| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

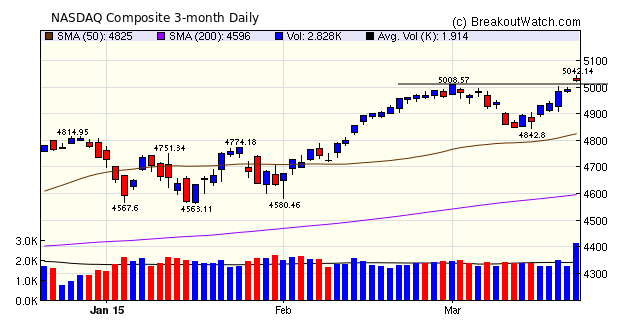

After testing resistance on Wednesday and Thursday the NASDAQ Composite finally broke through on Friday to set a new all-time high, on volume that was 50% above the 50 day average. Some of the volume was attributable to Friday being a "quadruple witching day".

Wednesday saw the most significant news of the week with the FOMC dropping the word "patient" from their statement. Contrary to expectations, the sky did not fall and stocks surged after the 2pm announcement as it was assumed a raise in interest rates was no longer imminent.

Our trend signal for the NASDAQ remains positive and is now joined by the signal for the DJI. The S&P 500 signal is still negative but could change on Monday.

Except for Wednesday and Friday, volumes this week were below average which restricted the number of breakouts as a volume of 150% of average daily volume is needed for a breakout to be confirmed for all breakouts except those from a High Tight Flag pattern. As usual, most breakouts were from a cup with handle pattern and the highest flyers from that pattern came from stocks with a relative strength rank of over 92. Only three breakouts were under water at the end of the week, with a very satisfactory average gain overall of 5.5%

| Breakouts for Week Beginning 03/16/15 | |||||||||

| Brkout Date | Symbol | Base | Squeeze | BrkoutOut Price | Brkout Day Close | RS Rank* | Last Close | Current % off BOP | Gain at Intraday High |

|---|---|---|---|---|---|---|---|---|---|

| 03/17/15 | GLMD | CwH | N | 9.79 | 10.92 | 94 | 13.25 | 35.34 | 35.34 |

| 03/20/15 | UTG | HSB | N | 471.50 | 588.50 | 1 | 588.5 | 24.81 | 24.81 |

| 03/16/15 | EDN | CwH | N | 15.86 | 16.09 | 96 | 18.33 | 15.57 | 15.57 |

| 03/17/15 | VSLR | CwH | N | 11.80 | 12.23 | 93 | 12.93 | 9.58 | 11.27 |

| 03/16/15 | TEO | CwH | N | 23.44 | 24.66 | 86 | 25.35 | 8.15 | 11.09 |

| 03/19/15 | AGRO | CwH | N | 9.88 | 10.02 | 85 | 10.64 | 7.69 | 7.69 |

| 03/16/15 | SIGM | CwH | N | 7.51 | 7.87 | 96 | 7.88 | 4.93 | 7.59 |

| 03/17/15 | PCTY | CwH | N | 30.40 | 31.60 | 91 | 32.63 | 7.34 | 7.34 |

| 03/19/15 | HRTX | HTF | N | 15.47 | 16.15 | 95 | 16.11 | 4.14 | 4.4 |

| 03/19/15 | HRTX | CwH | N | 15.47 | 16.15 | 95 | 16.11 | 4.14 | 4.4 |

| 03/16/15 | SHLM | CwH | N | 43.09 | 43.92 | 83 | 44.79 | 3.95 | 3.95 |

| 03/20/15 | NKE | CwH | N | 98.75 | 101.98 | 84 | 101.98 | 3.27 | 3.27 |

| 03/18/15 | SLG | DB | N | 129.93 | 130.60 | 83 | 134 | 3.13 | 3.13 |

| 03/20/15 | ENSG | CwH | N | 45.34 | 46.08 | 84 | 46.08 | 1.63 | 1.63 |

| 03/16/15 | ADXS | CwH | N | 12.81 | 13.01 | 99 | 12.54 | -2.11 | 1.56 |

| 03/18/15 | DTSI | CwH | N | 33.72 | 34.07 | 94 | 34.06 | 1.01 | 1.45 |

| 03/20/15 | NORD | CwH | N | 22.47 | 22.77 | 88 | 22.77 | 1.34 | 1.34 |

| 03/20/15 | ALG | CwH | N | 59.88 | 60.58 | 87 | 60.58 | 1.17 | 1.17 |

| 03/20/15 | CUBI | CwH | N | 24.07 | 24.32 | 89 | 24.32 | 1.04 | 1.04 |

| 03/20/15 | TRMB | HSB | N | 25.74 | 25.92 | 13 | 25.92 | 0.70 | 0.7 |

| 03/19/15 | OSIR | CwH | N | 18.40 | 18.48 | 91 | 17.59 | -4.40 | 0.43 |

| 03/20/15 | WK | HSB | N | 13.68 | 13.71 | 47 | 13.71 | 0.22 | 0.22 |

| 03/20/15 | UBSI | CwH | Y | 38.40 | 38.43 | 81 | 38.43 | 0.08 | 0.08 |

| 03/18/15 | RPTP | CwH | N | 11.88 | 11.88 | 81 | 11.86 | -0.17 | 0 |

| Weekly Average (24 breakouts) | 5.52 | 6.23 | |||||||

| *RS Rank on day before breakout. | |||||||||

No new features this week.

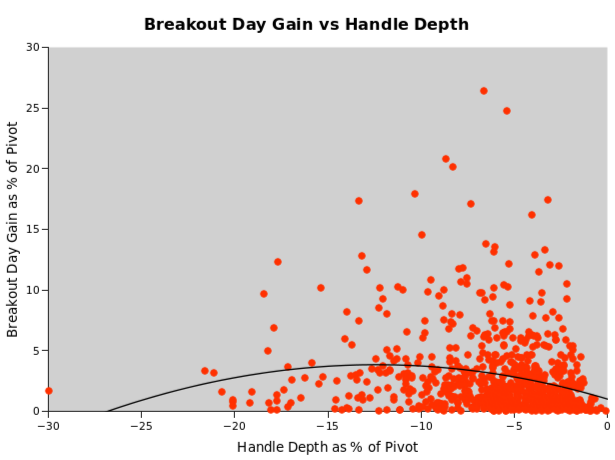

Moderate Handle Depth Gives Best Breakout Day Gain

In my February 28 newsletter (How to Find Cup and Handle breakouts with a 90% Chance of Success) I showed how cup and handle stocks that are close to their breakout price on the day before breakout have a high probability of breakout.

This week, I looked at the influence of handle depth on the strength of the breakout day gain. We know from my Analysis of a Cup and Handle Chart Pattern article that it is desirable that the stock retreat after forming the pivot but the question arises as to how much retreat generates the most powerful breakouts. To answer this question, I looked at successful cup with handle breakouts since January, 2014. The results are shown in the chart below.

The chart shows a scatter plot of gain as a % of breakout price (pivot) against handle depth as a % of breakout price. Each dot is one observation.

Firstly, notice that the most successful breakouts are clustered around a handle depth of about -5%, but the vast majority of them have a breakout day gain of less than 5%

Secondly, notice that at very shallow handle depths, the breakout day gain over breakout price is quite small. This is evident from the polynomial regression line which slopes down as handle depths approach zero.

Thirdly, the polynomial regression line shows peak gains at depths of around -12%. However, there are many fewer breakouts at that level so successful breakouts at that depth are rarer.

The optimum depth appears to be in the range -6% to -3%, with a high number of successful breakouts giving average breakout day gains of about 4%.

Conclusion

If we combine the results from February 28 and today we can conclude that the most desirable cup with handle stocks to buy on breakout are those whose price on the day before breakout is within 95% or better of the breakout price and whose cup depth was in the range -3% to -6%.

| Index | Value | Change Week | Change YTD | Trend | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | 18127.7 | 2.13% | 1.71% | Up | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 5026.42 | 3.17% | 6.13% | Up | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 2108.1 | 2.66% | 2.39% | Down | ||||||||||||||||||||||||||||||||||||

1The Market Signal is derived

from our proprietary market model. The market model is

described on the site.

2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

|

Category

|

Symbol

|

Company Name

|

Expected Gain1

|

|---|---|---|---|

| Best Overall | MWW | Monster Worldwide, Inc. | 102 |

| Top Technical | MWW | Monster Worldwide, Inc. | 102 |

| Top Fundamental | ODFL | Old Dominion Freight Line, Inc. | 30 |

| Top Tech. & Fund. | ODFL | Old Dominion Freight Line, Inc. | 30 |

|

Category

|

Symbol

|

Company Name

|

Expected Gain1

|

|---|---|---|---|

| Best Overall | SIGM | Sigma Designs, Inc. | 88 |

| Top Technical | ADXS | Advaxis, Inc. | 84 |

| Top Fundamental | DTSI | DTS, Inc. | 54 |

| Top Tech. & Fund. | DTSI | DTS, Inc. | 54 |

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2015 NBIcharts, LLC dba BreakoutWatch.com. All rights

reserved.

" BreakoutWatch," the BreakoutWatch.com "eye" logo, and the slogan

"tomorrow's breakouts today" are service marks of NBIcharts LLC.

All other marks are the property of their respective owners, and

are used for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or

with Mr. William O'Neil. Our site, research and analysis is

supported entirely by subscription and is free from advertising.