| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

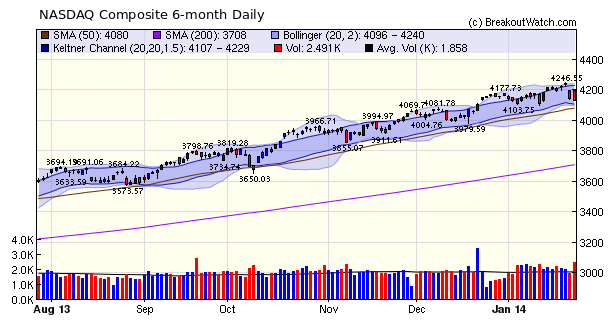

The NASDAQ consolidation we anticipated last week arrived on Thursday as markets fell globally. The DJI and S&P 500 experienced the biggest losses with both indexes closing below their 50 day moving average. The NASDAQ composite, whose stocks are somewhat less impacted by global trading, was more resilient and remains above the 50 DMA and within the Keltner Channel. Recent history shows that the lower Keltner bound has provided a support level, so a break of that level would confirm weakness and a break below the 50 DMA would signal that we move from consolidation to correction.

The number of breakouts fell to five this week. ADHD broke out of a CwH pattern and rose to a high of over 12% but profit taking reduced the stock to a loss of 2.5% by Friday's close.

A column identifying stocks that were in a squeeze situation immediately prior to breakout was added to the breakout report. This report does not yet include breakouts from the new "Squeeze Play" watchlist, however. That is still under development.

Although our market trend indicators remain positive, this is a time for caution while the markets a consolidating/correcting. You will see the number of long position alerts falling to a dribble while the number of short position alerts rises to an avalanche (there were 29 on Friday). Unless you are an experienced trader, I recommend staying out of the market until we see if this is just a consolidation of the gains of the last months, or a more serious correction .

| Index | Value | Change Week | Change YTD | Trend | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | 15879.1 | -3.52% | -4.21% | Up | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 4128.17 | -1.65% | -1.16% | Up | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 1790.29 | -2.63% | -3.14% | Up | ||||||||||||||||||||||||||||||||||||

1The Market Signal is derived

from our proprietary market model. The market model is

described on the site.

2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

|

# of Breakouts

|

Period Average1

|

Max. Gain During Period2

|

Gain at Period Close3

|

|

|---|---|---|---|---|

| This Week | 5 | 9.46 | 5.82% | -1.04% |

| Last Week | 6 | 9.54 | 5.15% | -9.87% |

| 13 Weeks | 122 | 10 | 20.45% |

6.02% |

2This represents the return if each stock were bought at its breakout price and sold at its intraday high.

3This represents the return if each stock were bought at its breakout price and sold at the most recent close.

|

Category

|

Symbol

|

Company Name

|

Expected Gain1

|

|---|---|---|---|

| Best Overall | ORBC | ORBCOMM Inc | 105 |

| Top Technical | ORBC | ORBCOMM Inc | 105 |

| Top Fundamental | QIHU | Qihoo 360 Technology Co Ltd | 47 |

| Top Tech. & Fund. | QIHU | Qihoo 360 Technology Co Ltd | 47 |

|

Category

|

Symbol

|

Company Name

|

Expected Gain1

|

|---|---|---|---|

| Best Overall | BLDR | Builders FirstSource, Inc. | 86 |

| Top Technical | BREW | Craft Brew Alliance Inc | 59 |

| Top Fundamental | EFII | Electronics For Imaging, Inc. | 40 |

| Top Tech. & Fund. | EFII | Electronics For Imaging, Inc. | 40 |

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2014 NBIcharts, LLC dba BreakoutWatch.com. All rights

reserved.

" BreakoutWatch," the BreakoutWatch.com "eye" logo, and the slogan

"tomorrow's breakouts today" are service marks of NBIcharts LLC.

All other marks are the property of their respective owners, and

are used for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or

with Mr. William O'Neil.

Our site, research and analysis is supported entirely by

subscription and is free from advertising.