| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

With

the exception of the Russell 2000, the major indexes made modest gains

this week on light volume. This muted response following the long

weekend shows investors are still nervous following a week of

contradictory economic news. Markets were lifted by lower new

jobless claims and a smaller external trade gap, but this was offset

earlier in the week by renewed concerns over European sovereign debt

and a move to raise capital by Deutche Bank. If DB needs more capital

then that may mean it is preparing for as yet unannounced losses. An

unexpected rise in inventories was a mixed blessing. This, together

with the trade figures, will raise 3rd Quarter GDP expectations, but

the increase in inventories may have been due to lackluster sales

rather than the anticipation of higher sales to come.

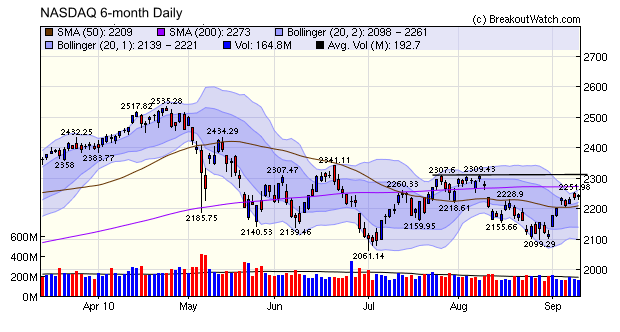

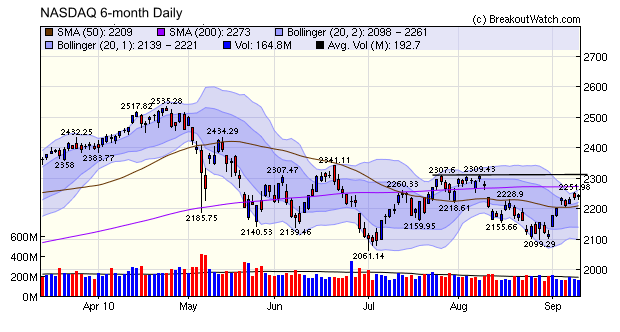

The NASDAQ Composite found support on Tuesday at its 50 dma but faces resistance at the 200 dma level and then at 2310. A rise above 2310 would confirm a new bullish phase.

The low volume kept the number of confirmed breakouts to a lowly nine this week compared to the thirteen week average of almost 14. The short week also contributed to this shortfall.

The NASDAQ Composite found support on Tuesday at its 50 dma but faces resistance at the 200 dma level and then at 2310. A rise above 2310 would confirm a new bullish phase.

The low volume kept the number of confirmed breakouts to a lowly nine this week compared to the thirteen week average of almost 14. The short week also contributed to this shortfall.

No new features this week.

Where we Differ from and Agree with CAN SLIM®

We started breakoutwatch.com in 1993 to provide the CAN SLIM investor with rapid access to watchlists of stocks that were in the chart patterns identified in "How to Make Money in Stocks" as being the ones with the most potential on breakout. At the time, it was necessary to subscribe to Daily Graphs and browse thousands of charts to find those in the desired patterns. It also required a detailed understanding of the various chart patterns in order to be able to recognize them. Once you found the charts you then had to perform your due diligence to determine which charts met the CAN SLIM guidelines.

Breakoutwatch.com provided a unique service that combined identification of the CAN SLIM recommended chart patterns with an evaluation of each stock's technical and fundamental condition against CAN SLIM principles. We originally called this evaluation our "CANSLIM Evaluator" but were forced to change that term when O'Neil successfully registered CAN SLIM as a trademark. Recognizing that we were emphasising technical analysis and adding timing to the methodology we adopted the CANTATA acronym standing for Current earnings, Annual growth, New highs, Technical Analysis and Timing Assistance.

Since 1993 we have developed a daily history of stocks in the cup-with-handle chart pattern (which appeared to be Bill O'Neil's favorite), and others, that have allowed us to compare the performance of stocks that broke out from the cup-with-handle pattern against the CAN SLIM principles. This history covers seven turbulent years of bull and extreme bear markets and allows us to draw some conclusions about what works and what doesn't. Here are some of the most important areas where we differ from or agree with CAN SLIM.

Differences

- Minimum volume on breakout should be at least 225% of average daily volume NOT at least 150%. While stocks with lesser volumes can do well, the chance of getting a strong gain after breakout, at least 25% gain above breakout price, is considerably improved at breakout day volumes of 225% ADV or more.

- Lower priced stocks give better returns than higher priced ones. By

using the CAN SLIM recommendation of a $12 minimum we found you were

losing 60% of your potential gains compared to the minimum price of $6 we require for inclusion on our watchlists.

- Relative Strength Rank of at least 80 is too low. We found a RS

Rank of at least 92 was necessary to give average returns after

breakout of at least 25%.

- Industry Rank has no correlation with subsequent performance

after breakout and can be safely ignored when selecting a breakout

stock for purchase. High performing breakouts can come from any

industry.

- While stocks that ranked higher in their industry are more likely to breakout, their rank within industry was not correlated with a better performance after breakout.

- CAN SLIM recommends minimum levels for the growth in earnings, sales, institutional ownership, ROI, and so on (see our CE for a complete list of these metrics and minimum criteria) but we found none of them to be significant except for the two mentioned below. While these may all be useful metrics for identifying strong stocks for the buy and hold investor, they had no perceptible influence on the subsequent performance of a cup-with-handle breakout.

- Breakouts will perform better when the market trend is up. It is better to avoid buying breakouts when the trend is flat or down.

- Use of stop loss orders is essential and the 7-8% stop loss recommendation is a good one. This should be converted to a trailing stop order once the stock has gained 5% or more above breakout.

- Two fundamentals have a definitely positive influence on performance after breakout: Last two quarters earnings must be positive and earnings growth rates must have increased in each of the last four quarters.

- A minimum average daily volume is necessary to provide adequate liquidity. The CAN SLIM recommendation of 100,000 ADV provides better performance after breakout than the minimum of 30,000 we use for inclusion on our watchlists.

Summary

The criteria ideal for a strong breakout are:

- Minimum RS Rank of 92

- Breakout day volume of 225% of Average Daily Volume (ADV)

- ADV must be at least 100,000

- Last two quarters earnings must be positive

- Last four quarters must have shown accelerating earnings

- set a stop loss at 8% of the breakout price

- move the stop up after the stock has gained at least 5%

- New Backtest Data shows Importance of Letting Winners Run and Cutting Losses

- Optimum Hold Days for Cup-with-Handle Breakouts

| Index | Value | Change Week | Change YTD | Trend | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | 10462.8 | 0.14% | 0.33% | Up | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 2242.48 | 0.39% | -1.18% | Down | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 1109.55 | 0.46% | -0.5% | Down | ||||||||||||||||||||||||||||||||||||

| Russell 2000 | 636.46 | -1.07% | 0.38% | Down | ||||||||||||||||||||||||||||||||||||

| Wilshire 5000 | 11552.2 | 0.24% | 0.48% | Down | ||||||||||||||||||||||||||||||||||||

1The Market Signal is derived from our proprietary

market model. The market model is described on the site. 2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

# of Breakouts |

Period Average1 |

Max. Gain During Period2 |

Gain at Period Close3 |

|

|---|---|---|---|---|

| This Week | 9 | 13.92 | 3.31% | 1.71% |

| Last Week | 28 | 13.23 | 8.24% | 4.4% |

| 13 Weeks | 182 | 14.23 | 11.63% |

4.63% |

2This represents the return if each stock were bought at its breakout price and sold at its intraday high.

3This represents the return if each stock were bought at its breakout price and sold at the most recent close.

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | BZ | Boise, Inc. | 97 |

| Top Technical | BAK | Braskem S.A. | 60 |

| Top Fundamental | FIRE | Sourcefire, Inc. | 50 |

| Top Tech. & Fund. | FIRE | Sourcefire, Inc. | 50 |

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | SVM | Silvercorp Metals Inc. | 88 |

| Top Technical | DAKT | Daktronics Inc. | 66 |

| Top Fundamental | SVM | Silvercorp Metals Inc. | 88 |

| Top Tech. & Fund. | SVM | Silvercorp Metals Inc. | 88 |

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2010 NBIcharts, LLC dba BreakoutWatch.com.

All rights reserved.

"

BreakoutWatch," the BreakoutWatch.com "eye" logo, and the

slogan "tomorrow's breakouts today" are service marks of NBIcharts

LLC. All other marks are the property of their respective owners, and are

used for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or with Mr. William O'Neil.

Our site, research and analysis is supported entirely by subscription and is free from advertising.