Breakoutwatch Weekly Summary 02/27/21

You are receiving this email because you are or were a

BreakoutWatch.com subscriber, or have subscribed to our weekly

newsletter. This newsletter summarizes the breakout events of the week

and provides additional guidance that does not fit into our daily

format. It is published each weekend.

Newsletter Archive: https://www.breakoutwatch.com/content/newsletters

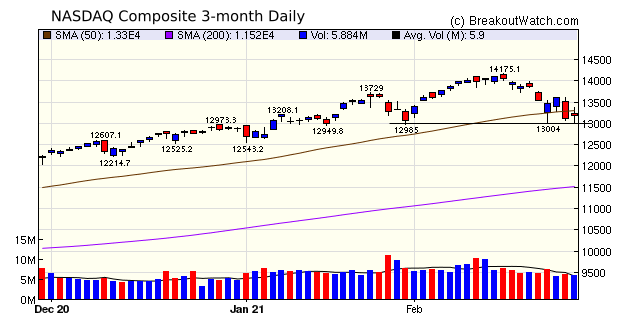

| NASDAQ Retreats as Long Term Rates

Rise The NASDAQ fell 4.9% this week as rising long term interest rates rose, the 10-year note hitting 1.6% at its peak. This is higher than the S&P 500's yield of 1.5%. The rise in the markets has been fueled, in part, by a search for higher returns than are available in fixed interest assets, so higher rates will be more attractive to risk sensitive investors. This hurt the high flying tech stocks that represent 50% of the NASDAQ top 100. Rates did fall back slightly on Friday, allowing a recovery in the NASDAQ from a support level to close 0.6% higher for the day. Fed Chairman Powell addressed inflation fears when he told Congress this week that the rising rates were in anticipation of a strong economic recovery but that it could be 2-3 years before the Fed's target of 2% inflation is reached.  Since most breakouts come from

NASDAQ listed stocks, this was a disappointing week for

breakouts with there being only 11, with most losing ground by

the end of the week. The standout performer was MERC with a 9.8%

gain.

|

| Five9, Inc.

(FIVN) Five9 is a software company developing cloud (internet) based services. On February 19, it set a high handle (meaning the pivot was above the left cup) which was followed by heavy profit taking. Since setting the handle low it has recovered to within 5% of its pivot and traded on double its 50 day volume on Friday. FIVN is worth watching in the coming week.  |

| No new features this week |

|

Our latest strategy

suggestions are here.

|

| List | Breakouts | Avg. Gain |

|---|---|---|

| CWH | 3 | -3.19 |

| SQZ | 8 | -5.84 |

| HTF | 0 | |

| HSB | 0 | |

| DB | 0 |

| Brkout Date | Symbol | Base | Squeeze | Brkout Price | Brkout Day Close | RS Rank* | Last Close | Current % off BOP | Gain at Intraday High |

|---|---|---|---|---|---|---|---|---|---|

| 2021-02-25 | MERC | CWH | n | 14.00 | 14.1 | 80 | 15.37 | 9.79% | 11.96% |

| 2021-02-24 | MAT | SQZ | y | 19.52 | 19.71 | 80 | 20.2 | 3.48% | 5.23% |

| 2021-02-23 | VER | CWH | n | 38.26 | 38.33 | 98 | 39 | 1.93% | 6.29% |

| 2021-02-22 | ATI | SQZ | y | 19.39 | 20.46 | 81 | 19.66 | 1.39% | 13.72% |

| 2021-02-24 | DCP | SQZ | y | 21.71 | 22.67 | 81 | 21.86 | 0.69% | 5.2% |

| 2021-02-22 | GES | SQZ | y | 25.24 | 26.45 | 86 | 25.21 | -0.12% | 9.55% |

| 2021-02-24 | AMSC | SQZ | y | 24.46 | 25.31 | 92 | 23.79 | -2.74% | 3.76% |

| 2021-02-22 | RYI | SQZ | y | 14.64 | 15.58 | 87 | 12.73 | -13.05% | 14.21% |

| 2021-02-22 | KZIA | SQZ | y | 11.71 | 11.94 | 90 | 9.99 | -14.69% | 12.66% |

| 2021-02-22 | FFHL | CWH | n | 12.96 | 14.76 | 95 | 10.2 | -21.3% | 32.1% |

| 2021-02-22 | CLF | SQZ | y | 17.03 | 17.39 | 92 | 13.34 | -21.67% | 5.46% |

| *RS Rank on day before breakout. | |||||||||

| Symbol | BO Price |

BO Vol. |

Company | Industry | RS Rank |

Last Close |

|---|---|---|---|---|---|---|

| No stocks met our suggested screening factors for

our Cup and Handle Chart Pattern watchlist. See Revised Rules for Trading Cup and Handle Breakouts |

||||||

| Index | Value | Change Week | Change YTD | Trend1 |

|---|---|---|---|---|

| Dow | 30932.4 |

-1.78% | 1.06% | Down |

| NASDAQ | 13192.3 |

-4.92% | 2.36% | Down |

| S&P 500 | 3811.15 |

-2.45% | 1.47% | Down |

|

1The Market Trend is derived from

our proprietary market model. The market model is described on

the site here.

2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||

| 1 Week | 13 Weeks | 26 Weeks | Year-to-Date |

|---|---|---|---|

| Dow Jones |

NASDAQ Composite 8.08 |

NASDAQ Composite 12.8 |

NASDAQ Composite 2.36 |

| 1 Week | 3 Weeks | 13 Weeks | 26 Weeks |

|---|---|---|---|

| Uranium |

Solar |

Silver |

| Travel Services 42 |

Travel Services 87 |

Department Stores 124 |

Department Stores 137 |

| Charts of each industry rank and performance over 12 months are available on the site | |||

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and you will then be able to register to receive the newsletter.

Copyright (c) 02/27/2021 NBIcharts, LLC dba BreakoutWatch.com. All

rights reserved.

" BreakoutWatch," the BreakoutWatch.com "eye" logo, and the slogan

"tomorrow's breakouts today" are service marks of NBIcharts LLC. All

other marks are the property of their respective owners, and are used

for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or with Mr. William O'Neil. Our site, research and analysis is supported entirely by subscription and is free from advertising.