Breakoutwatch Weekly Summary 06/03/2023

You are receiving this email because you are or were a

BreakoutWatch.com subscriber, or have subscribed to our weekly

newsletter.

To read this newsletter on the site, click here: Newsletter

.

Contents

Market Summary

Investors shrug off debt ceiling agreement

The major benchmarks ended with solid gains for the week, with the S&P 500 Index touching its highest intraday level since mid-August 2022. The technology-heavy Nasdaq Composite Index notched its sixth consecutive weekly gain and hit its best level since mid-April 2022. In contrast with the past several weeks, however, the rally was broad-based, with strong gains in both value and growth stocks, as well as small-caps. Markets were closed on Monday in observance of Memorial Day. [more...]

Major Index Performance

| Dow Jones | |

|---|---|

| Last Close | 33762.8 |

| Wk. Gain | 1.99 % |

| Yr. Gain | 1.94 % |

| Trend | Down |

|

|

| S&P 500 | |

|---|---|

| Last Close | 4282.37 |

| Wk. Gain | 1.32 % |

| Yr. Gain | 11.84 % |

| Trend | Up |

|

|

| NASDAQ Comp. | |

|---|---|

| Last Close | 13240.8 |

| Wk. Gain | 1 % |

| Yr. Gain | 27.7 % |

| Trend | Up |

|

|

| Russell 2000 | |

|---|---|

| Last Close | 1830.91 |

| Wk. Gain | 3.06 % |

| Yr. Gain | 3.46 % |

| Trend | Up |

|

|

Performance by Sector

| Sector | Wk. Change % | Yr. Change % | Trend |

|---|---|---|---|

| Consumer Discretionary | 3.37 | 20.96 | Up |

| Consumer Staples | 1.76 | 0.38 | Down |

| Energy | 4.26 | -7.57 | Down |

| Finance | 2.79 | -3.8 | Up |

| Health Care | 3.22 | -2.61 | Down |

| Industrials | 3.38 | 5.67 | Up |

| Technology | 1.42 | 34.11 | Up |

| Materials | 4.31 | 1.62 | Down |

| REIT | 3.24 | -0.63 | Down |

| Telecom | 2.05 | 27.04 | Up |

| Utilities | 1.26 | -8.37 | Down |

Breakouts This Week Still Within 5% of Breakout Price (Limit 20 top C Score)

| Watchlist | Symbol | Company | Industry | C Score* | % Gain |

|---|---|---|---|---|---|

| CWH | TSQ | Townsquare Media, Inc. | Advertising Agencies | 76.7 % | 3.3 % |

| SQZ | GAMB | Gambling.com Group Limited | Gambling | 76.7 % | 0.2 % |

| CWH | KNSA | Kiniksa Pharmaceuticals, Ltd. | Biotechnology | 76.2 % | 0.6 % |

| SQZ | KFS | Kingsway Financial Services, Inc. | Auto & Truck Dealerships | 76 % | 2.4 % |

| CWH | CWCO | Consolidated Water Co. Ltd. | Utilities - Regulated Water | 75.7 % | 1.1 % |

| CWH | PLAB | Photronics, Inc. | Semiconductor Equipment & Materials | 74.5 % | 0.1 % |

| CWH | AMPH | Amphastar Pharmaceuticals, Inc. | Drug Manufacturers - Specialty & Generic | 74 % | 2.6 % |

| CWH | NMIH | NMI Holdings Inc | Insurance - Specialty | 71.5 % | 0.8 % |

| CWH | AME | AMETEK, Inc. | Specialty Industrial Machinery | 71.3 % | 0.8 % |

| CWH | CTAS | Cintas Corporation | Specialty Business Services | 70.3 % | 0.8 % |

| CWH | ICFI | ICF International, Inc. | Consulting Services | 69.3 % | 0.2 % |

| SQZ | NYMT | New York Mortgage Trust, Inc. | REIT - Mortgage | 69.1 % | 3.1 % |

| SQZ | ATEC | Alphatec Holdings, Inc. | Medical Devices | 68.8 % | 0.2 % |

| SQZ | IMMR | Immersion Corporation | Software - Application | 68.8 % | 0.3 % |

| CWH | ASX | ASE Technology Holding Co., Ltd. American Deposita | Semiconductors | 68 % | 1.1 % |

| CWH | CMCO | Columbus McKinnon Corporation | Farm & Heavy Construction Machinery | 67.1 % | 4.6 % |

| CWH | JHX | James Hardie Industries p | Building Materials | 66.8 % | 2.3 % |

| SQZ | FWONA | Liberty Media Corporation | Entertainment | 66.2 % | 0.8 % |

| CWH | ADBE | Adobe Inc. | Software - Infrastructure | 66.1 % | 0.8 % |

| CWH | CGNX | Cognex Corporation | Scientific & Technical Instruments | 65.8 % | 1.5 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | |||||

Breakdowns within 5% of Breakdown Price

| Watchlist | Symbol | Company | Industry | C Score* | % Loss |

|---|---|---|---|---|---|

| SS | BBCP | Concrete Pumping Holdings, Inc. | Engineering & Construction | 69.7 % | -0.6 % |

| SS | MSI | Motorola Solutions, Inc. | Communication Equipment | 69.5 % | -0.1 % |

| SS | ITI | Iteris, Inc. | Communication Equipment | 64.8 % | -3.1 % |

| SS | HRMY | Harmony Biosciences Holdings, Inc. | Biotechnology | 64.3 % | -1.3 % |

| SS | MAG | MAG Silver Corporation Or | Silver | 51.2 % | -0.5 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | |||||

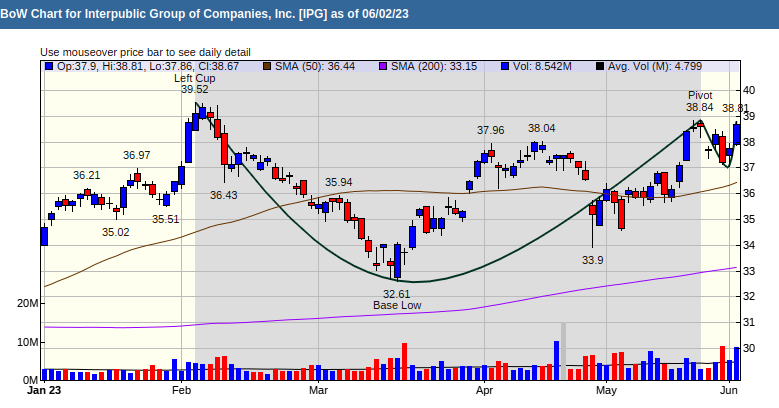

Cup and Handle Chart of the Week

Interpublic Group of Companies - Inc. (IPG) is showing a cup and handle pattern and the stock is close to completing the rise up the handle. The stock surged on Friday on above average volume and could be close to breakout.