Breakoutwatch Weekly Summary 01/11/2024

You are receiving this email because you are or were a

BreakoutWatch.com subscriber, or have subscribed to our weekly

newsletter.

To read this newsletter on the site, click here: Newsletter

.

Contents

Market Summary

Stocks start 2024 on a down note

Stocks gave back a portion of the past several weeks’ solid gains as investors appeared to rotate into sectors that lagged in 2023, including utilities, energy, consumer staples, and health care. Conversely, a slide in Apple shares following an analyst downgrade weighed on the large-cap, technology-heavy Nasdaq Composite Index. The small-cap Russell 2000 Index also fell more than the broad market. T. Rowe Price traders noted that trading volumes were relatively muted over much of the holiday-shortened week, with markets shuttered on Monday in observation of the New Year’s Day holiday. [more...]

Major Index Performance

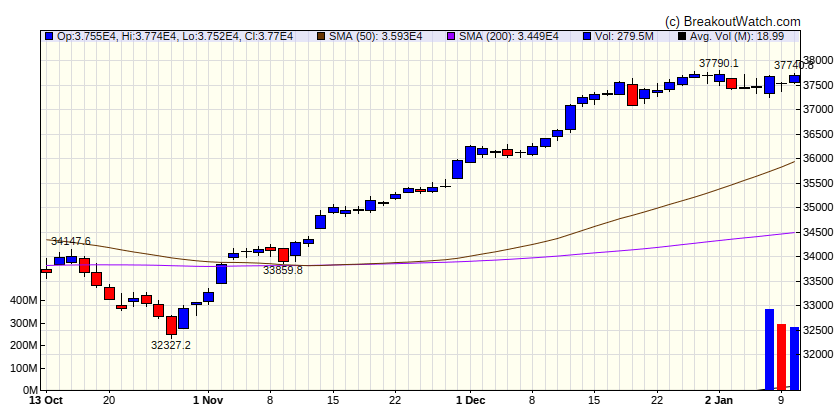

| Dow Jones | |

|---|---|

| Last Close | 37695.7 |

| Wk. Gain | 0.64 % |

| Yr. Gain | 0.34 % |

| Trend | Up |

|

|

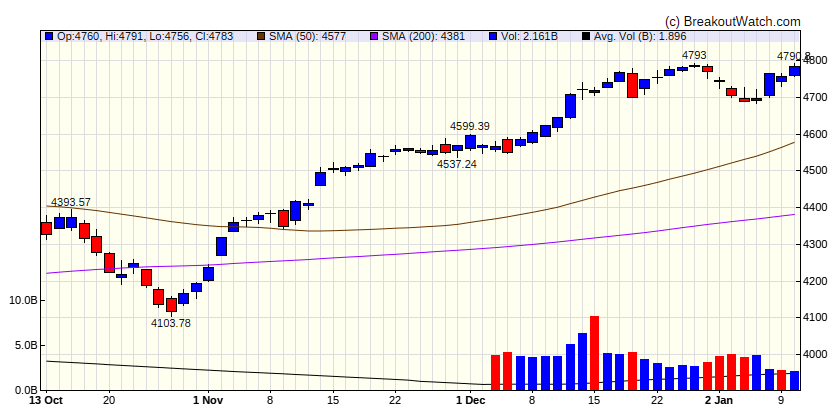

| S&P 500 | |

|---|---|

| Last Close | 4783.45 |

| Wk. Gain | 1.97 % |

| Yr. Gain | 0.81 % |

| Trend | Up |

|

|

| NASDAQ Comp. | |

|---|---|

| Last Close | 14969.7 |

| Wk. Gain | 3.24 % |

| Yr. Gain | 0.65 % |

| Trend | Up |

|

|

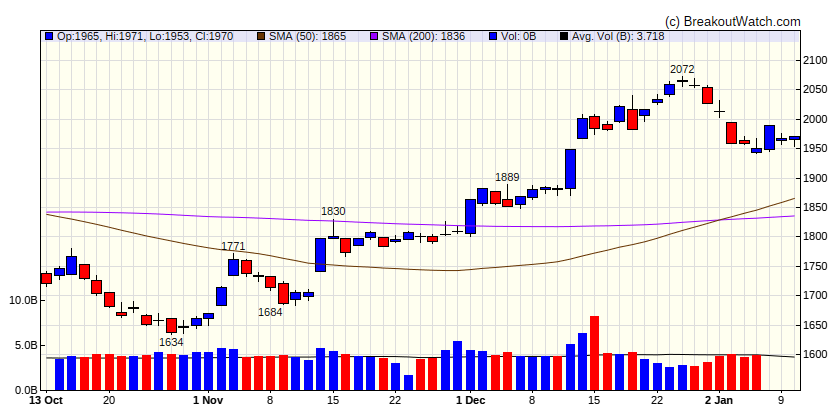

| Russell 2000 | |

|---|---|

| Last Close | 1970.26 |

| Wk. Gain | 1.35 % |

| Yr. Gain | -2.12 % |

| Trend | Down |

|

|

Performance by Sector

| Sector | Wk. Change % | Yr. Change % | Trend |

|---|---|---|---|

| Consumer Discretionary | 2.82 | -0.99 | Down |

| Consumer Staples | 0.62 | 1.08 | Up |

| Energy | -4.21 | -3.44 | Down |

| Finance | 0.62 | 0.52 | Up |

| Health Care | 1.63 | 3.47 | Up |

| Industrials | 0.91 | -1.2 | Down |

| Technology | 3.66 | 0.19 | Down |

| Materials | -0.29 | -2.02 | Down |

| REIT | 1.35 | -0.78 | Down |

| Telecom | 2.81 | 1.75 | Up |

| Utilities | 0.29 | 2.04 | Up |

Breakouts This Week Still Within 5% of Breakout Price (Limit 20 top C Score)

| Watchlist | Symbol | Company | Industry | C Score* | % Gain |

|---|---|---|---|---|---|

| SQZ | MSFT | Microsoft Corporation | Software - Infrastructure | 89.9 % | 1.9 % |

| CWH | SMCI | Super Micro Computer, Inc. | Computer Hardware | 81.3 % | 4.5 % |

| SQZ | ETN | Eaton Corporation, PLC Or | Specialty Industrial Machinery | 79.1 % | 0.8 % |

| SQZ | DVA | DaVita Inc. | Medical Care Facilities | 78.7 % | 1.1 % |

| DB | DLR | Digital Realty Trust, Inc. | REIT - Specialty | 76.2 % | 0.1 % |

| SQZ | ETRN | Equitrans Midstream Corporation | Utilities - Regulated Electric | 76.1 % | 4.3 % |

| SQZ | FRHC | Freedom Holding Corp. | Capital Markets | 73 % | 0.3 % |

| CWH | AIRS | AirSculpt Technologies, Inc. | Medical Care Facilities | 72.4 % | 1.8 % |

| CWH | ARCT | Arcturus Therapeutics Holdings Inc. | Biotechnology | 69.9 % | 0.2 % |

| SQZ | LTRX | Lantronix, Inc. | Communication Equipment | 69.4 % | 0.8 % |

| CWH | MG | Mistras Group Inc | Asset Management | 68.8 % | 1.7 % |

| CWH | NCNO | nCino, Inc. | Software - Application | 68.7 % | 1.5 % |

| SQZ | DBRG | DigitalBridge Group, Inc. | Real Estate Services | 68.5 % | 1.1 % |

| SQZ | AVDL | Avadel Pharmaceuticals plc | Drug Manufacturers - Specialty & Generic | 68.3 % | 0.5 % |

| SQZ | TGH | Textainer Group Holdings Limited | Copper | 67.4 % | 0 % |

| SQZ | MUSA | Murphy USA Inc. | Specialty Retail | 66.3 % | 0.2 % |

| SQZ | LMND | Lemonade, Inc. | Entertainment | 65.6 % | 0.9 % |

| SQZ | TPC | Tutor Perini Corporation | Tobacco | 64.2 % | 1.3 % |

| CWH | MRVL | Marvell Technology, Inc. | Semiconductors | 62.6 % | 2.7 % |

| SQZ | GRPN | Groupon, Inc. | Biotechnology | 62.6 % | 3.8 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | |||||

Breakdowns within 5% of Breakdown Price

| Watchlist | Symbol | Company | Industry | C Score* | % Loss |

|---|---|---|---|---|---|

| SS | AMAT | Applied Materials, Inc. | Biotechnology | 74.5 % | -0.6 % |

| SS | PARR | Par Pacific Holdings, Inc. | Entertainment | 73.6 % | -0.1 % |

| SS | XTNT | Xtant Medical Holdings, Inc. | Medical Devices | 68.6 % | -1.7 % |

| SS | TRNS | Transcat, Inc. | Industrial Distribution | 67.9 % | -0.2 % |

| SS | XPRO | Expro Group Holdings N.V. | Leisure | 57.6 % | -0.4 % |

| SS | MKFG | Markforged Holding Corporation | Computer Hardware | 36.5 % | -3.9 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. | |||||

Cup and Handle Chart of the Week