| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

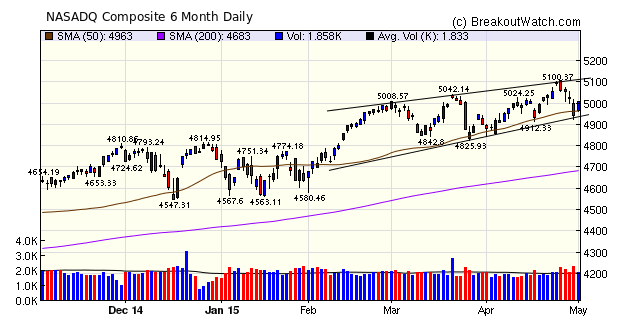

The NASDAQ Composite gave up 1.7% this week as earnings proved disappointing in most cases, but the size of upside surprises was above the norm.

"With 72% of the companies in the S&P 500 reporting actual

results for Q1 to date, fewer companies are reporting actual EPS

above estimates (71%) and actual sales above estimates (46%)

than average. However, the companies that are reporting upside

earnings surprises are surpassing estimates by much wider

margins (+6.2%) than average." (Facset,

May 1,2015)

The largely disappointing earnings combined with with relatively large surprises contributed to market uncertainty and therefor higher volatility.

Nevertheless, The market uptrend continues with the NASDAQ continuing t find support when threatened at about the 50 day average level.

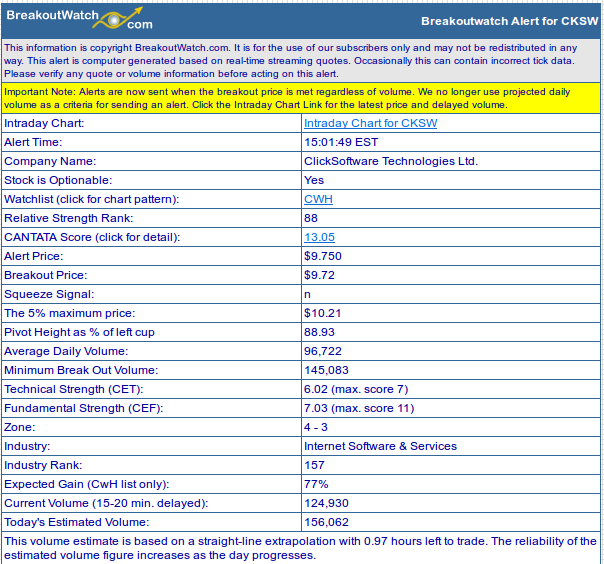

Clicksoftware Technologies (CKSW) was the top performing breakout due to a takeover announced after the market close on Thursday. Our alert was issued at 3:01pm on Thursday. Read more about this below.

| Breakouts for Week Beginning 04/27/15 | |||||||||

| Brkout Date | Symbol | Base | Squeeze | BrkoutOut Price | Brkout Day Close | RS Rank* | Last Close | Current % off BOP | Gain at Intraday High |

|---|---|---|---|---|---|---|---|---|---|

| 04/29/15 | CKSW | CwH | N | 9.72 | 9.82 | 88 | 12.43 | 27.88 | 29.12 |

| 04/30/15 | AAWW | DB | N | 44.98 | 48.74 | 77 | 51.95 | 15.50 | 17.25 |

| 04/29/15 | MSTR | CwH | Y | 176.63 | 187.07 | 82 | 182.68 | 3.43 | 12.04 |

| 04/30/15 | AVG | SQZ | Y | 22.01 | 23.92 | 81 | 23.87 | 8.45 | 11.72 |

| 04/27/15 | IPWR | CwH | N | 10.22 | 10.30 | 92 | 10.45 | 2.25 | 10.57 |

| 04/27/15 | USLV | HSB | N | 18.69 | 19.29 | 2 | 18.42 | -1.44 | 9.68 |

| 05/01/15 | BCOR | HSB | N | 14.50 | 15.55 | 14 | 15.55 | 7.24 | 8.21 |

| 04/30/15 | AAC | CwH | Y | 33.25 | 34.66 | 91 | 34.43 | 3.55 | 6.47 |

| 04/30/15 | CSGP | SQZ | Y | 201.10 | 204.43 | 87 | 204.47 | 1.68 | 6.2 |

| 04/30/15 | SPCB | CwH | N | 11.68 | 12.16 | 90 | 12.37 | 5.91 | 6.08 |

| 05/01/15 | YUM | CwH | N | 87.10 | 91.90 | 85 | 91.9 | 5.51 | 5.61 |

| 05/01/15 | AA | HSB | N | 13.55 | 14.15 | 14 | 14.15 | 4.43 | 5.39 |

| 04/29/15 | RNG | CwH | N | 17.19 | 17.64 | 89 | 17.13 | -0.35 | 4.42 |

| 04/29/15 | LVLT | CwH | N | 54.67 | 56.68 | 83 | 55.71 | 1.90 | 4.34 |

| 04/27/15 | CNCO | HSB | N | 7.80 | 8.09 | 29 | 7.7 | -1.28 | 3.72 |

| 04/29/15 | EEFT | CwH | N | 59.92 | 61.01 | 85 | 58.36 | -2.60 | 3.47 |

| 05/01/15 | WAB | CwH | N | 98.61 | 99.82 | 82 | 99.82 | 1.23 | 2.92 |

| 05/01/15 | VAC | SQZ | Y | 82.31 | 84.4 | 90 | 84.4 | 2.54 | 2.75 |

| 05/01/15 | CRUS | CwH | N | 35.13 | 35.80 | 95 | 35.8 | 1.91 | 2.11 |

| 05/01/15 | CSX | CwH | N | 37.12 | 37.46 | 80 | 37.46 | 0.92 | 1.48 |

| 04/27/15 | MNST | SQZ | Y | 141.88 | 143.44 | 96 | 141.13 | -0.53 | 1.1 |

| 04/28/15 | SLAB | CwH | N | 52.98 | 53.31 | 80 | 52.26 | -1.36 | 0.98 |

| 04/27/15 | BOOT | HTF | N | 25.76 | 25.79 | 91 | 24.55 | -4.70 | 0.31 |

| Weekly Average (24 breakouts) | 5.23 | 8.51 | |||||||

| *RS Rank on day before breakout. | |||||||||

No New Features This Week

Use Limit Orders when Buying at Open

At 3:01 pm on Thursday we issued an alert for ClickSoftware Technologies (CKSW). CKSW was on our CWH watchlist with a breakout price of 9.72 and we issued an alert when the price was 9.75. The stock closed for the day at 9.82. If you were lucky enough to place an order before the close you were in for a massive windfall as the stock gapped up at next day's open to 12.53 on news that the company was to be acquired by Fransisco Partners for $12.65 a share.

If instead of buying on the alert, you placed a buy at open order at market then you would be surprised at the 28% premium that you would have to pay with very little upside potential to 12.65 of less than 1%.

To avoid gaps-up when an acquisition is made we recommend a limit order no more than 5% above the breakout price. We show that limit on our email alerts. Here's the alert for CKSW with the relevant prices circled.

Note that the stock closed for the day within the limit price so a buy order on receipt of the alert with a limit of 10.21 would have been executed, but an overnight order with the same limit would not have been executed as the stock opened at 12.53.

Conclusion

When acting on an alert to either place an immediate order, or to place an overnight order, place a 5% limit on the order. You will find the limit price on the alert we send.

| Index | Value | Change Week | Change YTD | Trend | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | 18024.1 | -0.31% | 1.13% | Up | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 5005.39 | -1.7% | 5.69% | Up | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 2108.29 | -0.44% | 2.4% | Up | ||||||||||||||||||||||||||||||||||||

1The Market Signal is derived

from our proprietary market model. The market model is

described on the site.

2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

|

Category

|

Symbol

|

Company Name

|

Expected Gain1

|

|---|---|---|---|

| Best Overall | GTIM | Good Times Restaurants Inc. | 99 |

| Top Technical | GTIM | Good Times Restaurants Inc. | 99 |

| Top Fundamental | WLDN | Willdan Group, Inc. | 74 |

| Top Tech. & Fund. | WLDN | Willdan Group, Inc. | 74 |

|

Category

|

Symbol

|

Company Name

|

Expected Gain1

|

|---|---|---|---|

| Best Overall | AAC | AAC Holdings, Inc. | 54 |

| Top Technical | IPWR | Ideal Power Inc. | 52 |

| Top Fundamental | AAC | AAC Holdings, Inc. | 54 |

| Top Tech. & Fund. | AAC | AAC Holdings, Inc. | 54 |

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2015 NBIcharts, LLC dba BreakoutWatch.com. All rights

reserved.

" BreakoutWatch," the BreakoutWatch.com "eye" logo, and the slogan

"tomorrow's breakouts today" are service marks of NBIcharts LLC.

All other marks are the property of their respective owners, and

are used for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or

with Mr. William O'Neil. Our site, research and analysis is

supported entirely by subscription and is free from advertising.