| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

Wishing all my readers a happy holiday season and successful trading in the New Year.

The number of breakouts soared to 41 this week after just 10 last week. While average gains were not spectacular, there were just 5 of the 41 that were slightly under water at the end of the week. None of t he 5 were cup and handle breakouts.

| Breakouts for Week Beginning 12/15/14 | ||||||||

| Brkout Date | Symbol | Base | Squeeze | BrkoutOut Price | Brkout Day Close | Last Close | Current % off BOP | Gain at Intraday High |

|---|---|---|---|---|---|---|---|---|

| 12/18/14 | MGNX | CwH | N | 30.76 | 33.83 | 34.53 | 12.26 | 12.26 |

| 12/18/14 | FPRX | CwH | N | 23.25 | 24.28 | 25.89 | 11.35 | 11.35 |

| 12/17/14 | GEVA | CwH | N | 91.27 | 96.04 | 95.46 | 4.59 | 7.1 |

| 12/17/14 | CENTA | SQZ | Y | 8.62 | 8.92 | 8.99 | 4.29 | 6.61 |

| 12/17/14 | CLH | HSB | N | 48.00 | 49.75 | 49.06 | 2.21 | 6.49 |

| 12/15/14 | KIRK | CwH | N | 22.53 | 22.84 | 23.12 | 2.62 | 5.9 |

| 12/16/14 | PCCC | SQZ | Y | 23.95 | 23.95 | 24.58 | 2.63 | 4.97 |

| 12/15/14 | CBAY | CwH | N | 8.25 | 8.30 | 8.61 | 4.36 | 4.36 |

| 12/18/14 | SAAS | HSB | N | 8.65 | 8.81 | 9.02 | 4.28 | 4.28 |

| 12/18/14 | LNKD | SQZ | Y | 226.28 | 231.84 | 234.61 | 3.68 | 3.68 |

| 12/18/14 | TWOU | CwH | N | 18.71 | 19.10 | 19.35 | 3.42 | 3.42 |

| 12/17/14 | LBAI | SQZ | Y | 11.54 | 11.77 | 11.9 | 3.12 | 3.38 |

| 12/17/14 | TSRE | CwH | Y | 7.87 | 7.97 | 8.03 | 2.03 | 3.3 |

| 12/16/14 | WM | SQZ | Y | 49.30 | 49.39 | 50.78 | 3.00 | 3.16 |

| 12/17/14 | LIN | SQZ | Y | 25.03 | 25.79 | 25 | -0.12 | 3.04 |

| 12/18/14 | CSV | SQZ | Y | 20.18 | 20.49 | 20.78 | 2.97 | 2.97 |

| 12/17/14 | WM | SQZ | Y | 49.49 | 49.55 | 50.78 | 2.61 | 2.77 |

| 12/17/14 | RMD | CwH | N | 54.75 | 54.95 | 56.24 | 2.72 | 2.72 |

| 12/17/14 | TWM | HSB | Y | 51.61 | 52.92 | 52.92 | 2.54 | 2.54 |

| 12/19/14 | IL | SQZ | Y | 11.17 | 11.42 | 11.42 | 2.24 | 2.24 |

| 12/17/14 | AEL | SQZ | Y | 28.30 | 28.5 | 28.35 | 0.18 | 2.16 |

| 12/17/14 | EXPO | SQZ | Y | 81.31 | 81.65 | 81.89 | 0.71 | 2.05 |

| 12/19/14 | MSG | DB | Y | 73.84 | 75.07 | 75.07 | 1.67 | 1.67 |

| 12/17/14 | OTTR | SQZ | Y | 30.22 | 30.48 | 30.72 | 1.65 | 1.65 |

| 12/18/14 | XLU | SQZ | Y | 46.49 | 47.2 | 46.86 | 0.80 | 1.53 |

| 12/19/14 | Q | SQZ | Y | 59.48 | 60.39 | 60.39 | 1.53 | 1.53 |

| 12/18/14 | EXPO | SQZ | Y | 81.75 | 82.98 | 81.89 | 0.17 | 1.5 |

| 12/19/14 | NRZ | HTF | N | 13.34 | 13.51 | 13.51 | 1.27 | 1.27 |

| 12/16/14 | NKX | CwH | N | 14.47 | 14.50 | 14.65 | 1.24 | 1.24 |

| 12/18/14 | SVU | CwH | N | 9.40 | 9.49 | 9.43 | 0.32 | 1.06 |

| 12/18/14 | FDML | HSB | Y | 15.64 | 15.80 | 15.61 | -0.19 | 1.02 |

| 12/18/14 | FRME | SQZ | Y | 22.59 | 22.81 | 22.58 | -0.04 | 0.97 |

| 12/19/14 | WIBC | HSB | N | 9.85 | 9.93 | 9.93 | 0.81 | 0.81 |

| 12/18/14 | PAYX | DB | N | 47.41 | 47.75 | 46.3 | -2.34 | 0.72 |

| 12/18/14 | OUTR | CwH | N | 73.91 | 74.34 | 74.22 | 0.42 | 0.58 |

| 12/17/14 | EFSC | SQZ | Y | 19.80 | 19.89 | 19.72 | -0.40 | 0.45 |

| 12/18/14 | DLX | SQZ | Y | 61.21 | 61.32 | 61.46 | 0.41 | 0.41 |

| 12/19/14 | NJ | CwH | N | 17.12 | 17.15 | 17.15 | 0.18 | 0.18 |

| 12/18/14 | MGAM | CwH | N | 36.41 | 36.45 | 36.44 | 0.08 | 0.11 |

| 12/19/14 | PIKE | CwH | N | 11.99 | 12.00 | 12 | 0.08 | 0.08 |

| 12/17/14 | HSKA | SQZ | Y | 16.91 | 16.91 | 16.74 | -1.01 | -0 |

| Weekly Average (41 breakouts) | 2.06 | 2.87 | ||||||

No New Features this Week

Focus Due Diligence on High RS Cup and Handle Stocks

The two strongest breakouts this week were MGNX with an RS of 91 on the day before breakout and FPRX with an RS of 98 on the day before breakout. Both were from a cup and handle pattern.

Over the 12 years this site has been operational, I have consistently found that the most important factor in determining performance after breakout is Relative Strength Rank (RS) and that the most reliable pattern is the cup and handle.

Stocks with ab RS of 90 or above have consistently outperformed 90% of the market over the last 12 months. While this is no guarantee of future performance, the data shows that this performance does tend to continue on the average.

For this reason, I recommend that when doing your due diligence on stocks on our watchlists, you focus firstly on the cup and handle watchlist and look for stocks with an RS rank of 90 or above.

RS Rank Formula

RS Rank is a gauge of a stock's price performance vs. all other stocks in the NYSE, AMEX and NASDAQ. The change in each stock's price for each of the previous four quarters is used to derive a weighted price performance for each stock. This weighted price performance is then used to rank all stocks against each other. Each stock is then given an RS Rank from 99 (highest) to 1 (lowest). This value is updated daily, so is a dynamic indicator of relative performance against all other stocks given the latest closing prices.

Formula for determining RS Rank:

Weighted Price Change = (Price change this quarter * 40%)

+ (Price change 1 qtr ago * 20%)

+ (Price change 2 qtrs ago * 20%)

+ (Price change 3 qtrs ago * 20%)

When less than 4 quarters of data are available, 3 quarters are weighted 50%/30%/20%; 2 quarters are weighted 60%/40%; and one quarter or less is weighted 100% on the available data.

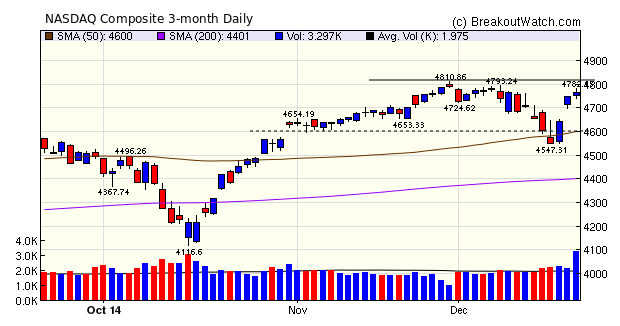

| Index | Value | Change Week | Change YTD | Trend | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | 17804.8 | 3.03% | 7.41% | Up | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 4765.38 | 2.4% | 14.1% | Up | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 2070.65 | 3.41% | 12.03% | Up | ||||||||||||||||||||||||||||||||||||

1The Market Signal is derived

from our proprietary market model. The market model is

described on the site.

2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

|

Category

|

Symbol

|

Company Name

|

Expected Gain1

|

|---|---|---|---|

| Best Overall | EVC | Entravision Communications Corporation | 106 |

| Top Technical | EVC | Entravision Communications Corporation | 106 |

| Top Fundamental | HW | Headwaters Incorporated | 66 |

| Top Tech. & Fund. | RAX | Rackspace Hosting, Inc | 30 |

|

Category

|

Symbol

|

Company Name

|

Expected Gain1

|

|---|---|---|---|

| Best Overall | SVU | SuperValu Inc. | 86 |

| Top Technical | TWOU | 2U, Inc. | 52 |

| Top Fundamental | NJ | Nidec Corporation (Nihon Densan Kabushiki Kaisha) | 54 |

| Top Tech. & Fund. | KIRK | Kirkland's, Inc. | 42 |

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2014 NBIcharts, LLC dba BreakoutWatch.com. All rights

reserved.

" BreakoutWatch," the BreakoutWatch.com "eye" logo, and the slogan

"tomorrow's breakouts today" are service marks of NBIcharts LLC.

All other marks are the property of their respective owners, and

are used for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or

with Mr. William O'Neil. Our site, research and analysis is

supported entirely by subscription and is free from advertising.