| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

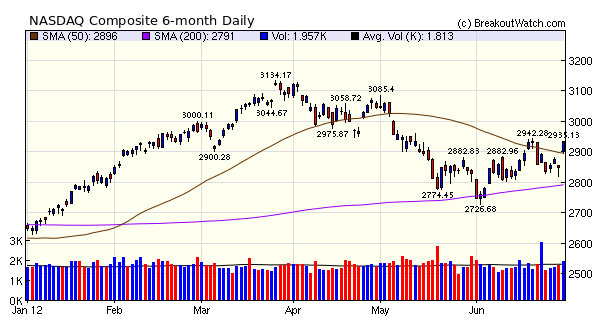

NASDAQ is still range bound between support and resistance. Until this is resolved expect a continuation of choppy,directionless trading.

"The

EU has decided to create TCRP, the Troubled Country Relief Program,

their offshoot of our Troubled Asset Relief Program. They will do this

by giving the ESM and EFSF the ability to inject money directly into

banks (voila, Spain just cut their debt by 100b euros after seeing it

go up by that amount a few weeks ago) instead of via countries first

with unanimous consent from all EU members and with a central bank

supervisor. The financial help will also be pari passu with other

bondholders instead of senior and countries of banks getting help won’t

experience the same EU fiscal scrutiny as before. This news is most

positive for Spain and Ireland whose failed banks became the noose

around the sovereign as opposed to Italy and Greece where the debt pile

up was at the government level. The next question is whether the

ESM/EFSF will have enough capital and assuming they don’t, will the ECB

chip in by giving it a bank license thus leveraging its size. That is

yet to be determined. For now, party on and turn that hour glass over

as more time has been bought but only the symptoms are being fought as

the underlying disease of excessive debt and lack of growth still

remains."

We can expect that when this is absorbed by the markets there could be a pull-back from Friday's exuberance. The index is now above the H&S Bottom neckline we described last week (a bullish sign) but faces resistance at 2942 should it attempt to go higher on Monday. With the 4th July holiday falling on Wednesday, next week will likely see reduced trading volume and consequently fewer breakouts.

I shall be travelling on 4th July to Australia, but I wish you all a safe and happy holiday.

No new features this week.

I am taking a vacation until mid-July. This feature will return on July 20.

| Index | Value | Change Week | Change YTD | Trend | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| I am taking a vacation until mid-July. This feature will return on July 20.Dow | 12880.1 | 1.89% | 5.42% | Down | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 2935.05 | 1.47% | 12.66% | Down | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 1362.16 | 2.03% | 8.31% | Up | ||||||||||||||||||||||||||||||||||||

1The Market Signal is derived from our proprietary

market model. The market model is described on the site. 2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

# of Breakouts |

Period Average1 |

Max. Gain During Period2 |

Gain at Period Close3 |

|

|---|---|---|---|---|

| This Week | 26 | 12.54 | 4.15% | 3.16% |

| Last Week | 17 | 11.69 | 8% | 4.93% |

| 13 Weeks | 222 | 13.69 | 6.29% |

0.93% |

2This represents the return if each stock were bought at its breakout price and sold at its intraday high.

3This represents the return if each stock were bought at its breakout price and sold at the most recent close.

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | XNPT | XenoPort, Inc. | 113 |

| Top Technical | XNPT | XenoPort, Inc. | 113 |

| Top Fundamental | GEOI | GeoResources, Inc. | 45 |

| Top Tech. & Fund. | GEOI | GeoResources, Inc. | 45 |

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | LBAI | Lakeland Bancorp, Inc. | 65 |

| Top Technical | SBAC | SBA Communications Corporation | 32 |

| Top Fundamental | TGH | Textainer Group Holdings Limited | 49 |

| Top Tech. & Fund. | MRLN | Marlin Business Services Corp. | 54 |

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2012 NBIcharts, LLC dba BreakoutWatch.com.

All rights reserved.

"

BreakoutWatch," the BreakoutWatch.com "eye" logo, and the

slogan "tomorrow's breakouts today" are service marks of NBIcharts

LLC. All other marks are the property of their respective owners, and are

used for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or with Mr. William O'Neil.

Our site, research and analysis is supported entirely by subscription and is free from advertising.