| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

This week I got an email from a subscriber saying:

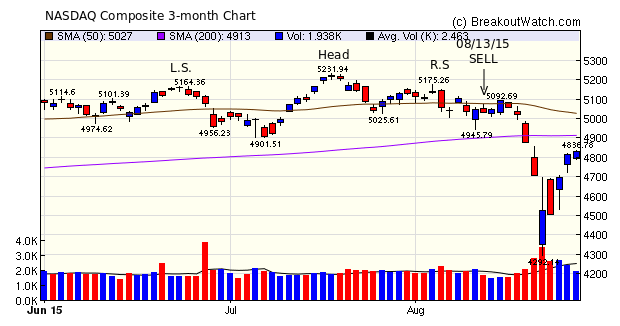

That was nice, so let me brag a little. Last week I warned of a bearish head and shoulders top and also drew attention to my NASDAQ market signal that had turned to sell on August 13. There was no brilliance on my part, I was simply looking at what the technical indicators said.

So that's the value in subscribing to breakoutwatch.com. We are a provider of information that aims to help you in making rational investment decisions based on sound technical analysis. And the value we offer just got better. The market is down and so are our subscription fees - see our Top Tip below.

So what now? Well our trend indicators are all down, and are likely to remain so. Watch them every day (they our published in our daily update email) and if you are risk averse, don't go long until they turn up. I suspect we will not return to the highs of July in the near term as markets will continue to fret over the Fed's next interest rate decision due September 17.

Volatility Squeeze breakouts dominated the week with very few cup and handle stocks able to climb out of their very deep handles. Of the week's breakouts, none were under water by Friday's close and the average gain for the week was a healthy 4.1%.

| Breakouts for Week Beginning 08/24/15 | |||||||||

| Brkout Date | Symbol | Base | Squeeze | BrkoutOut Price | Brkout Day Close | RS Rank* | Last Close | Current % off BOP | Gain at Intraday High |

|---|---|---|---|---|---|---|---|---|---|

| 08/27/15 | MDCO | SQZ | Y | 30.41 | 31.75 | 89 | 33.64 | 10.62 | 10.62 |

| 08/25/15 | CVGW | SQZ | Y | 55.18 | 55.52 | 95 | 59.23 | 7.34 | 9.64 |

| 08/28/15 | SPWH | SQZ | Y | 11.84 | 12.92 | 98 | 12.92 | 9.12 | 9.12 |

| 08/26/15 | CVGW | SQZ | Y | 55.53 | 59.62 | 95 | 59.23 | 6.66 | 8.95 |

| 08/27/15 | SRPT | SQZ | Y | 34.20 | 36.23 | 99 | 36.69 | 7.28 | 7.28 |

| 08/28/15 | MDCO | SQZ | Y | 31.82 | 33.64 | 91 | 33.64 | 5.72 | 5.72 |

| 08/27/15 | QURE | SQZ | Y | 24.66 | 25.23 | 97 | 25.77 | 4.50 | 4.5 |

| 08/28/15 | DO | HSB | N | 23.25 | 24.29 | 15 | 24.29 | 4.47 | 4.47 |

| 08/27/15 | HEES | HSB | N | 17.98 | 18.52 | 11 | 18.69 | 3.95 | 3.95 |

| 08/25/15 | PETX | SQZ | Y | 17.03 | 17.46 | 95 | 17.64 | 3.58 | 3.58 |

| 08/28/15 | VRTU | SQZ | Y | 50.82 | 52.34 | 95 | 52.34 | 2.99 | 2.99 |

| 08/28/15 | IPHI | SQZ | Y | 23.29 | 23.88 | 93 | 23.88 | 2.53 | 2.53 |

| 08/28/15 | JBSS | SQZ | Y | 53.23 | 54.48 | 96 | 54.48 | 2.35 | 2.35 |

| 08/27/15 | DY | DB | N | 69.80 | 71.26 | 98 | 71.14 | 1.92 | 2.09 |

| 08/28/15 | JAKK | SQZ | Y | 9.28 | 9.42 | 96 | 9.42 | 1.51 | 1.51 |

| 08/28/15 | SPPI | SQZ | Y | 7.49 | 7.6 | 90 | 7.6 | 1.47 | 1.47 |

| 08/28/15 | SRPT | SQZ | Y | 36.30 | 36.69 | 99 | 36.69 | 1.07 | 1.07 |

| 08/28/15 | CPE | CwH | N | 8.83 | 8.91 | 81 | 8.91 | 0.91 | 0.91 |

| 08/28/15 | CCS | CwH | N | 22.65 | 22.81 | 91 | 22.81 | 0.71 | 0.71 |

| Weekly Average (19 breakouts) | 4.14 | 4.39 | |||||||

| *RS Rank on day before breakout. | |||||||||

No new features this week.

Subscription Rates reduced 30%. Test Drive for Just $4.95.

The market is down so I have dramatically reduced subscription rates to improve the value we offer at this uncertain time.

Our Platinum subscription, with all the bells and whistles we offer, is now just $39.95 a month, that's a 30% reduction from $59.95. Longer term Platinum subscriptions of 3, 6 and 12 months are similarly reduced, and you get a further 5% discount for choosing to autorenew. Gold and Silver subscriptions are also substantially reduced.

|

Service

Offering |

Service Description |

Subscription

|

||||

|---|---|---|---|---|---|---|

| 1 Month |

3 Month

(Save 10%) |

6 mnth

(Save 15%) |

12 mnth

(Save 20%) |

|||

| Silver |

Daily Breakouts + All watchlists for

next session + annotated charts + CE* for watchlist

stocks + Weekly Newsletter

|

$19.95

|

$53.86

|

$101.74

|

$191.52

|

|

| Gold |

Silver + T/A Charts + email alerts**

|

$29.95

|

$80.86

|

$152.74

|

$287.52

|

|

| Platinum |

Gold + Unlimited CE + Watchlist/Alert

Filters + Tradewatch***

|

$39.95

|

$107.87

|

$203.75

|

$383.52

|

|

| Test Drive | Platinum | $4.95 | N/A | N/A | N/A | |

| An additional 5% discount is given for subscriptions that are on Autorenew. | ||||||

|

Please

note that subscriptions are non-refundable.

|

||||||

|

* CANTATA Evaluator:

analysis of stock by timing, technical and fundamental

criteria |

||||||

| Index | Value | Change Week | Change YTD | Trend | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | 16643 | 1.11% | -6.62% | Down | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 4828.33 | 2.6% | 1.95% | Down | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 1988.87 | 0.91% | -3.4% | Down | ||||||||||||||||||||||||||||||||||||

1The Market Signal is derived

from our proprietary market model. The market model is

described on the site.

2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

|

Category

|

Symbol

|

Company Name

|

Expected Gain1

|

|---|---|---|---|

| Best Overall | CWST | Casella Waste Systems, Inc. | 97 |

| Top Technical | CWST | Casella Waste Systems, Inc. | 97 |

| Top Fundamental | PAYC | Paycom Software, Inc. | 53 |

| Top Tech. & Fund. | PAYC | Paycom Software, Inc. | 53 |

|

Category

|

Symbol

|

Company Name

|

Expected Gain1

|

|---|---|---|---|

| Best Overall | CPE | Callon Petroleum Company | 83 |

| Top Technical | CCS | Century Communities, Inc. | 61 |

| Top Fundamental | CCS | Century Communities, Inc. | 61 |

| Top Tech. & Fund. | CCS | Century Communities, Inc. | 61 |

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2015 NBIcharts, LLC dba BreakoutWatch.com. All rights

reserved.

" BreakoutWatch," the BreakoutWatch.com "eye" logo, and the slogan

"tomorrow's breakouts today" are service marks of NBIcharts LLC.

All other marks are the property of their respective owners, and

are used for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or with Mr. William O'Neil. Our site, research and analysis is supported entirely by subscription and is free from advertising.