| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

As we anticipated last week, the NASDAQ Composite broke out from a

short flat base pattern and moved up moderately with a 2.14% gain to post a

new post-recession high. The 1 year chart shows that the resistance

line has flattened slightly since last September and that the index is

now about to meet that resistance line again. This would suggest that

another period of consolidation or retrenchment is due.

![]()

This is also confirmed by the 6-month chart with Bollinger Bands where

we see that the index has ridden up the outer band for a few days.

Riding the upper (or lower) band is not unusual, but when combined with

meeting the resistance trend, then a pull back is more likely.

![]()

The number of breakouts jumped to 21 this week from just 7 last week. Star performers were Harley-Davidson (HOG), which broke out from a cup-with-handle base on Monday and closed 13.6% above its breakout price, and MGM Mirage (MGM) which closed 15.6% higher.

Over the weekend we will be installing the new menu system we announced last week. This required a major rewrite of many of the linkages within the site and although it may not look at all different, it should function more effectively, especially for Internet Explorer users.

If you find any problems with the new menu please tell us!

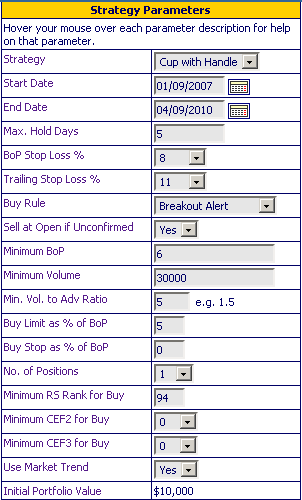

One of our subscribers has done extensive work with the the cup-with-handle backtest tool and found a combination that gives exceptional returns. His method was to use a very short hold time (5 days) which delivered small gains per trade but when compounded gave massive gains overall.

These were his parameters:

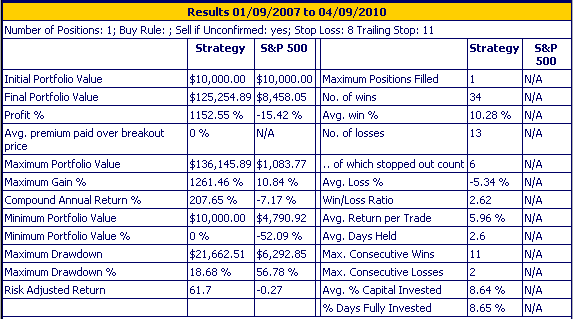

And these were the results:

| Index | Value | Change Week | Change YTD | Trend | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | 10997.3 | 0.64% | 5.46% | Up | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 2454.05 | 2.14% | 8.15% | Up | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 1194.37 | 1.38% | 7.11% | Up | ||||||||||||||||||||||||||||||||||||

| Russell 2000 | 702.95 | 2.77% | 10.86% | Up | ||||||||||||||||||||||||||||||||||||

| Wilshire 5000 | 12447.9 | 1.61% | 8.27% | Up | ||||||||||||||||||||||||||||||||||||

1The Market Signal is derived from our proprietary

market model. The market model is described on the site. 2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

# of Breakouts |

Period Average1 |

Max. Gain During Period2 |

Gain at Period Close3 |

|

|---|---|---|---|---|

| This Week | 21 | 16.54 | 6.2% | 3.57% |

| Last Week | 7 | 17.85 | 12.42% | 8.98% |

| 13 Weeks | 233 | 19.23 | 14.89% |

9.29% |

2This represents the return if each stock were bought at its breakout price and sold at its intraday high.

3This represents the return if each stock were bought at its breakout price and sold at the most recent close.

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | CPD | Caraco Pharmaceutical Laboratories Ltd. | 105 |

| Top Technical | CVGI | Commercial Vehicle Group Inc. | 89 |

| Top Fundamental | CAAS | China Automotive Systems Inc. | 76 |

| Top Tech. & Fund. | CAAS | China Automotive Systems Inc. | 76 |

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | YSI | U-Store-It Trust | 95 |

| Top Technical | CITP | COMSYS IT Partners, Inc. | 42 |

| Top Fundamental | TREX | Trex Co. Inc. | 56 |

| Top Tech. & Fund. | TREX | Trex Co. Inc. | 56 |

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2010 NBIcharts, LLC dba BreakoutWatch.com.

All rights reserved.

"

BreakoutWatch," the BreakoutWatch.com "eye" logo, and the

slogan "tomorrow's breakouts today" are service marks of NBIcharts

LLC. All other marks are the property of their respective owners, and are

used for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or with Mr. William O'Neil.

Our site, research and analysis is supported entirely by subscription and is free from advertising.