| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

As foreseen in last week's newsletter, the roller coaster ride of the NASDAQ composite continued as the index pulled back from last week's new high. Although our trend indicators for the three major indexes remain positive, for now, that will change if the weakness continues on Monday. In general, the market's were disappointed with earnings results, particularly those of AAPL, which is heavily weighted in the S&P 500 and DJI.

Friday's new jobless claim number was the lowest since 1973 but that good news was overwhelmed by a fall in new home sales and a continued bear market in crude oil.

The number of breakouts fell to 37 following 59 last week. The biggest gain for the week came from ATTU which broke out from a Volatility Squeeze pattern to yield a gain of 10.6%. The biggest loser was BIIB (Biogen), which also broke out from a Volatility Squeeze but whose earnings results turned out to be a huge disappointment.

| Breakouts for Week Beginning 07/20/15 | |||||||||

| Brkout Date | Symbol | Base | Squeeze | BrkoutOut Price | Brkout Day Close | RS Rank* | Last Close | Current % off BOP | Gain at Intraday High |

|---|---|---|---|---|---|---|---|---|---|

| 07/20/15 | ALDX | SQZ | Y | 8.98 | 9.69 | 83 | 9.68 | 7.80 | 18.37 |

| 07/22/15 | MRNS | CwH | N | 15.49 | 15.91 | 96 | 15.99 | 3.23 | 12.2 |

| 07/20/15 | ATTU | SQZ | Y | 13.90 | 14.31 | 96 | 15.37 | 10.58 | 10.58 |

| 07/20/15 | FIX | SQZ | Y | 23.42 | 23.63 | 93 | 24.87 | 6.19 | 8.88 |

| 07/23/15 | UA | CwH | N | 89.46 | 95.93 | 89 | 96.05 | 7.37 | 7.37 |

| 07/20/15 | WIX | CwH | N | 25.85 | 27.01 | 92 | 27.06 | 4.68 | 5.96 |

| 07/21/15 | OC | CwH | N | 43.10 | 43.15 | 80 | 43.81 | 1.65 | 5.85 |

| 07/22/15 | ZOES | SQZ | Y | 43.14 | 45.54 | 92 | 42.85 | -0.67 | 5.7 |

| 07/23/15 | VRX | CwH | N | 240.79 | 253.84 | 95 | 251.92 | 4.62 | 5.42 |

| 07/22/15 | FIX | SQZ | Y | 24.22 | 25.45 | 94 | 24.87 | 2.68 | 5.28 |

| 07/21/15 | MMI | SQZ | Y | 48.52 | 49.93 | 96 | 50.73 | 4.55 | 4.55 |

| 07/22/15 | BGFV | SQZ | Y | 14.73 | 15.34 | 90 | 14.6 | -0.88 | 4.14 |

| 07/24/15 | JNPR | SQZ | Y | 26.49 | 27.54 | 85 | 27.54 | 3.96 | 3.96 |

| 07/21/15 | DHT | CwH | N | 8.57 | 8.72 | 84 | 8.38 | -2.22 | 3.85 |

| 07/23/15 | GWRE | CwH | N | 57.94 | 60.08 | 86 | 59.36 | 2.45 | 3.69 |

| 07/21/15 | ABMD | CwH | N | 72.90 | 75.58 | 98 | 73.1 | 0.27 | 3.68 |

| 07/21/15 | STBA | CwH | N | 31.48 | 31.94 | 83 | 31.46 | -0.06 | 3.56 |

| 07/20/15 | CUBA | SQZ | Y | 10.04 | 10.39 | 81 | 10.04 | 0.00 | 3.49 |

| 07/23/15 | TXMD | SQZ | Y | 8.22 | 8.5 | 96 | 8.16 | -0.73 | 3.41 |

| 07/20/15 | ICUI | SQZ | Y | 96.46 | 97.1 | 89 | 97.73 | 1.32 | 3.15 |

| 07/24/15 | NPTN | SQZ | Y | 8.98 | 9.22 | 98 | 9.22 | 2.67 | 2.67 |

| 07/24/15 | UVE | CwH | N | 27.39 | 28.09 | 95 | 28.09 | 2.56 | 2.56 |

| 07/23/15 | COR | CwH | N | 48.67 | 49.54 | 84 | 49.81 | 2.34 | 2.34 |

| 07/23/15 | AFOP | CwH | N | 21.29 | 21.73 | 86 | 21.16 | -0.61 | 2.07 |

| 07/21/15 | FFIN | SQZ | Y | 35.34 | 35.52 | 88 | 34.33 | -2.86 | 1.87 |

| 07/23/15 | CAKE | CwH | Y | 55.48 | 56.48 | 80 | 55.72 | 0.43 | 1.8 |

| 07/22/15 | BJRI | SQZ | Y | 49.58 | 50.35 | 83 | 49.89 | 0.63 | 1.55 |

| 07/22/15 | BSX | SQZ | Y | 17.77 | 18.02 | 86 | 17.36 | -2.31 | 1.41 |

| 07/20/15 | WSO | DB | N | 125.47 | 127.04 | 84 | 123.44 | -1.62 | 1.25 |

| 07/22/15 | HFC | CwH | N | 46.74 | 47.22 | 85 | 46.51 | -0.49 | 1.03 |

| 07/22/15 | ICUI | SQZ | Y | 98.85 | 99.5 | 91 | 97.73 | -1.13 | 0.66 |

| 07/21/15 | CSGP | CwH | N | 217.23 | 218.43 | 90 | 214.83 | -1.10 | 0.55 |

| 07/23/15 | HCSG | CwH | Y | 34.75 | 34.93 | 80 | 34.39 | -1.04 | 0.52 |

| 07/21/15 | ARES | SQZ | Y | 19.93 | 20.01 | 80 | 19.94 | 0.05 | 0.4 |

| 07/21/15 | BIIB | SQZ | Y | 408.71 | 409.5 | 80 | 300.03 | -26.59 | 0.19 |

| 07/24/15 | AMSG | SQZ | Y | 70.39 | 70.49 | 90 | 70.49 | 0.14 | 0.14 |

| 07/23/15 | AZZ | SQZ | Y | 52.24 | 52.29 | 83 | 51.63 | -1.17 | 0.1 |

| Weekly Average (37 breakouts) | 0.72 | 3.9 | |||||||

| *RS Rank on day before breakout. | |||||||||

Cup and Handle Stocks Expected to Move Up

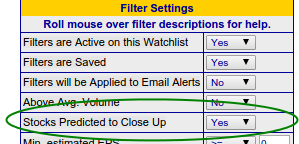

As reported last week, I have a new model that attempts to predict which cup and handle stocks will move up at the next session. This does not mean that they will necessarily break out, which requires that they close above their breakout price on 150% of average volume, only that there is high probability that they will close higher.

There is a new filter on the Cup and Handle watchlist which will select these stocks. This filter will not be used for filtering alerts, however. Alerts will continue to be sent only when stocks reach their breakout price.

Cup and Handle Stocks Expected to Move Up - New Motif

The model used to predict these stocks is still undergoing development but the back testing results reported last week I feel are good enough to make this filter available now.

It is important to understand that these results were obtained in aggregate since 2008. A prediction accuracy of 68% will not be achieved each day, week or even month. To provide a real world demonstration of how they will perform, I've established a Motif for these stocks. My plan is to re-balance the Motif each day by retaining stocks that moved up, dropping those that moved down, and adding new ones predicted to move up.

Below you will see the performance so far. As I only established the Motif a couple of days ago, and the market has been down since then, the performance so far is negative. Clicking the "VIEW MOTIF DETAILS" below will show you the current stock holdings.

| Index | Value | Change Week | Change YTD | Trend | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | 17568.5 | -2.86% | -1.43% | Up | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 5088.63 | -2.33% | 7.44% | Up | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 2079.65 | -2.21% | 1.01% | Up | ||||||||||||||||||||||||||||||||||||

1The Market Signal is derived

from our proprietary market model. The market model is

described on the site.

2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

|

Category

|

Symbol

|

Company Name

|

Expected Gain1

|

|---|---|---|---|

| Best Overall | GLUU | Glu Mobile Inc. | 120 |

| Top Technical | GLUU | Glu Mobile Inc. | 120 |

| Top Fundamental | ANET | Arista Networks, Inc. | 34 |

| Top Tech. & Fund. | SCMP | Sucampo Pharmaceuticals, Inc. | 63 |

|

Category

|

Symbol

|

Company Name

|

Expected Gain1

|

|---|---|---|---|

| Best Overall | DHT | DHT Holdings, Inc. | 83 |

| Top Technical | MRNS | Marinus Pharmaceuticals, Inc. | 76 |

| Top Fundamental | UVE | UNIVERSAL INSURANCE HOLDINGS INC | 54 |

| Top Tech. & Fund. | UVE | UNIVERSAL INSURANCE HOLDINGS INC | 54 |

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2015 NBIcharts, LLC dba BreakoutWatch.com. All rights

reserved.

" BreakoutWatch," the BreakoutWatch.com "eye" logo, and the slogan

"tomorrow's breakouts today" are service marks of NBIcharts LLC.

All other marks are the property of their respective owners, and

are used for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or

with Mr. William O'Neil. Our site, research and analysis is

supported entirely by subscription and is free from advertising.