA | CwH | 13.34 | 14.10 | 92.00 | 15.69 | 17.62% | 25.94% | 85 |

| 04/28/08 | ARLP | CwH | 40.34 | 41.75 | 81.00 | 41.73 | 3.45% | 5.78% | 48 |

| 04/28/08 | ARD | CwH | 47.50 | 47.87 | 98.00 | 44.45 | -6.42% | 3.89% | 67 |

| 04/28/08 | ACL | CwH | 156.90 | 159.40 | 81.00 | 159.13 | 1.42% | 3.15% | 39 |

No New Features this Week

Get a 14 day free

Trial of our premium 'Platinum' service and TradeWatch.

No Credit Card Required.

Click

Here for 14 Day Free Trial |

| Index | Value | Change Week | Change YTD | Market1 Signal |

||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | 13058.2 | 1.29% | -1.56% | enter | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 2476.99 | 2.23% | -6.61% | exit | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 1413.9 | 1.15% | -3.71% | enter | ||||||||||||||||||||||||||||||||||||

| Russell 2000 | 725.74 | 0.53% | -5.26% | N/A | ||||||||||||||||||||||||||||||||||||

1The Market Signal is derived from our proprietary

market model. The market model is described on the site. 2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone (similar to IBD). The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

# of Breakouts |

Period Average1 |

Max. Gain During Period2 |

Gain at Period Close3 |

|

|---|---|---|---|---|

| This Week | 42 | 18.54 | 7.2% | 3.62% |

| Last Week | 30 | 16.15 | 10.27% | 4.96% |

| 13 Weeks | 252 | 19.38 | 12.05% |

4.14% |

Sector |

Industry |

Breakout Count for Week |

|---|---|---|

BANKING |

Foreign Money Center Banks |

2 |

COMPUTER SOFTWARE & SERVICES |

Business Software & Services |

2 |

DRUGS |

Biotechnology |

2 |

ENERGY |

Oil & Gas Equipment & Services |

2 |

HEALTH SERVICES |

Medical Instruments & Supplies |

2 |

INTERNET |

Internet Software & Services |

2 |

MANUFACTURING |

Industrial Electrical Equipment |

2 |

AEROSPACE/DEFENSE |

Aerospace/Defense Products & Services |

1 |

AEROSPACE/DEFENSE |

Aerospace/Defense - Major Diversified |

1 |

AUTOMOTIVE |

Auto Parts |

1 |

BANKING |

Regional - Northeast Banks |

1 |

BANKING |

Regional - Midwest Banks |

1 |

COMPUTER SOFTWARE & SERVICES |

Multimedia & Graphics Software |

1 |

COMPUTER SOFTWARE & SERVICES |

Application Software |

1 |

COMPUTER SOFTWARE & SERVICES |

Technical & System Software |

1 |

DIVERSIFIED SERVICES |

Business Services |

1 |

ELECTRONICS |

Semiconductor - Specialized |

1 |

ELECTRONICS |

Scientific & Technical Instruments |

1 |

ENERGY |

Independent Oil & Gas |

1 |

ENERGY |

Oil & Gas Drilling & Exploration |

1 |

FINANCIAL SERVICES |

Diversified Investments |

1 |

FOOD & BEVERAGE |

Meat Products |

1 |

FOOD & BEVERAGE |

Confectioners |

1 |

FOOD & BEVERAGE |

Beverages - Wineries & Distillers |

1 |

HEALTH SERVICES |

Medical Appliances & Equipment |

1 |

INTERNET |

Internet Information Providers |

1 |

MANUFACTURING |

Industrial Equipment & Components |

1 |

MEDIA |

Movie Production, Theaters |

1 |

METALS & MINING |

Nonmetallic Mineral Mining |

1 |

REAL ESTATE |

REIT - Office |

1 |

TELECOMMUNICATIONS |

Communication Equipment |

1 |

TELECOMMUNICATIONS |

Telecom Services - Foreign |

1 |

UTILITIES |

Foreign Utilities |

1 |

UTILITIES |

Electric Utilities |

1 |

2This represents the return if each stock were bought at its breakout price and sold at its intraday high.

3This represents the return if each stock were bought at its breakout price and sold at the most recent close.

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | AIRV | AIRVANA, INC. | 109 |

| Top Technical | IPAR | Inter Parfums Inc | 50 |

| Top Fundamental | TYL | Tyler Technologies | 57 |

| Top Tech. & Fund. | FTI | Fmc Technologies | 53 |

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | VIT | VAN KAMPEN HI INC | 100 |

| Top Technical | VIT | VAN KAMPEN HI INC | 100 |

| Top Fundamental | CEDC | Central European Dist | 55 |

| Top Tech. & Fund. | ARD | Arena Resources Inc | 67 |

If you received this newletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2008 NBIcharts, LLC dba BreakoutWatch.com. All rights reserved.

" BreakoutWatch," the BreakoutWatch.com "eye" logo, and the slogan "tomorrow's breakouts today" are service marks of NBIcharts LLC. All other marks are the property of their respective owners, and are used for descriptive purposes only.