Breakoutwatch Weekly Summary 12/09/2023

You are receiving this email because you are or were a

BreakoutWatch.com subscriber, or have subscribed to our weekly

newsletter.

To read this newsletter on the site, click here: Newsletter

.

Contents

Market Summary

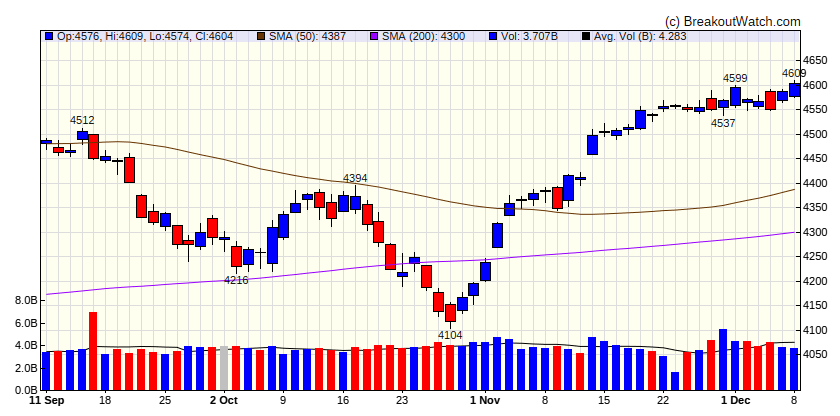

Stocks end mixed as small-caps continue their comeback

A late rally helped the major indexes end flat to modestly higher for the week. The small-cap Russell 2000 Index outperformed the S&P 500 Index for the third time in the past four weeks, helping narrow its significant underperformance for the year-to-date period. Growth stocks built modestly on their lead over value shares, however. Within the S&P 500, energy stocks lagged as domestic oil prices fell below USD 70 per barrel for the first time since June. [more...]

Major Index Performance

| Dow Jones | |

|---|---|

| Last Close | 36248 |

| Wk. Gain | 0.44 % |

| Yr. Gain | 9.35 % |

| Trend | Down |

|

|

| S&P 500 | |

|---|---|

| Last Close | 4604 |

| Wk. Gain | 0.88 % |

| Yr. Gain | 19.49 % |

| Trend | Down |

|

|

| NASDAQ Comp. | |

|---|---|

| Last Close | 14404 |

| Wk. Gain | 1.66 % |

| Yr. Gain | 36.38 % |

| Trend | Down |

|

|

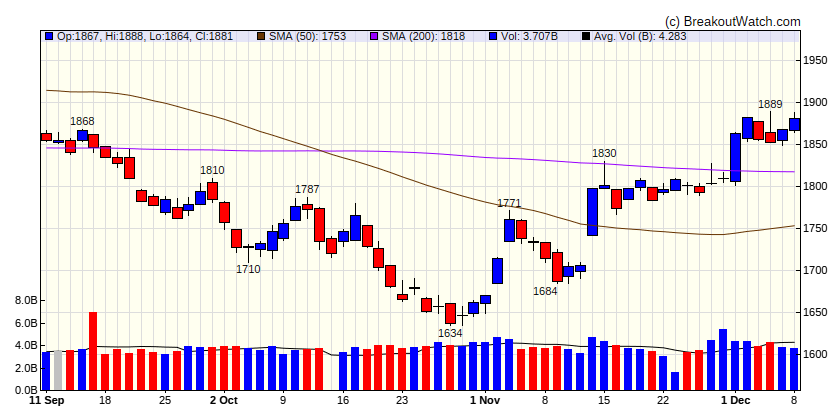

| Russell 2000 | |

|---|---|

| Last Close | 1881 |

| Wk. Gain | 1.29 % |

| Yr. Gain | 6.27 % |

| Trend | Up |

|

|

Performance by Sector

| Sector | Wk. Change % | Yr. Change % | Trend |

|---|---|---|---|

| Consumer Discretionary | 1.75 | 34.64 | Up |

| Consumer Staples | -0.41 | -3.14 | Up |

| Energy | -2.78 | -3.98 | Down |

| Finance | 0.88 | 6.98 | Up |

| Health Care | 0.47 | -2.74 | Up |

| Industrials | 1.02 | 15.26 | Up |

| Technology | 1.53 | 47.82 | Up |

| Materials | -0.83 | 5.89 | Up |

| REIT | 0.31 | 1.41 | Up |

| Telecom | 2.01 | 39.68 | Down |

| Utilities | 0.57 | -11.59 | Up |

Breakouts This Week Still Within 5% of Breakout Price (Limit 20 top C Score)

| Watchlist | Symbol | Company | Industry | C Score* | % Gain |

|---|---|---|---|---|---|

| SQZ | POWL | Powell Industries, Inc. | Semiconductors | 83.1 % | 0.5 % |

| CWH | SKT | Tanger Inc. | REIT - Retail | 80.6 % | 2 % |

| SQZ | EME | EMCOR Group, Inc. | Asset Management | 79.6 % | 1.3 % |

| CWH | FWRG | First Watch Restaurant Group, Inc. | Restaurants | 78.7 % | 1.8 % |

| SQZ | STRL | Sterling Infrastructure, Inc. | Biotechnology | 78.3 % | 2.3 % |

| SQZ | VRRM | Verra Mobility Corporation | Infrastructure Operations | 76.6 % | 3.6 % |

| SQZ | SP | SP Plus Corporation | Specialty Business Services | 76.1 % | 0.1 % |

| CWH | FRPT | Freshpet, Inc. | Packaged Foods | 75.7 % | 3.4 % |

| SQZ | WTS | Watts Water Technologies, Inc. | Specialty Industrial Machinery | 74.8 % | 0.2 % |

| CWH | WSO | Watsco, Inc. | Industrial Distribution | 74.5 % | 1.9 % |

| SQZ | UNH | UnitedHealth Group Inco | Healthcare Plans | 73.8 % | 0.3 % |

| CWH | RYTM | Rhythm Pharmaceuticals, Inc. | Biotechnology | 73.4 % | 3.4 % |

| SQZ | STRA | Strategic Education, Inc. | Biotechnology | 73.4 % | 1.1 % |

| CWH | ASX | ASE Technology Holding Co., Ltd. American Deposita | Semiconductors | 72.9 % | 0.2 % |

| CWH | WSR | Whitestone REIT | REIT - Retail | 72.8 % | 2.9 % |

| SQZ | EXEL | Exelixis, Inc. | Biotechnology | 72.6 % | 0.3 % |

| CWH | AMD | Advanced Micro Devices, Inc. | Semiconductors | 71.9 % | 2.5 % |

| CWH | HUBB | Hubbell Inc | Asset Management | 71.2 % | 1 % |

| SQZ | KOF | Coca Cola Femsa S.A.B. de | Beverages - Non-Alcoholic | 71.1 % | 1.5 % |

| CWH | BA | Boeing Company (The) | Specialty Industrial Machinery | 70.3 % | 4 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | |||||

Breakdowns within 5% of Breakdown Price

| Watchlist | Symbol | Company | Industry | C Score* | % Loss |

|---|---|---|---|---|---|

| SS | TDC | Teradata Corporation | Software - Infrastructure | 73.3 % | -4.4 % |

| SS | NATR | NATURES SUNSHINE PRODS INC C | Packaged Foods | 67.5 % | -2.1 % |

| SS | INSW | International Seaways, Inc. | Software - Application | 65.9 % | -3.3 % |

| SS | RSI | Rush Street Interactive, Inc. | Gambling | 63.5 % | -3.6 % |

| SS | SXC | SunCoke Energy, Inc. | Coking Coal | 58.6 % | -0.2 % |

| SS | CTRN | Citi Trends, Inc. | Apparel Retail | 56.1 % | -2.6 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | |||||

Cup and Handle Stocks Likely to Breakout next Week

| Symbol | BoP | Company | Industry | Relative Strength Rank | Within x% of BoP | C Score* |

|---|---|---|---|---|---|---|

| MDXG | 8.20 | MiMedx Group, Inc | Biotechnology | 96.00 | 97.68 | 79.8 |

| FCNCA | 1498.16 | First Citizens BancShares, Inc. | Banks - Regional | 94.00 | 96.55 | 78.9 |

| LRCX | 730.99 | Lam Research Corporation | Internet Retail | 89.00 | 96.19 | 73.4 |

| UFPT | 179.63 | UFP Technologies, Inc. | Medical Devices | 88.00 | 98.58 | 72.1 |

| VECO | 29.55 | Veeco Instruments Inc. | Biotechnology | 88.00 | 96.14 | 73.3 |

| CARG | 22.09 | CarGurus, Inc. | Banks - Regional | 87.00 | 97.74 | 66.4 |

| FTDR | 35.99 | Frontdoor, Inc. | Personal Services | 87.00 | 97.19 | 78.2 |

| CTLP | 7.37 | Cantaloupe, Inc. | Information Technology Services | 86.00 | 97.01 | 71.9 |

| WDC | 48.86 | Western Digital Corporation | Computer Hardware | 86.00 | 97.95 | 61.2 |

| ICLR | 276.68 | ICON plc | Advertising Agencies | 85.00 | 98.47 | 70.8 |

| MFIN | 9.74 | Medallion Financial Corp. | Credit Services | 85.00 | 97.64 | 80.7 |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | ||||||

Cup and Handle Chart of the Week

Western Digital is in a "High Handle" position, meaning that the pivot was set at a price above the left cup. Our algorithm allows high handles within 5% above the left cup price. Of the stocks listed in the possible breakouts for next week, WDC is the only one that closed on Friday with above average volume. See Anatomy of a Cup-with-Handle Chart Pattern