| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

The NASDAQ Composite found support at the 2900 level and is about to test resistance at 3000. The chart illustrates the often noted point about resistance becoming support and vice-versa (see Why Resistance Becomes Support and Vice Versa). The 2900 level provided resistance for three days at the beginning of February and then provided support two days later. After reaching the psychologically important resistance level of 3000, the index tested the 2900 support level again and that appears to be a floor under the index for the time being. Although it may take several attempts to break through 3,000, the improving economy will likely keep the current trend in effect. There are significant threats, though. The Atlantic Magazine estimates the chance of war with Iran at an alarming 50-50 and unless tensions over Iran recede, oil prices will rise further and threaten the recovery.

No new features this week

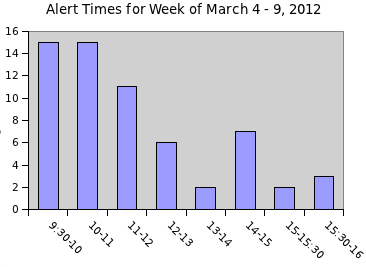

Update on Real Time Alerts

Our new realtime alert feed went into production on Monday and indications are that we are now issuing alerts in a timely manner. An analysis of alert times shows that no alerts were issued after 16:00 (4pm EST). The analysis also confirms that the most important time to monitor the market is after the open.

| Index | Value | Change Week | Change YTD | Trend | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | 12922 | -0.43% | 5.77% | Down | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 2988.34 | 0.41% | 14.71% | Up | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 1370.87 | 0.09% | 9.01% | Up | ||||||||||||||||||||||||||||||||||||

| Russell 2000 | 817 | 1.82% | 10.27% | Up | ||||||||||||||||||||||||||||||||||||

1The Market Signal is derived from our proprietary

market model. The market model is described on the site. 2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

# of Breakouts |

Period Average1 |

Max. Gain During Period2 |

Gain at Period Close3 |

|

|---|---|---|---|---|

| This Week | 20 | 26 | 4.51% | 4.04% |

| Last Week | 28 | 25.77 | 3.01% | -0.4% |

| 13 Weeks | 226 | 27.31 | 9.74% |

4.2% |

2This represents the return if each stock were bought at its breakout price and sold at its intraday high.

3This represents the return if each stock were bought at its breakout price and sold at the most recent close.

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | MGIC | Magic Software Enterprises Ltd. | 107 |

| Top Technical | SVVC | Firsthand Technology Value Fund, Inc. | 60 |

| Top Fundamental | DAN | Dana Holding Corporation | 51 |

| Top Tech. & Fund. | DAN | Dana Holding Corporation | 51 |

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | MITK | Mitek Systems, Inc. | 92 |

| Top Technical | ERT | eResearch Technology Inc. | 89 |

| Top Fundamental | BECN | Beacon Roofing Supply, Inc. | 61 |

| Top Tech. & Fund. | CBD | Companhia Brasileira de Distribuicao | 41 |

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2012 NBIcharts, LLC dba BreakoutWatch.com.

All rights reserved.

"

BreakoutWatch," the BreakoutWatch.com "eye" logo, and the

slogan "tomorrow's breakouts today" are service marks of NBIcharts

LLC. All other marks are the property of their respective owners, and are

used for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or with Mr. William O'Neil.

Our site, research and analysis is supported entirely by subscription and is free from advertising.