| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

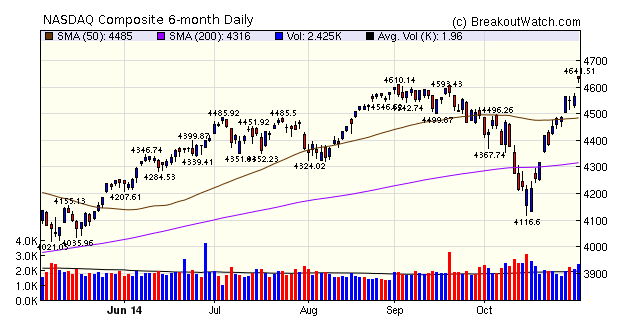

The NASDAQ gapped up past its previous 14 year high on Friday following a week that saw the ending of QE, an unexpected rise in Q3 GDP, consumer confidence at its highest levels since 2007 and the adoption by the central bank of Japan of quantitative easing measures, similar to those adopted here. The European Union may also adopt similar measures. The market loved it!

A week ago , I was lamenting the mediocre volume that supported the week's gains, but that concern has vanished now following four days of at or above average volume. Surely we will see some consolidation now after the rapid gains of the last three weeks.

The number of breakouts jumped to 36 with the cup and handle pattern (CWH) dominating the success stories. Only 2 out of the 36 were under water at Friday's close.

| Breakouts for Week Beginning 10/27/14 | ||||||||

| Brkout Date | Symbol | Base | Squeeze | BrkoutOut Price | Brkout Day Close | Last Close | Current % off BOP | Gain at Intraday High |

|---|---|---|---|---|---|---|---|---|

| 10/30/14 | VPRT | CwH | N | 56.90 | 64.24 | 66.86 | 17.50 | 17.5 |

| 10/28/14 | GPX | CwH | N | 29.51 | 29.83 | 33.16 | 12.37 | 12.37 |

| 10/28/14 | VRTU | CwH | N | 36.83 | 37.07 | 40.98 | 11.27 | 11.27 |

| 10/28/14 | SXI | CwH | N | 78.16 | 80.10 | 86.25 | 10.35 | 10.35 |

| 10/30/14 | TEDU | SQZ | Y | 12.45 | 13.2 | 13.73 | 10.28 | 10.28 |

| 10/28/14 | TAX | CwH | N | 35.26 | 36.82 | 37.89 | 7.46 | 8.91 |

| 10/28/14 | PFSW | CwH | N | 10.95 | 10.98 | 11.77 | 7.49 | 7.49 |

| 10/28/14 | QLYS | CwH | N | 30.05 | 30.07 | 32.08 | 6.76 | 6.76 |

| 10/28/14 | CWT | CwH | N | 24.41 | 25.00 | 26.03 | 6.64 | 6.64 |

| 10/28/14 | MOH | CwH | N | 45.74 | 47.10 | 48.64 | 6.34 | 6.34 |

| 10/30/14 | CEMP | CwH | N | 12.92 | 13.69 | 13.6 | 5.26 | 5.96 |

| 10/28/14 | PCCC | SQZ | Y | 22.64 | 23.93 | 23.85 | 5.34 | 5.7 |

| 10/27/14 | FRGI | SQZ | Y | 52.36 | 52.73 | 55.15 | 5.33 | 5.33 |

| 10/28/14 | ELLI | CwH | N | 37.46 | 38.49 | 38.38 | 2.46 | 4.89 |

| 10/30/14 | AVNR | SQZ | Y | 12.59 | 13.2 | 12.94 | 2.78 | 4.85 |

| 10/27/14 | HCC | CwH | N | 49.86 | 50.37 | 52.19 | 4.67 | 4.67 |

| 10/28/14 | SKH | SQZ | Y | 6.70 | 6.71 | 6.93 | 3.43 | 3.43 |

| 10/31/14 | PZE | SQZ | Y | 6.53 | 6.75 | 6.75 | 3.37 | 3.37 |

| 10/31/14 | MOH | CwH | N | 47.10 | 48.64 | 48.64 | 3.27 | 3.27 |

| 10/28/14 | SEP | CwH | N | 54.13 | 55.74 | 54 | -0.24 | 2.97 |

| 10/31/14 | GLL | CwH | N | 101.00 | 103.75 | 103.75 | 2.72 | 2.72 |

| 10/28/14 | ABCB | CwH | N | 24.20 | 24.49 | 24.8 | 2.48 | 2.48 |

| 10/31/14 | DMND | SQZ | Y | 29.42 | 30.15 | 30.15 | 2.48 | 2.48 |

| 10/28/14 | DXCM | CwH | N | 44.08 | 44.16 | 44.95 | 1.97 | 1.97 |

| 10/30/14 | TTPH | HTF | N | 24.71 | 25.19 | 23.9 | -3.28 | 1.94 |

| 10/28/14 | TXRH | CwH | N | 28.32 | 28.87 | 28.87 | 1.94 | 1.94 |

| 10/28/14 | KNL | CwH | N | 19.52 | 19.54 | 19.89 | 1.90 | 1.9 |

| 10/31/14 | XNCR | CwH | N | 10.60 | 10.79 | 10.79 | 1.79 | 1.79 |

| 10/30/14 | MRH | CwH | N | 32.60 | 32.97 | 33.14 | 1.66 | 1.66 |

| 10/31/14 | IART | SQZ | Y | 50.44 | 51.11 | 51.11 | 1.33 | 1.33 |

| 10/28/14 | KAI | DB | N | 41.30 | 41.58 | 41.34 | 0.10 | 1.04 |

| 10/28/14 | HPP | CwH | N | 27.27 | 27.51 | 27.31 | 0.15 | 0.88 |

| 10/31/14 | CUZ | CwH | N | 12.91 | 13.01 | 13.01 | 0.77 | 0.77 |

| 10/31/14 | IRM | CwH | N | 35.85 | 36.07 | 36.07 | 0.61 | 0.61 |

| 10/29/14 | LHCG | SQZ | Y | 24.42 | 24.49 | 24.35 | -0.29 | 0.29 |

| 10/31/14 | ANGO | CwH | N | 17.00 | 17.00 | 17 | 0.00 | 0 |

| Weekly Average (36 breakouts) | 4.12 | 4.62 | ||||||

No new features this week.

This feature will return when I again have full use of my right arm. Hopefully in two weeks at the most.

| Index | Value | Change Week | Change YTD | Trend | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | 17390.5 | 3.48% | 4.91% | Up | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 4630.74 | 3.28% | 10.87% | Up | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 2018.05 | 2.72% | 9.18% | Up | ||||||||||||||||||||||||||||||||||||

1The Market Signal is derived

from our proprietary market model. The market model is

described on the site.

2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

|

Category

|

Symbol

|

Company Name

|

Expected Gain1

|

|---|---|---|---|

| Best Overall | SPCB | SuperCom, Ltd. | 77 |

| Top Technical | SPCB | SuperCom, Ltd. | 77 |

| Top Fundamental | AFH | Atlas Financial Holdings, Inc. | 39 |

| Top Tech. & Fund. | AFH | Atlas Financial Holdings, Inc. | 39 |

|

Category

|

Symbol

|

Company Name

|

Expected Gain1

|

|---|---|---|---|

| Best Overall | HPP | Hudson Pacific Properties, Inc. | 42 |

| Top Technical | GLL | ProShares UltraShort Gold (ETF) | 0 |

| Top Fundamental | TXRH | Texas Roadhouse, Inc. | 24 |

| Top Tech. & Fund. | TXRH | Texas Roadhouse, Inc. | 24 |

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2014 NBIcharts, LLC dba BreakoutWatch.com. All rights

reserved.

" BreakoutWatch," the BreakoutWatch.com "eye" logo, and the slogan

"tomorrow's breakouts today" are service marks of NBIcharts LLC.

All other marks are the property of their respective owners, and

are used for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or

with Mr. William O'Neil. Our site, research and analysis is

supported entirely by subscription and is free from advertising.