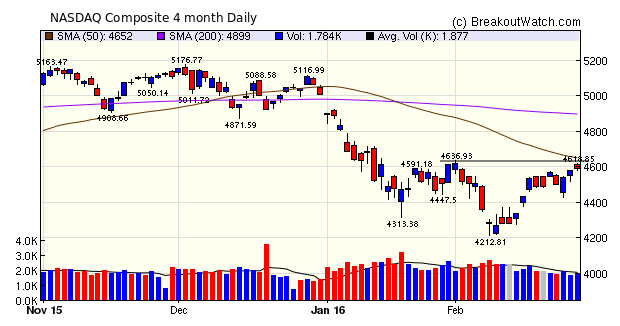

The NASDAQ Composite out paced the S&P 500 and DJI to close 2.3% higher for the week, but this was not sufficient to turn around our trend indicator for the NASDAQ which continues to point down. In contrast, the trend indicator for the the other two major indexes turned up this week and I expect the NASDAQ trend will reverse if Monday delivers a positive trading day.

Counter to this, however, was the weakness in the large cap stocks on Friday, as traders fear that the upward revisions to Q4 GDP will bring on sooner than expected interest rate increases by the Fed.

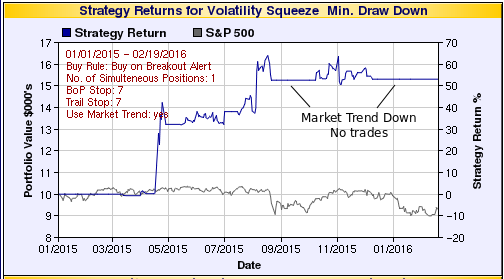

As most breakouts come from the NASDAQ market, I continue to suggest caution is appropriate until the NASDAQ trend indicator turns up.