| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

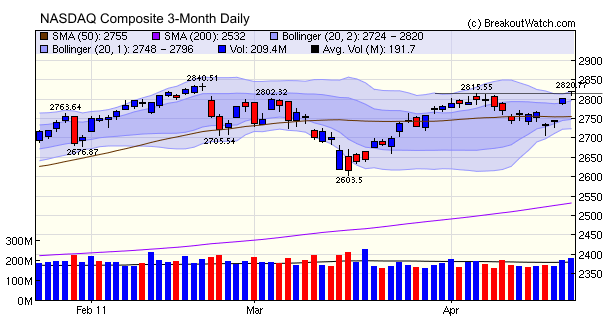

The NASDAQ Composite moved ahead strongly on Wednesday and Thursday on the strength of better than expected earnings from leading tech stocks such as Intel and Apple. Volume was well above average showing that the upward price move was well supported. The index powered through the 2815 resistance level to close at its intraday high of 2820. The index is now just 20 points (0.7%) away from its post crash high and 41 points (1.4%) away from its 2007 high. We could easily see a test of these levels next week.

The surge in the NASDAQ Composite also

brought with it a flurry of breakouts: four on Wednesday and eight on

Thursday. The top performer was Travel Zoo (TZOO) which broke out from

a high tight flag formation and closed 11% above its breakout price.

We wish all our subscribers a safe and happy holiday weekend.

We wish all our subscribers a safe and happy holiday weekend.

No new features this week.

This feature will return next week.

| Index | Value | Change Week | Change YTD | Trend | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | 12506 | 1.33% | 8.02% | Up | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 2820.16 | 2.01% | 6.31% | Up | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 1337.38 | 1.34% | 6.34% | Up | ||||||||||||||||||||||||||||||||||||

| Russell 2000 | 845.64 | 1.28% | 7.91% | Up | ||||||||||||||||||||||||||||||||||||

| Wilshire 5000 | 14154 | 1.35% | 6.5% | Up | ||||||||||||||||||||||||||||||||||||

1The Market Signal is derived from our proprietary

market model. The market model is described on the site. 2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

# of Breakouts |

Period Average1 |

Max. Gain During Period2 |

Gain at Period Close3 |

|

|---|---|---|---|---|

| This Week | 15 | 13.77 | 5.63% | 3.81% |

| Last Week | 13 | 12.92 | 8.54% | 4.47% |

| 13 Weeks | 225 | 14.62 | 12.6% |

5.89% |

2This represents the return if each stock were bought at its breakout price and sold at its intraday high.

3This represents the return if each stock were bought at its breakout price and sold at the most recent close.

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | MDM | Mountain Province Diamonds, Inc. | 114 |

| Top Technical | END | Endeavour International Corporation | 62 |

| Top Fundamental | SQM | Sociedad Quimica y Minera (ADR) | 39 |

| Top Tech. & Fund. | SVN | 7 DAYS GROUP HOLDINGS LIMITED(ADR) | 57 |

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | ELN | Elan Corporation, plc (ADR) | 84 |

| Top Technical | SUR | CNA Surety Corporation | 62 |

| Top Fundamental | GDI | Gardner Denver, Inc. | 50 |

| Top Tech. & Fund. | GDI | Gardner Denver, Inc. | 50 |

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2011 NBIcharts, LLC dba BreakoutWatch.com.

All rights reserved.

"

BreakoutWatch," the BreakoutWatch.com "eye" logo, and the

slogan "tomorrow's breakouts today" are service marks of NBIcharts

LLC. All other marks are the property of their respective owners, and are

used for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or with Mr. William O'Neil.

Our site, research and analysis is supported entirely by subscription and is free from advertising.