Breakoutwatch Weekly Summary 09/29/18

You are receiving this email because you are or were a BreakoutWatch.com subscriber, or have subscribed to our weekly newsletter. This newsletter summarizes the breakout events of the week and provides additional guidance that does not fit into our daily format. It is published each weekend.

| 50 Day Average Provides

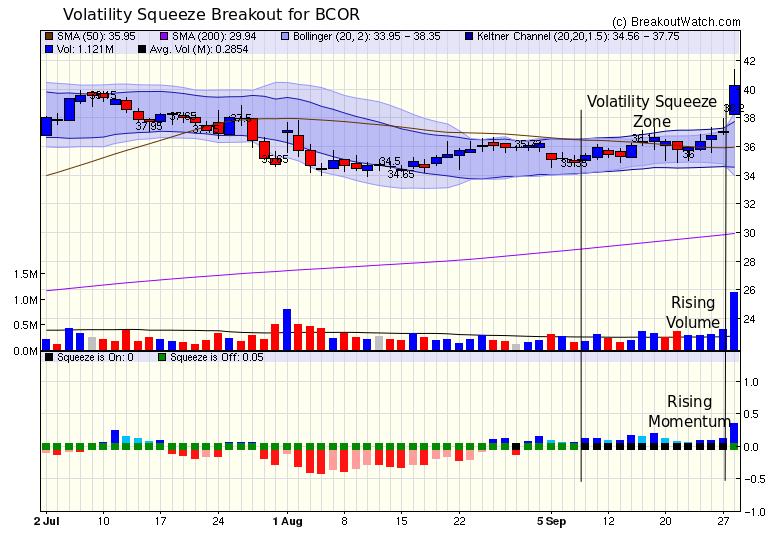

NASDAQ Support The NASDAQ made a modest gain of 0.7% while the DJI and S&P 500 made losses of 1% and 0.5% respectively. The Fed raised interest rates 0.25% on Wednesday which surprisingly caused the markets to turn south after the announcement despite the rate rise being expected and presumably already priced in. The 50 day moving average or thereabouts can be seen to be a consistent support level for the NASDAQ. A sustained breach of that level would be an early warning of a possible correction to come.  The best performing breakout for

the week, BCOR, came from a Volatility Squeeze breakout. As is

often the case, the breakout was preceded by rising volume

which was well above average on the day before breakout. The

methodology for a Volatility Squeeze candidate is described here.

|

| Smartphone Site Version in Beta

Test If you access https://www.breakoutwatch.com on your smartphone you will be able to access a version of the site. Use the menu icon to login and navigate. Not all desktop site functionality is available as many of the legacy pages do not adapt easily to the smartphone format. I will be enhancing the functionality as time and life permit. Please let me know of any defects you would like addressed.  |

|

Our latest strategy

suggestions are here.

|

| List | Breakouts | Avg. Gain |

|---|---|---|

| CWH | 1 | 5.3 |

| SQZ | 5 | 4.15 |

| HTF | 0 | |

| HSB | 0 | |

| DB | 1 | 3.31 |

| Brkout Date | Symbol | Base | Squeeze | BrkoutOut Price | Brkout Day Close | RS Rank* | Last Close | Current % off BOP | Gain at Intraday High |

|---|---|---|---|---|---|---|---|---|---|

| 2018-09-27 | BCOR | SQZ | y | 36.81 | 37.05 | 90 | 40.25 | 9.35% | 3.78% |

| 2018-09-27 | CEO | CWH | n | 187.59 | 193.08 | 87 | 197.54 | 5.3% | 3.9% |

| 2018-09-26 | GMED | SQZ | y | 54.66 | 56.02 | 88 | 56.76 | 3.84% | 0.68% |

| 2018-09-26 | AMOT | SQZ | y | 52.42 | 52.62 | 93 | 54.43 | 3.83% | 0.23% |

| 2018-09-26 | LOXO | DB | n | 165.35 | 171.75 | 93 | 170.83 | 3.31% | 2.76% |

| 2018-09-26 | TGLS | SQZ | y | 9.53 | 9.65 | 81 | 9.83 | 3.15% | 3.57% |

| 2018-09-26 | PLNT | SQZ | y | 53.73 | 54.16 | 94 | 54.03 | 0.56% | 0.06% |

| *RS Rank on day before breakout. | |||||||||

| Symbol | BO Price |

BO Vol. |

Company | Industry | RS Rank |

Last Close |

|---|---|---|---|---|---|---|

| NDLS | 12.55 | 798,458 | Noodles & Company - Common Stock | Restaurants | 97 | 12.10 |

| XOXO | 34.63 | 411,750 | XO Group - Inc. Common Stock | Specialty Retail - Other | 95 | 34.48 |

| These stocks meet our suggested screening factors

for our Cup and Handle Chart Pattern watchlist. See Revised Rules for Trading Cup and Handle Breakouts |

||||||

| Index | Value | Change Week | Change YTD | Trend1 |

|---|---|---|---|---|

| Dow | 26458.3 |

-1.07% | 7.04% | Up |

| NASDAQ | 8046.35 |

0.74% | 16.56% | Up |

| S&P 500 | 2913.98 |

-0.54% | 8.99% | Up |

|

1The Market Trend is derived from

our proprietary market model. The market model is described on

the site here.

2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||

| 1 Week | 13 Weeks | 26 Weeks | Year-to-Date |

|---|---|---|---|

| NASDAQ Composite |

Dow Jones 7.14 % |

NASDAQ Composite 17.12 % |

NASDAQ Composite 16.56 % |

| 1 Week | 3 Weeks | 13 Weeks | 26 Weeks |

|---|---|---|---|

| Auto Parts Stores |

Internet Service Providers |

Auto Parts Stores |

Auto Parts Stores |

| Computer Based Systems 193 |

Computer Based Systems 195 |

Computer Based Systems 201 |

Basic Materials Wholesale 177 |

| Charts of each industry rank and performance over 12 months are available on the site | |||

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and you will then be able to register to receive the newsletter.

Copyright (c) 09/29/2018 NBIcharts, LLC dba BreakoutWatch.com. All

rights reserved.

" BreakoutWatch," the BreakoutWatch.com "eye" logo, and the slogan

"tomorrow's breakouts today" are service marks of NBIcharts LLC. All

other marks are the property of their respective owners, and are used

for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or with Mr. William O'Neil. Our site, research and analysis is supported entirely by subscription and is free from advertising.