| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

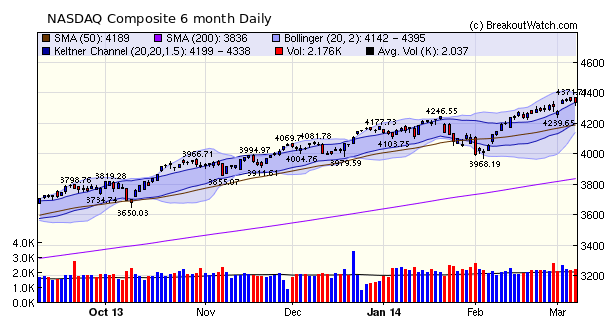

The NASDAQ quickly shrugged off concerns over the situation in the Ukraine and resumed its upward march, as did the other major indexes. The pace is slowing, however, but that was expected as I reported last week. The chart shows that the consolidation I was expecting is beginning and the index will likely move sideways from here.

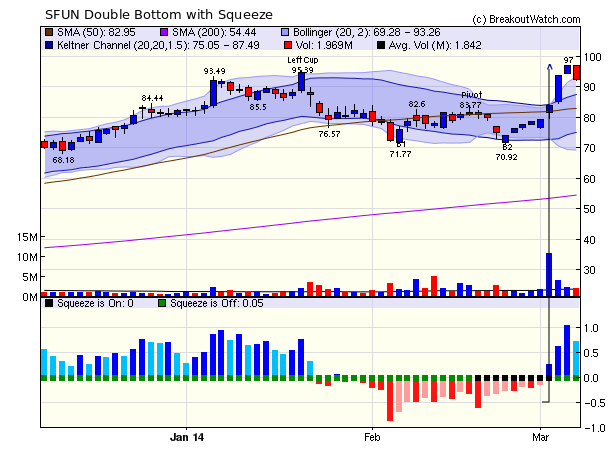

The number of breakouts jumped to 39 this week with an average gain overall of 4.4%. Six of them gained over 10% (OSUR, SFUN, QTWW, FENG, TSL and FSS), and three of these were in a squeeze on the day of breakout. I'll discuss SFUN more below.

|

Breakouts

for Week Beginning 2/28/14

|

|||||||||

| B'out Date |

Symbol | Base | Squeeze | B'Out Price |

B'out Day Close |

B'out Vol % ADV |

Last Close |

Current % off BOP |

*Gain at Intraday High |

|---|---|---|---|---|---|---|---|---|---|

| 03/07/14 | TAOM | SQZ | Y | 7.10 | 7.4 | 228 | 7.4 | 4.23% | 4.23% |

| 03/07/14 | SB | SQZ | Y | 11.24 | 11.43 | 204 | 11.43 | 1.69% | 1.69% |

| 03/07/14 | LJPC | SQZ | Y | 8.99 | 9.76 | 399 | 9.76 | 8.57% | 8.57% |

| 03/07/14 | SYRG | CwH | Y | 10.77 | 10.80 | 1.56 | 10.8 | 0.28% | 0.28% |

| 03/07/14 | RGDO | CwH | N | 7.66 | 8.18 | 1.87 | 8.18 | 6.79% | 6.79% |

| 03/07/14 | QTWW | CwH | Y | 9.55 | 10.25 | 4.99 | 10.25 | 7.33% | 7.33% |

| 03/07/14 | JASO | CwH | Y | 10.97 | 11.18 | 1.99 | 11.18 | 1.91% | 1.91% |

| 03/07/14 | CPE | CwH | Y | 7.30 | 7.73 | 2.45 | 7.73 | 5.89% | 5.89% |

| 03/07/14 | ARSD | CwH | N | 12.53 | 12.56 | 2.64 | 12.56 | 0.24% | 0.24% |

| 03/06/14 | YGE | SQZ | Y | 6.65 | 6.78 | 305 | 6.76 | 1.65% | 1.95% |

| 03/06/14 | TSL | SQZ | Y | 16.40 | 18.19 | 319 | 18.34 | 11.83% | 11.83% |

| 03/06/14 | FATE | CwH | Y | 8.98 | 9.47 | 1.81 | 9.09 | 1.22% | 5.46% |

| 03/06/14 | BONA | CwH | N | 7.28 | 7.50 | 2.46 | 7.43 | 2.06% | 3.02% |

| 03/06/14 | BIDU | CwH | N | 178.92 | 184.64 | 2.16 | 182.04 | 1.74% | 3.2% |

| 03/05/14 | FSS | SQZ | Y | 13.24 | 14.33 | 239 | 14.74 | 11.33% | 11.33% |

| 03/05/14 | EJ | DB | N | 13.94 | 14.28 | 2.03 | 15.23 | 9.25% | 9.25% |

| 03/05/14 | UIHC | CwH | Y | 14.91 | 15.05 | 5.32 | 14.62 | -1.95% | 3.29% |

| 03/05/14 | CKEC | CwH | N | 30.04 | 31.81 | 2.16 | 32.15 | 7.02% | 7.02% |

| 03/04/14 | SAAS | SQZ | Y | 9.26 | 9.94 | 251 | 9.63 | 4.00% | 7.34% |

| 03/04/14 | QTWW | SQZ | Y | 8.89 | 9.55 | 323 | 10.25 | 15.30% | 15.3% |

| 03/04/14 | CPE | SQZ | Y | 7.18 | 7.3 | 206 | 7.73 | 7.66% | 7.66% |

| 03/04/14 | WIBC | DB | Y | 10.21 | 10.42 | 2.19 | 10.87 | 6.46% | 6.46% |

| 03/04/14 | SFUN | DB | Y | 83.77 | 83.99 | 6.23 | 92.47 | 10.39% | 15.79% |

| 03/04/14 | ORBK | DB | Y | 14.26 | 14.78 | 1.59 | 14.19 | -0.49% | 3.65% |

| 03/04/14 | SGYP | CwH | N | 6.37 | 6.51 | 1.47 | 6.09 | -4.40% | 2.2% |

| 03/04/14 | SGY | CwH | Y | 36.92 | 36.99 | 1.87 | 36.49 | -1.16% | 0.19% |

| 03/04/14 | RBCN | CwH | N | 13.38 | 13.86 | 1.58 | 14.34 | 7.17% | 8.3% |

| 03/04/14 | OSUR | CwH | N | 7.14 | 7.39 | 1.54 | 8.48 | 18.77% | 18.77% |

| 03/04/14 | MOD | CwH | N | 14.91 | 15.35 | 2.15 | 15.47 | 3.76% | 3.76% |

| 03/04/14 | KCG | CwH | Y | 12.00 | 12.24 | 1.80 | 12.22 | 1.83% | 2.25% |

| 03/04/14 | INVN | CwH | Y | 22.22 | 22.25 | 1.58 | 22.8 | 2.61% | 4.73% |

| 03/04/14 | HEI | CwH | N | 62.70 | 64.52 | 1.73 | 63.35 | 1.04% | 2.9% |

| 03/04/14 | GWRE | CwH | Y | 53.97 | 57.38 | 4.56 | 54.54 | 1.06% | 6.32% |

| 03/04/14 | FENG | CwH | N | 11.68 | 12.00 | 2.20 | 12.8 | 9.59% | 13.61% |

| 03/04/14 | FC | CwH | N | 21.40 | 22.05 | 2.28 | 21.56 | 0.75% | 4.21% |

| 03/04/14 | DATE | CwH | Y | 8.23 | 8.44 | 1.64 | 8.8 | 6.93% | 6.93% |

| 03/04/14 | AXDX | CwH | Y | 15.27 | 15.38 | 1.51 | 15.33 | 0.39% | 1.77% |

| 03/04/14 | ACXM | CwH | Y | 37.86 | 38.90 | 2.54 | 38.36 | 1.32% | 2.75% |

| 03/03/14 | CIMT | SQZ | Y | 9.81 | 10.11 | 158 | 9.51 | -3.06% | 8.15% |

The "Chart Browser", which allows you to quickly step through the charts on each watchlist, was added to the Squeeze Play list.

I noticed that a bug had crept into the Head and Shoulders Bottom watchlist and that was no longer being populated. That is now corrected.

Squeeze Can Work on any Cup Formation

The breakout of SFUN this week from a Double Bottom base is another example of the squeeze allowing you to make stronger gains while a stock is still low in its base, and demonstrates that a breakout which also takes the squeeze off can be more profitable. This stock has set a new pivot of 97 and will possibly form a CwH from here.

Although I don't yet have any data to support it, I expect that the head and shoulders bottom pattern when combined with a squeeze will prove very profitable. This is because HSB stocks are even lower in their bases still, and so have more upside potential.

| Index | Value | Change Week | Change YTD | Trend | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | 16452.7 | 0.8% | -0.75% | Up | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 4336.22 | 0.65% | 3.82% | Up | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 1878.04 | 1% | 1.61% | Up | ||||||||||||||||||||||||||||||||||||

1The Market Signal is derived

from our proprietary market model. The market model is

described on the site.

2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

|

Category

|

Symbol

|

Company Name

|

Expected Gain1

|

|---|---|---|---|

| Best Overall | NYNY | Empire Resorts, Inc. | 95 |

| Top Technical | NYNY | Empire Resorts, Inc. | 95 |

| Top Fundamental | ADUS | Addus HomeCare Corporation | 46 |

| Top Tech. & Fund. | ADUS | Addus HomeCare Corporation | 46 |

|

Category

|

Symbol

|

Company Name

|

Expected Gain1

|

|---|---|---|---|

| Best Overall | FATE | Fate Therapeutics, Inc. | 92 |

| Top Technical | UIHC | United Insurance Holdings Corp. | 69 |

| Top Fundamental | UIHC | United Insurance Holdings Corp. | 69 |

| Top Tech. & Fund. | UIHC | United Insurance Holdings Corp. | 69 |

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2014 NBIcharts, LLC dba BreakoutWatch.com. All rights

reserved.

" BreakoutWatch," the BreakoutWatch.com "eye" logo, and the slogan

"tomorrow's breakouts today" are service marks of NBIcharts LLC.

All other marks are the property of their respective owners, and

are used for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or

with Mr. William O'Neil. Our site, research and analysis is

supported entirely by subscription and is free from advertising.