| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

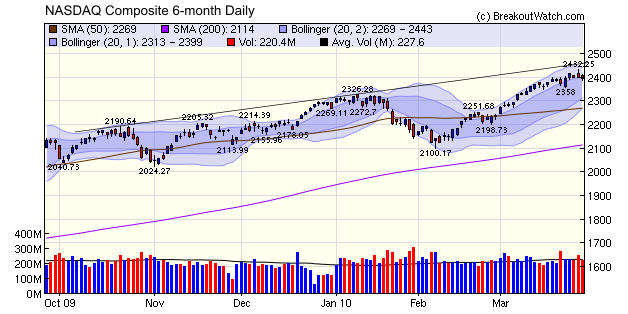

The major indexes closed higher for the week but gains for the NASDAQ were curtailed by three consecutive days of losses leading to Friday's close. The index pulled back from its upper trend line on Thursday and it appears we are in for a few days of consolidation. Next week is a short week due to Good Friday so volumes may be lower causing prices to drift a little lower.

This week's downward revision to fourth quarter GDP indicates that the recovery is even more anemic than it appears. This could lead to disappointing employment figures next week from the ADP private sector employment report on Wednesday which would add to the pullback momentum.

The number of breakouts improved slightly to 24 this week, all from a cup-with-handle pattern except one high-tight-flag and one flat base. Five stocks met our target criteria of a high RS Rank and strong recent earnings: DAN, LVS, CVGI, JBL and KID.

We are always pleased to hear from or meet our subscribers and this week I met with a long term subscriber vacationing on Maui.

My first question always is 'Since you have been with us for many years, you must find the site valuable so how do you use it?. In this case, the answer was to cross-check our rankings against other sources and if there was agreement, then to consider buying after a confirmed breakout.

This subscriber was unaware of our Personal Watchlist feature so for his benefit, and for others who may do something similar, there's a recap of that feature below. But instead of reading the text, why not watch a video tutorial? (This is the first time we've done this so excuse me if it's somewhat amateurish).

![]()

How to Use Personal Watchlists

The Personal Watchlist (PWL) is a means to input stock ideas from multiple sources to determine if any of those many ideas are near a buy price as determined by our CANTATA methodology. Then you can choose to send an alert for the identified stocks on your lists.

Note that email alerts for PWL's are locked at 9:29AM EST for that day. Changes to your PWL's are possible while the market is open and will show up on the alert monitor page, but email alerts are locked in.

The PWL is designed to allow you to create or cut and paste a list of up to 500 stock symbols into each PWL. There are four PWL’s for a total of 2,000 stock symbols. Not that you would normally use that many but, for example, you could add one stock daily for over one year from a daily stock idea source.

Each stock list can be from a different source that you subscribe or read about in an article, or hear about from your stock investors’ group. Even stock ideas from business television programs can be put into a list for comparison with breakoutwatch.com’s stock timing and alert service.

You can select a column from a spreadsheet or a postscript (pdf) file or a Notepad file and copy/cut and then paste into the box for the selected PWL.

To cut and paste from a column of stock symbols in a postscript (pdf) file into the PWL.

1. Open the pdf file page with an Adobe Reader.

2. Click the left mouse button and release it at the bottom right of the stock symbol column

3. Hold down the “ALT” key on the keyboard

4. Click the left mouse button and hold it down as you move the cursor to the top of the list, highlighting all the symbols.

5. Release the left mouse button and the ATL key, the column will be highlighted in blue.

6. Position the cursor over the blue column and click the right mouse button.

7. Select ‘copy’ from the menu with the left mouse button.

8. Now go to the “Personal Watchlist ” menu choice under the Evaluate menu choice.

9. Click the right mouse button and selection ‘paste’ from the menu with the left mouse button.

10. The column of stock symbols should now be in the window.

11. In the top left-hand corner of the PWM window is a box under “New” type in the name of your watchlist and click the GO button. For example, “9-3-08-source XYZ” Your PWL is now saved.

Four PWL’s are the maximum at any one time. If you want to add an additional list, you must first select and delete a PWL you no longer need. You can combine many lists into one list of 500 stock symbols if you choose.

Now you can compare the PWL with the latest breakoutwatch.com chart patterns.

Under “Compare BoW watchlists” is a list and selection arrow. Select the pattern you are most interested and a table will appear showing which stock symbols on your PWL’s matches that pattern. Also listed is the number of occurrences that symbol appears in your PWL’s and the BoW watch list.

By doing this you can now identify which stocks meet your fundamental requirements and breakoutwatch.com’s technical and timing requirements.

You can change your PWL email alert preferences under the Take Action - Alerts > Alert Preferences menu choice.

You can change your email address for alerts under “Account Management” and “Update Account” tabs on the left side of any of our site pages.

| Index | Value | Change Week | Change YTD | Trend | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | 10850.4 | 1.01% | 4.05% | Up | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 2395.13 | 0.87% | 5.55% | Up | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 1166.59 | 0.58% | 4.62% | Up | ||||||||||||||||||||||||||||||||||||

| Russell 2000 | 678.97 | 0.75% | 7.08% | Up | ||||||||||||||||||||||||||||||||||||

| Wilshire 5000 | 12133 | 0.62% | 5.53% | Up | ||||||||||||||||||||||||||||||||||||

1The Market Signal is derived from our proprietary

market model. The market model is described on the site. 2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

# of Breakouts |

Period Average1 |

Max. Gain During Period2 |

Gain at Period Close3 |

|

|---|---|---|---|---|

| This Week | 24 | 17.69 | 4.93% | 1.02% |

| Last Week | 23 | 16.77 | 7.52% | 1% |

| 13 Weeks | 248 | 18.77 | 13.84% |

5.91% |

2This represents the return if each stock were bought at its breakout price and sold at its intraday high.

3This represents the return if each stock were bought at its breakout price and sold at the most recent close.

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | CNO | Conseco Inc. | 111 |

| Top Technical | BONT | Bon-Ton Stores Inc. | 65 |

| Top Fundamental | FIRE | Sourcefire, Inc. | 67 |

| Top Tech. & Fund. | AIXG | Aixtron Aktiengesellschaft | 55 |

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | KID | Kid Brands, Inc. | 112 |

| Top Technical | CVGI | Commercial Vehicle Group Inc. | 89 |

| Top Fundamental | CTRP | Ctrip.com International Ltd. | 53 |

| Top Tech. & Fund. | CTRP | Ctrip.com International Ltd. | 53 |

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2010 NBIcharts, LLC dba BreakoutWatch.com.

All rights reserved.

"

BreakoutWatch," the BreakoutWatch.com "eye" logo, and the

slogan "tomorrow's breakouts today" are service marks of NBIcharts

LLC. All other marks are the property of their respective owners, and are

used for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or with Mr. William O'Neil.

Our site, research and analysis is supported entirely by subscription and is free from advertising.