| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

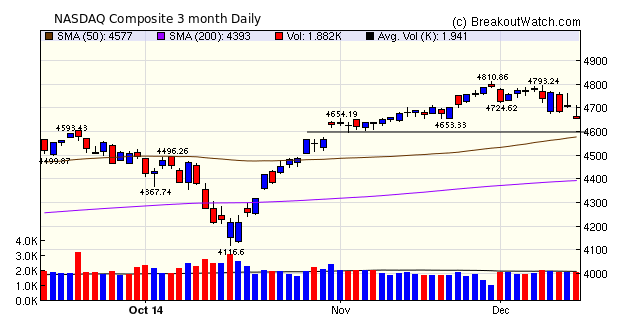

While falling gas prices at home promise to put more cash in consumers' pockets and provide a short term economic stimulus, they are a symptom of the malaise in the world economy and portend lower profits for large cap players in the global market. Hence we saw the DJI and S&P 500 fall substantially more than the NASDAQ Composite.

Despite the sharp fall for the week, the biggest hit came on Friday and so our trend indicators remain positive for now. I make no prediction as to how the markets will move next week, but would not be surprised to see the NASDAQ dip to its support level at 4600 (horizontal line on chart).

Not surprisingly, there were fewer breakouts this week, although most of the few that did breakout were quite strong. Note that 5 of the10 breakouts came from a squeeze situation.

| Breakouts for Week Beginning 12/08/14 | ||||||||

| Brkout Date | Symbol | Base | Squeeze | BrkoutOut Price | Brkout Day Close | Last Close | Current % off BOP | Gain at Intraday High |

|---|---|---|---|---|---|---|---|---|

| 12/08/14 | CEMP | CwH | N | 14.54 | 16.06 | 19 | 30.67 | 30.67 |

| 12/10/14 | NBIX | CwH | Y | 19.95 | 21.89 | 21.97 | 10.13 | 10.13 |

| 12/09/14 | DHT | HSB | N | 6.03 | 6.07 | 6.64 | 10.12 | 10.12 |

| 12/09/14 | QURE | CwH | N | 15.05 | 16.50 | 15.55 | 3.32 | 9.63 |

| 12/10/14 | VIXM | HTF | N | 62.02 | 63.22 | 67.7 | 9.16 | 9.16 |

| 12/08/14 | MMSI | SQZ | Y | 15.67 | 15.83 | 16.41 | 4.72 | 5.49 |

| 12/08/14 | CIA | SQZ | Y | 8.01 | 8.23 | 8 | -0.12 | 4.99 |

| 12/09/14 | AFSI | SQZ | Y | 55.45 | 56.44 | 56.87 | 2.56 | 4.18 |

| 12/12/14 | FRED | HSB | N | 15.36 | 15.82 | 15.82 | 2.99 | 2.99 |

| 12/08/14 | CSFL | SQZ | Y | 11.56 | 11.6 | 10.97 | -5.10 | 0.35 |

| Weekly Average (10 breakouts) | 6.85 | 8.77 | ||||||

No new features this week.

Big Short Term Profits come from Volatility Squeeze Breakouts

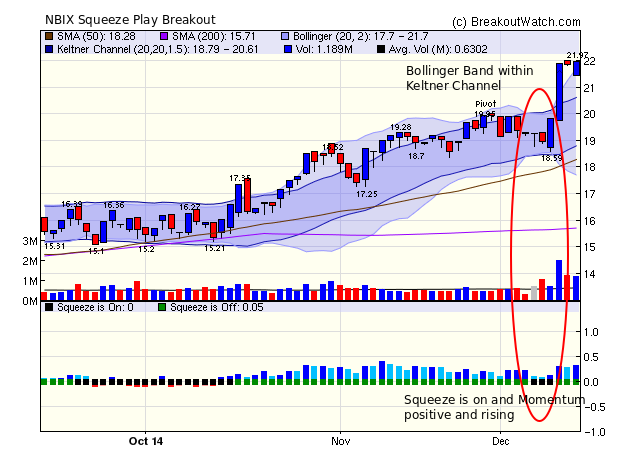

NBIX gained 10% on breakout from a volatility squeeze this week. The squeeze occurred while the stock was in the handle of a cup and handle formation. These situations can be particularly profitable for in-the-money option plays (see The Volatility Edge in Options Trading the Cup with Handle and Squeeze Combination).

A

"Volatility Squeeze" occurs when the volatility of a stock falls

below its recent levels. A fall in volatility usually means that

the stock is in a period of consolidation and trending in a

narrow range. When that period of consolidation ends, normal

volatility will return resulting in a breakout to the upside or

downside. If we can recognize a volatility squeeze situation,

then we have the opportunity to place a long or short position

order and profit from the breakout.

How can we recognize a

Volatility Squeeze?

While the BB are within the KC, we say the "squeeze is on". For trading purposes, we are interested in the moment when the squeeze comes off, meaning that the upper and lower BB move outside the KC again, which signals a breakout. Of course, the breakout can be to the upside or downside, but for our Squeeze watchlist we are interested only in breakouts to the upside.

A squeeze can occur while a stock is trending up or down. For our squeeze watchlist, we are only concerned with stocks trending up.

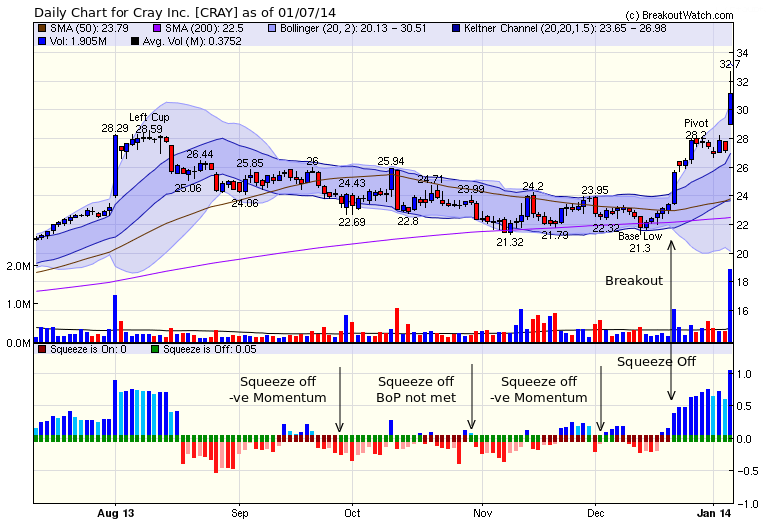

This graphic shows four possible situations in which a squeeze can occur and then come off. In scenarios A, B and C, CRAY would not have appeared on the SQZ watchlist because it was not ascending the right side of a cup, nevertheless A, B and C illustrate the circumstances under which a squeeze can occur. In scenario D, CRAY would have been on the watchlist and an alert would have been issued.

Selecting Stocks for Our Squeeze Watchlist

When we select stocks for our cup-with-Handle (CwH), Double Bottom (DB) or Head and Shoulders Bottom (HSB) patterns, we first look for stocks that have formed the left side of a cup and are starting to ascend the right side. This behavior is common to all three patterns and we place these stocks on an internal watchlist we call Basewatch. To select stocks for the Squeeze (SQZ) watchlist, our algorithms examine each stock on Basewatch to determine if the squeeze is on for each stock. To remove the likelihood that the stock could breakdown from the squeeze we also look at the momentum of the stock and the slope of the momentum curve. If both momentum and the slope of the momentum curve are positive, then these stocks go on the SQZ watchlist.

Determining Breakout Price

For the squeeze to come off and give a buy signal, the price must rise to the extent that the Bollinger Bands move outside the Keltner Channel. This price can be calculated and is published on the watchlist as the breakoutprice.

value. So while in a squeeze we can calculate the price at which the stock must close at the next session to lift the upper BB above the upper KC. This price now becomes the breakout price.

Squeeze Alerts

As with our other watchlists, we monitor the real-time price during the next session and issue an alert if the breakout price is reached.

| Index | Value | Change Week | Change YTD | Trend | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | 17280.8 | -3.78% | 4.25% | Up | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 4653.6 | -2.66% | 11.42% | Up | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 2002.33 | -3.52% | 8.33% | Up | ||||||||||||||||||||||||||||||||||||

1The Market Signal is derived

from our proprietary market model. The market model is

described on the site.

2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

|

Category

|

Symbol

|

Company Name

|

Expected Gain1

|

|---|---|---|---|

| Best Overall | FTR | Frontier Communications Corporation | 97 |

| Top Technical | FTR | Frontier Communications Corporation | 97 |

| Top Fundamental | CMG | Chipotle Mexican Grill, Inc. | 30 |

| Top Tech. & Fund. | CDW | CDW Corporation | 44 |

|

Category

|

Symbol

|

Company Name

|

Expected Gain1

|

|---|---|---|---|

| Best Overall | QURE | uniQure N.V. | 58 |

| Top Technical | QURE | uniQure N.V. | 58 |

| Top Fundamental | QURE | uniQure N.V. | 58 |

| Top Tech. & Fund. | QURE | uniQure N.V. | 58 |

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2014 NBIcharts, LLC dba BreakoutWatch.com. All rights

reserved.

" BreakoutWatch," the BreakoutWatch.com "eye" logo, and the slogan

"tomorrow's breakouts today" are service marks of NBIcharts LLC.

All other marks are the property of their respective owners, and

are used for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or

with Mr. William O'Neil. Our site, research and analysis is

supported entirely by subscription and is free from advertising.