| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

Our

market model for small cap stocks turned down again this week and it

looked as if we were heading for a test of last November's low.

However, the market rallied on Thursday and Friday following release of

the second $350 billion of TARP funds and further details on the $850

billion Obama stimulus package. Bailout funds for Bank of America,

Citibank and Chrysler financials also helped to turn the tide.

Under 'normal' circumstances, we would consider Thursday's market

action, when it recovered from a steep loss to close higher, day one of

a new rally and would be looking for a follow-through day as early as

next Tuesday to confirm the rally. As it happens, next Tuesday is also

Inauguration Day, so we may well get an apparent follow-through day

that will fuel the rally for a while longer. This would therefore seem

to be a short term buying opportunity but we expect it will be another

bear-market rally with another sell-off to follow, so take your profits

early!

As you can see from our New Features and Top Tip below, the Head and Shoulders Bottom pattern has delivered some profitable breakouts recently and should not be overlooked. The beta version of this watchlist is open to all subscribers and guests for a little while longer.

We have continued to enhance our new watchlist format with the addition of a backtest feature. This is very similar to the backtest option that has been available for the cup-with-handle watchlist for several years.

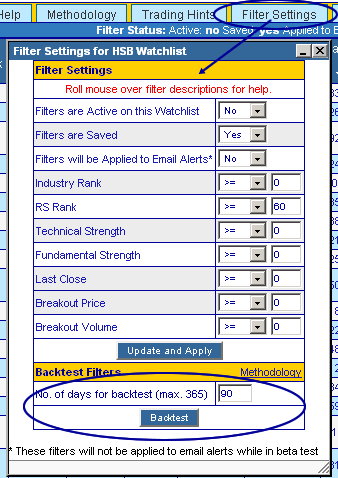

To use the backtest feature on the H&S Bottom watchlist, choose the Mine for Candidates > Long Positions > H&S Bottom (beta) menu choice. You then access the filter setting by choosing the 'Filter Settings' tab.

Enter the filters that you want to test and then set the number of days over which to run a backtest and click the 'backtest' button.

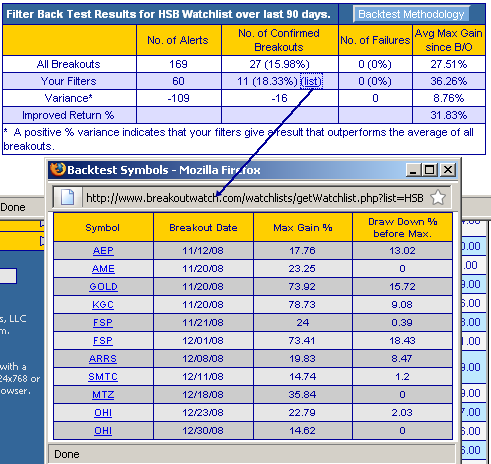

As you can see from the results shown above, the Head and Shoulders Bottom list has produced some outstanding winners in the last three months. All the breakouts gained at least 5% (hence the zero fails number) and the average of all HSB breakouts was 27.5%. using a filter of a minimum RS rank of 60 improved the average return with three breakouts gaining over 70%.

| Index | Value | Change Week | Change YTD | Trend | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | 8281.22 | -3.7% | -5.64% | Down | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 1529.33 | -2.69% | -3.02% | Down | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 850.12 | -4.52% | -5.88% | Down | ||||||||||||||||||||||||||||||||||||

| Russell 2000 | 466.45 | -3.09% | -6.61% | Down | ||||||||||||||||||||||||||||||||||||

| Wilshire 5000 | 8603.2 | -4.26% | -5.33% | Down | ||||||||||||||||||||||||||||||||||||

1The

Market Signal is derived from our proprietary

market model. The market model is described on the site.

2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

|

# of Breakouts

|

Period Average1

|

Max. Gain During Period2

|

Gain at Period Close3

|

|

|---|---|---|---|---|

| This Week | 3 | 4 | 12.37% | 9.18% |

| Last Week | 5 | 3.69 | 9.05% | 4.14% |

| 13 Weeks | 51 | 4 | 11.01% |

-2.21% |

2This represents the return if each stock were bought at its breakout price and sold at its intraday high.

3This represents the return if each stock were bought at its breakout price and sold at the most recent close.

|

Category

|

Symbol

|

Company Name

|

Expected Gain1

|

|---|---|---|---|

| Best Overall | TSYS | Telecommunications Systm | 113 |

| Top Technical | HMSY | Hms Holdings Corp | 45 |

| Top Fundamental | WES | WESTERN GAS PARTNERS | 78 |

| Top Tech. & Fund. | WES | WESTERN GAS PARTNERS | 78 |

|

Category

|

Symbol

|

Company Name

|

Expected Gain1

|

|---|---|---|---|

| Best Overall | PSD | Puget Sound Energy | 51 |

| Top Technical | PSD | Puget Sound Energy | 51 |

| Top Fundamental | PSD | Puget Sound Energy | 51 |

| Top Tech. & Fund. | PSD | Puget Sound Energy | 51 |

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2009 NBIcharts, LLC dba BreakoutWatch.com.

All rights reserved.

"

BreakoutWatch," the BreakoutWatch.com "eye" logo, and the

slogan "tomorrow's breakouts today" are service marks of NBIcharts

LLC. All other marks are the property of their respective owners, and

are

used for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business

Daily or with Mr. William O'Neil.

Our site, research and analysis is supported entirely by subscription

and is free from advertising.