Breakoutwatch Weekly Summary 07/24/2023

You are receiving this email because you are or were a

BreakoutWatch.com subscriber, or have subscribed to our weekly

newsletter.

To read this newsletter on the site, click here: Newsletter

.

Special July 4 Offer: 6 months for the price of 3

Enroll for a free trial and then Subscribe for 3 months ($105) and receive a 6 month Subscription ($187 value)

Email me after you have subscribed to receive the subscription extension

(Offer not available to current subscribers)

Market Summary

Retail sales increased modestly in June; initial jobless claims decline

Most of the major U.S. equity indexes advanced on hopes that the tight labor market and moderating inflation would help the economy avoid a hard landing. The tech-heavy Nasdaq Composite, however, suffered a modest pullback. Value stocks outperformed their growth counterparts in the large-cap Russell 1000 Index. [more...]

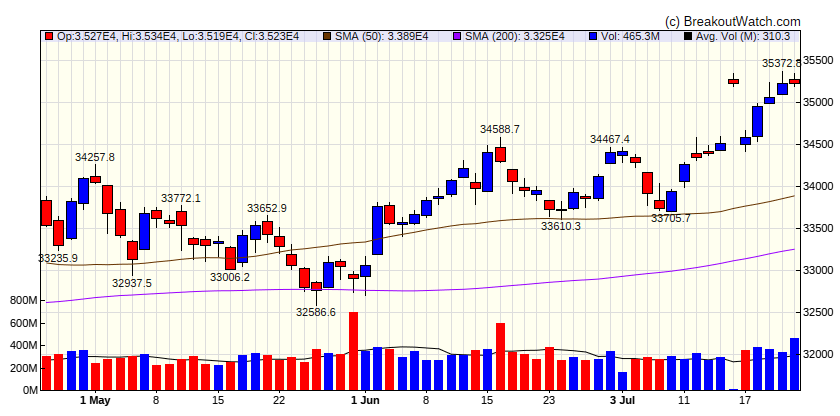

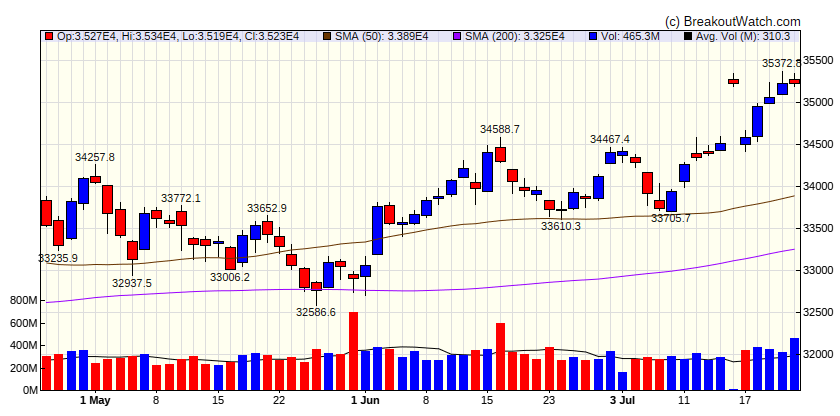

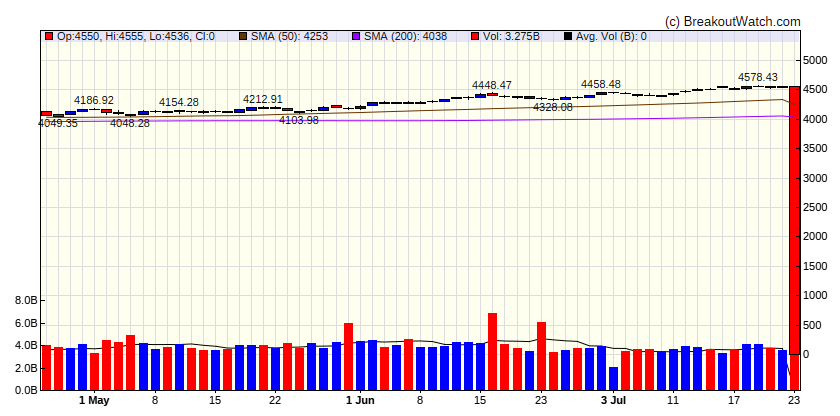

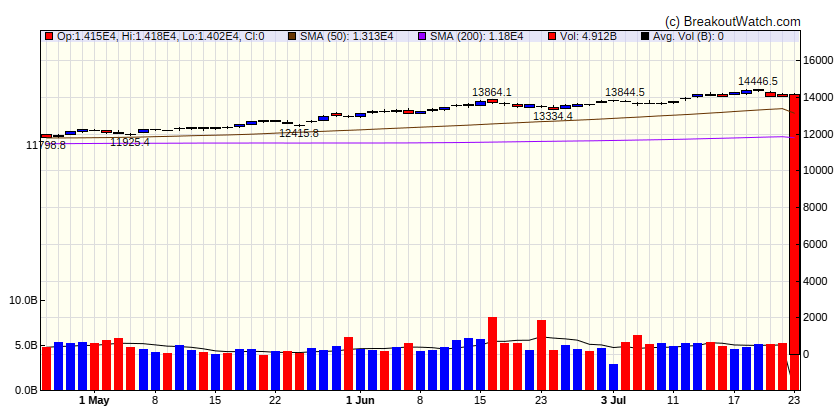

Major Index Performance

| Dow Jones

|

| Last Close

| |

| Wk. Gain

| -100 % |

| Yr. Gain

| -100 % |

| Trend

| Up |

|

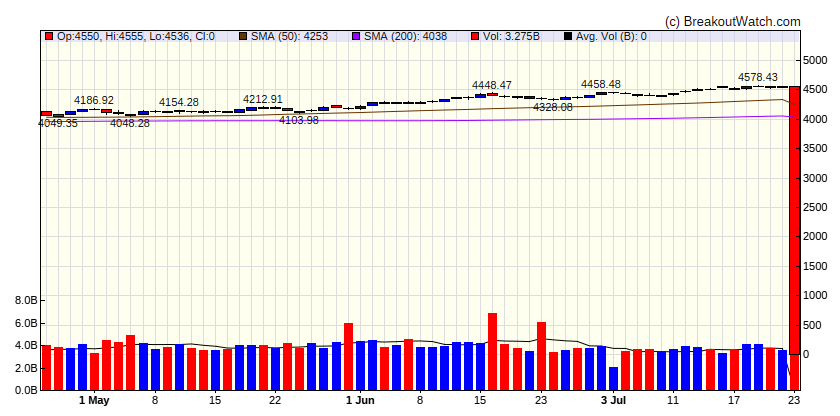

| S&P 500

|

| Last Close

| 0 |

| Wk. Gain

| -100 % |

| Yr. Gain

| -100 % |

| Trend

| Up |

|

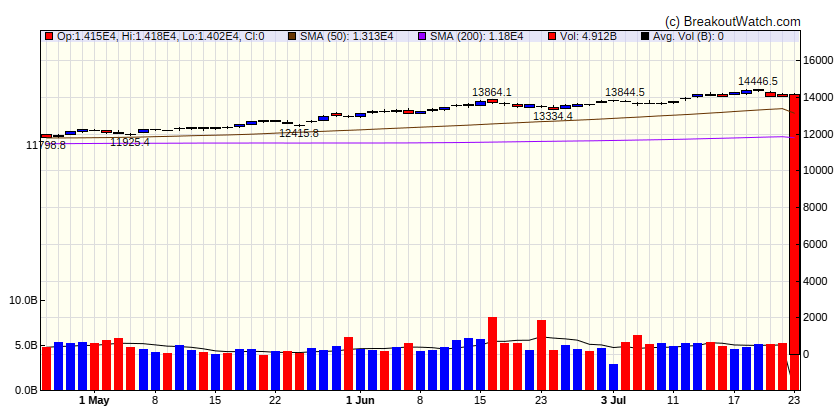

| NASDAQ Comp.

|

| Last Close

| 0 |

| Wk. Gain

| -100 % |

| Yr. Gain

| -100 % |

| Trend

| Up |

|

| Russell 2000

|

| Last Close

| 0 |

| Wk. Gain

| -100 % |

| Yr. Gain

| -100 % |

| Trend

| Up |

|

Performance by Sector

| Sector |

Wk. Change % |

Yr. Change % |

Trend |

| Consumer Discretionary |

-100 |

-100 |

Up |

| Consumer Staples |

-100 |

-100 |

Up |

| Energy |

-100 |

-100 |

Up |

| Finance |

-100 |

-100 |

Up |

| Health Care |

-100 |

-100 |

Down |

| Industrials |

-100 |

-100 |

Up |

| Technology |

-100 |

-100 |

Up |

| Materials |

-100 |

-100 |

Up |

| REIT |

-100 |

-100 |

Up |

| Telecom |

-100 |

-100 |

Up |

| Utilities |

-100 |

-100 |

Down |

Breakouts This Week Still Within 5% of Breakout Price (Limit 20 top C Score)

| Watchlist |

Symbol |

Company |

Industry |

C Score* |

% Gain |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. |

Breakdowns within 5% of Breakdown Price

| Watchlist |

Symbol |

Company |

Industry |

C Score* |

% Loss |

There were no Breakdowns still within 5% of breakdown price this week |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. |

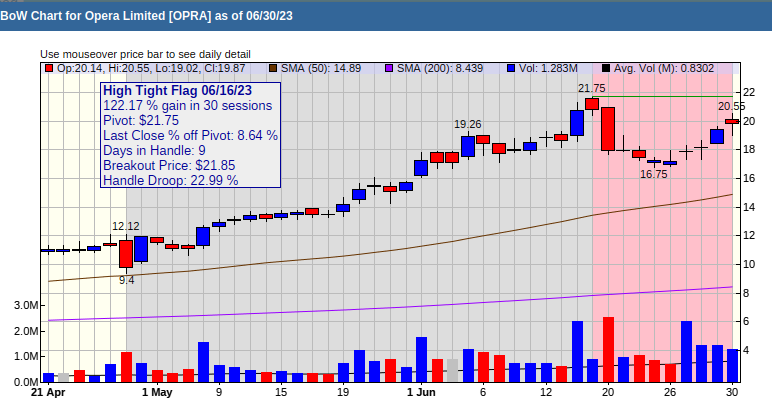

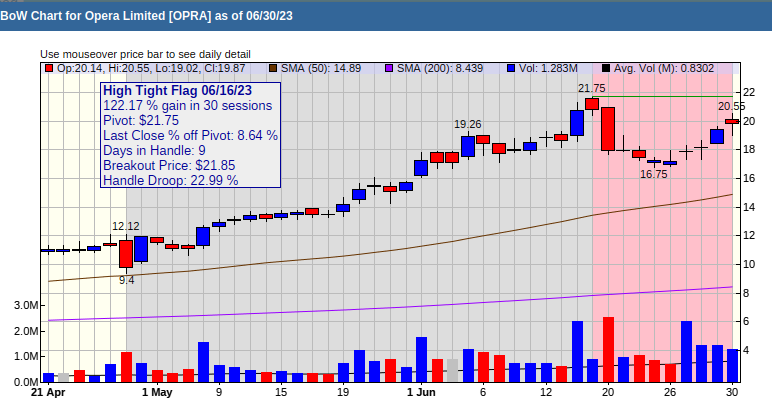

High Tight Flag Chart of the Week

Opera Limited (OPRA) Opera gained 117% in 30 sessions and has a relative strength Rank of 99. High flying stocks can fly higher and Opera is climbing again after some recent profit taking.