Breakoutwatch Weekly Summary 06/17/2023

You are receiving this email because you are or were a

BreakoutWatch.com subscriber, or have subscribed to our weekly

newsletter.

To read this newsletter on the site, click here: Newsletter

.

Contents

Market Summary

Rally continues on calming inflation fears

Favorable inflation and growth signals appeared to help stocks continue a rally that began with only a few interruptions in late May. The S&P 500 Index notched its longest stretch of daily gains since November 2021 and its best weekly performance since the end of March. The market’s advanced narrowed a bit, however, as reflected in the renewed outperformance of growth stocks and large-caps. Markets were scheduled to be closed the following Monday in observance of the Juneteenth holiday. [more...]

Major Index Performance

| Dow Jones | |

|---|---|

| Last Close | 34299.1 |

| Wk. Gain | 1.16 % |

| Yr. Gain | 3.56 % |

| Trend | Up |

|

|

| S&P 500 | |

|---|---|

| Last Close | 4409.59 |

| Wk. Gain | 2.35 % |

| Yr. Gain | 15.16 % |

| Trend | Up |

|

|

| NASDAQ Comp. | |

|---|---|

| Last Close | 13689.6 |

| Wk. Gain | 2.73 % |

| Yr. Gain | 32.03 % |

| Trend | Up |

|

|

| Russell 2000 | |

|---|---|

| Last Close | 1875.47 |

| Wk. Gain | 0.47 % |

| Yr. Gain | 5.97 % |

| Trend | Up |

|

|

Performance by Sector

| Sector | Wk. Change % | Yr. Change % | Trend |

|---|---|---|---|

| Consumer Discretionary | 1.29 | 27.54 | Up |

| Consumer Staples | 0.71 | 1.82 | Down |

| Energy | 0.94 | -6.29 | Up |

| Finance | 1.39 | -1.48 | Up |

| Health Care | 1.37 | -1.24 | Down |

| Industrials | 1.44 | 10.41 | Up |

| Technology | 0.81 | 39 | Up |

| Materials | 1.14 | 5.37 | Up |

| REIT | 0.83 | 1.75 | Up |

| Telecom | 1.01 | 30.79 | Up |

| Utilities | 1.11 | -5.6 | Down |

Breakouts This Week Still Within 5% of Breakout Price (Limit 20 top C Score)

| Watchlist | Symbol | Company | Industry | C Score* | % Gain |

|---|---|---|---|---|---|

| SQZ | ALGM | Allegro MicroSystems, Inc. | Semiconductors | 82.6 % | 0.4 % |

| CWH | IRMD | iRadimed Corporation | Medical Devices | 82.1 % | 2.7 % |

| SQZ | GPOR | Gulfport Energy Corporation | Oil & Gas E&P | 81.7 % | 4.4 % |

| CWH | CRT | Cross Timbers Royalty Trust | Oil & Gas E&P | 81.5 % | 2.3 % |

| CWH | APG | APi Group Corporation | Engineering & Construction | 80.2 % | 2.6 % |

| CWH | KNSA | Kiniksa Pharmaceuticals, Ltd. | Biotechnology | 79.6 % | 0.5 % |

| SQZ | FND | Floor & Decor Holdings, Inc. | Home Improvement Retail | 78.4 % | 0.3 % |

| SQZ | ISRG | Intuitive Surgical, Inc. | Medical Instruments & Supplies | 78.3 % | 4.4 % |

| CWH | IT | Gartner, Inc. | Information Technology Services | 77.3 % | 2.1 % |

| CWH | ANSS | ANSYS, Inc. | Software - Application | 76.6 % | 0.8 % |

| SQZ | CPNG | Coupang, Inc. | Internet Retail | 76.5 % | 2.9 % |

| CWH | CCJ | Cameco Corporation | Uranium | 76.1 % | 1 % |

| CWH | KE | Kimball Electronics, Inc. | Electrical Equipment & Parts | 75 % | 1.8 % |

| CWH | IRS | IRSA Inversiones Y Representaciones S.A. | Real Estate Services | 74.2 % | 4.2 % |

| SQZ | CLBT | Cellebrite DI Ltd. | Software - Infrastructure | 72.3 % | 4.4 % |

| SQZ | ORC | Orchid Island Capital, Inc. | REIT - Mortgage | 71.5 % | 0.8 % |

| SQZ | CVLG | Covenant Logistics Group, Inc. | Trucking | 70.3 % | 0.9 % |

| CWH | MCK | McKesson Corporation | Medical Distribution | 70.2 % | 1.2 % |

| SQZ | DASH | DoorDash, Inc. | Internet Content & Information | 69.9 % | 2 % |

| SQZ | SAP | SAP SE ADS | Software - Application | 69.7 % | 2.6 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | |||||

Breakdowns within 5% of Breakdown Price

| Watchlist | Symbol | Company | Industry | C Score* | % Loss |

|---|---|---|---|---|---|

| SS | TH | Target Hospitality Corp. | Specialty Business Services | 82 % | -1.6 % |

| SS | TDW | Tidewater Inc. | Oil & Gas Equipment & Services | 81.1 % | -1.1 % |

| SS | IRDM | Iridium Communications Inc | Telecom Services | 77.1 % | -2.9 % |

| SS | CMBM | Cambium Networks Corporation | Communication Equipment | 69.2 % | -0.3 % |

| SS | IMMR | Immersion Corporation | Software - Application | 68.8 % | -3.8 % |

| SS | KWR | Quaker Houghton | Specialty Chemicals | 64.5 % | -1.8 % |

| SS | CVE | Cenovus Energy Inc | Oil & Gas Integrated | 62.3 % | -1.4 % |

| SS | TIPT | Tiptree Inc. | Insurance - Specialty | 56.5 % | -2.5 % |

| SS | TBPH | Theravance Biopharma, Inc. | Biotechnology | 55.9 % | -3.9 % |

| SS | PET | Wag! Group Co. | Software - Application | 53.7 % | -0.9 % |

| SS | CVEO | Civeo Corporation (Canada) | Specialty Business Services | 51.1 % | -4.8 % |

| SS | ANIK | Anika Therapeutics Inc. | Medical Devices | 51 % | -1.5 % |

| SS | QURE | uniQure N.V. | Biotechnology | 50.8 % | -2.9 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | |||||

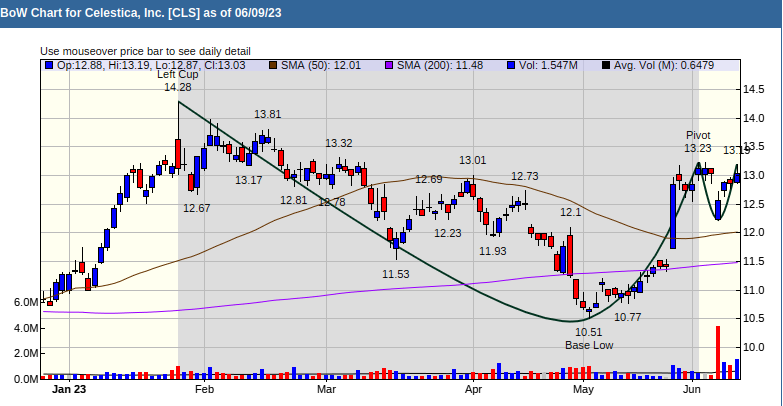

Cup and Handle Chart of the Week

Celestica - Inc. (CLS) Following strong profit taking upon setting its pivot, CLS has climbed the right side of the handle on strong volume. CLS has great technical strength and above average fundamentals. The stock surged on Friday on 2 times average volume and could be close to breakout.