Breakoutwatch Weekly Summary 07/12/2023

You are receiving this email because you are or were a

BreakoutWatch.com subscriber, or have subscribed to our weekly

newsletter.

To read this newsletter on the site, click here: Newsletter

.

Special July 4 Offer: 6 months for the price of 3

Enroll for a free trial and then Subscribe for 3 months ($105) and receive a 6 month Subscription ($187 value)

Email me after you have subscribed to receive the subscription extension

(Offer not available to current subscribers)

Market Summary

Stocks move lower in quiet trading

Stocks closed lower in a generally quiet week, which T. Rowe Price traders attributed to the holiday-shortened week and investors awaiting the release of second-quarter earnings reports. Growth stocks held up modestly better than value shares. Tesla, which has a heavy weighting in the Nasdaq Composite and growth indices, provided a boost after reporting better-than-expected sales, as did its smaller electric vehicle rival, Rivian. Conversely, disappointing trial results for AstraZeneca’s new lung cancer drug weighed on the health care sector. Markets closed early Monday and were shuttered Tuesday in observance of the Independence Day holiday. [more...]

Major Index Performance

| Dow Jones

|

| Last Close

| |

| Wk. Gain

| NAN % |

| Yr. Gain

| NAN % |

| Trend

| Up |

|

| S&P 500

|

| Last Close

| |

| Wk. Gain

| NAN % |

| Yr. Gain

| NAN % |

| Trend

| Down |

|

| NASDAQ Comp.

|

| Last Close

| |

| Wk. Gain

| NAN % |

| Yr. Gain

| NAN % |

| Trend

| Down |

|

| Russell 2000

|

| Last Close

| |

| Wk. Gain

| NAN % |

| Yr. Gain

| NAN % |

| Trend

| Up |

|

Performance by Sector

| Sector |

Wk. Change % |

Yr. Change % |

Trend |

| Consumer Discretionary |

-0.75 |

30.41 |

Down |

| Consumer Staples |

-1.43 |

0.3 |

Down |

| Energy |

-0.5 |

-5.32 |

Down |

| Finance |

-0.01 |

-1.21 |

Down |

| Health Care |

-0.8 |

-2.82 |

Down |

| Industrials |

0.65 |

12.98 |

Down |

| Technology |

-0.4 |

38.26 |

Down |

| Materials |

-1.28 |

5.35 |

Down |

| REIT |

-0.13 |

1.95 |

Down |

| Telecom |

-0.41 |

30.74 |

Down |

| Utilities |

-0.97 |

-8.8 |

Down |

Breakouts This Week Still Within 5% of Breakout Price (Limit 20 top C Score)

| Watchlist |

Symbol |

Company |

Industry |

C Score* |

% Gain |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. |

Breakdowns within 5% of Breakdown Price

| Watchlist |

Symbol |

Company |

Industry |

C Score* |

% Loss |

| SS |

CERE |

Cerevel Therapeutics Holdings, Inc. |

Biotechnology |

20.8 % |

-3.5 % |

| SS |

CMPX |

Compass Therapeutics, Inc. |

Biotechnology |

8.3 % |

-4.5 % |

| SS |

SNDX |

Syndax Pharmaceuticals, Inc. |

Biotechnology |

8.3 % |

-2.8 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. |

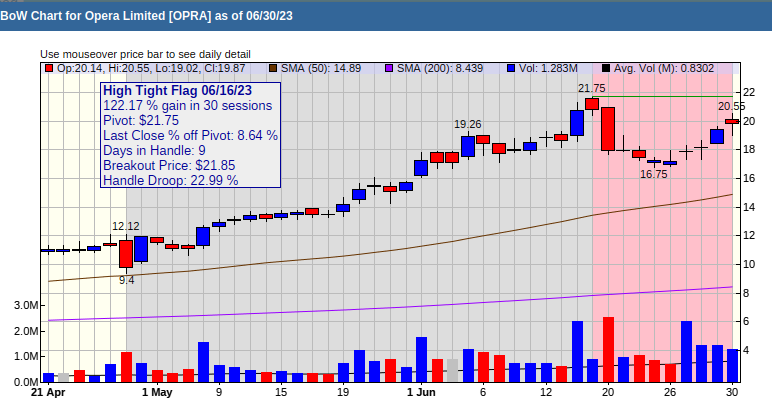

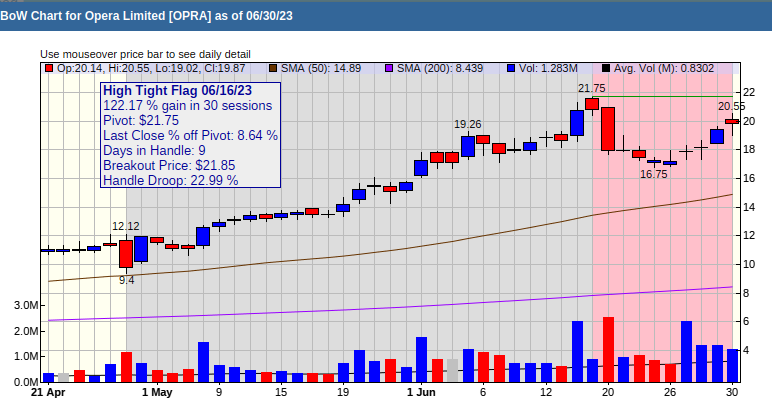

High Tight Flag Chart of the Week

Opera Limited (OPRA) Opera gained 117% in 30 sessions and has a relative strength Rank of 99. High flying stocks can fly higher and Opera is climbing again after some recent profit taking.