| Weekly Newsletter 04/17/09 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Login Trial Guest | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

You are receiving this email because

you are or were a BreakoutWatch.com subscriber, or have subscribed to

our weekly newsletter. This newsletter

summarizes the breakout events of the week and provides additional guidance

that does not fit into our daily format. It is published each weekend.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Prior editions of this newsletter with our valuable Tips of the Week are available here. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Weekly Commentary | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

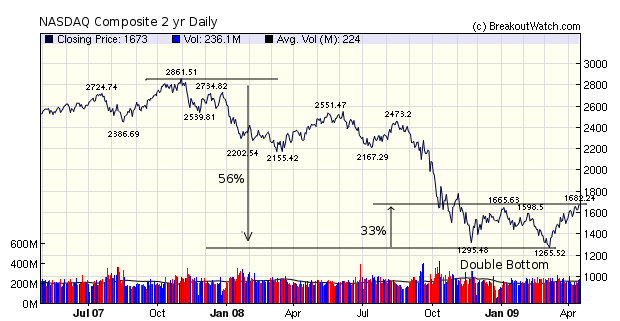

There were several things to feel good about with this week's market action but there are still storm clouds on the horizon. As our chart of the NASDAQ shows, the index has recovered 33% since its March 9 low and on Thursday broke out of its double bottom base. The gain of over 20% qualifies the index as being in a 'bull' market. The index is now 6% positive for the year.

The number of successful breakouts is steadily increasing as is the quality of gains they are making. Take a look at this report of all breakouts since March 9 and note the number of dark blue cells in the final column - these are breakouts that rose by over 20% following breakout. Our Gold and Platinum subscribers were notified of these winning stocks as they broke out and our Bronze and Silver subscribers were notified on breakout day in our daily email. The major banks are reporting profits, although this is somewhat illusory since mark-to-market rules were relaxed; they are borrowing from the Fed and FDIC at very low rates of interest and bolstering their balance sheets with tax-payer funds. Can this rally be sustained? We don't know of course, but bear market rallies of 33% are not unkown.The most famous is the 48% rally from mid-November 1928 to April 1930. Certainly there is cause for doubt that the rally can go much higher.

However, should confidence continue to improve, then we can expect a lot of money currently in cash, bonds and treasuries to pour into the market giving us the mother of all rallies. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| New Features this Week | Additional Value that we added this week | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

No new features this week. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| This Week's Top Tip | Tips for getting the most out of our site | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

No tip this week. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Market Summary | Overview of market direction and industry rotation | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Weekly Breakout Report | How confirmed breakouts performed this week | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

2This represents the return if each stock were bought at its breakout price and sold at its intraday high. 3This represents the return if each stock were bought at its breakout price and sold at the most recent close. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Top Breakout Choices | Stocks on our Cup-and-Handle list with best expected gain if they breakout | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Top Second Chances | Stocks that broke out this week and are still in buyable range | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter. Copyright © 2009 NBIcharts, LLC dba BreakoutWatch.com.

All rights reserved. BreakoutWatch is not affiliated with Investor's Business Daily or with Mr. William O'Neil.

Our site, research and analysis is supported entirely by subscription and is free from advertising. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||