Breakoutwatch Weekly Summary 02/02/2024

You are receiving this email because you are or were a

BreakoutWatch.com subscriber, or have subscribed to our weekly

newsletter.

To read this newsletter on the site, click here: Newsletter

.

Market Summary

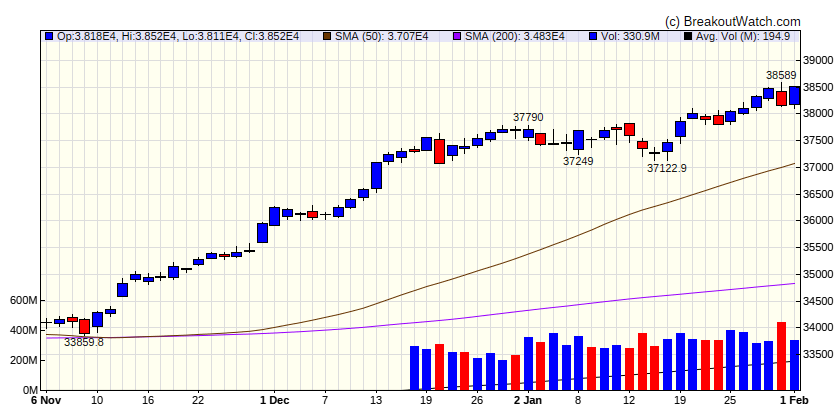

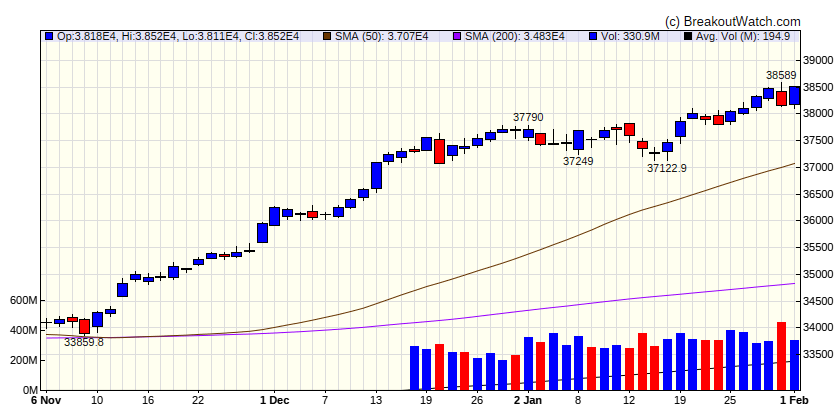

Large-cap indexes move to records

Stocks recorded another week of gains, bringing the Dow Jones Industrial Average and the S&P 500 Index to new all-time highs and marking the 12th weekly advance out of the last 13 for the latter. The gains were relatively broad, although the small-cap Russell 2000 Index remained nearly 20% below its all-time intraday high. [more...]

Major Index Performance

| Dow Jones

|

| Last Close

| 38519.8 |

| Wk. Gain

| 1.06 % |

| Yr. Gain

| 2.54 % |

| Trend

| Up |

|

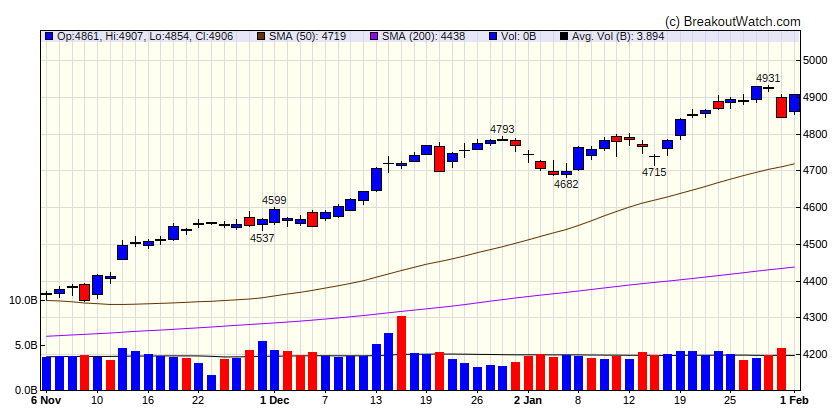

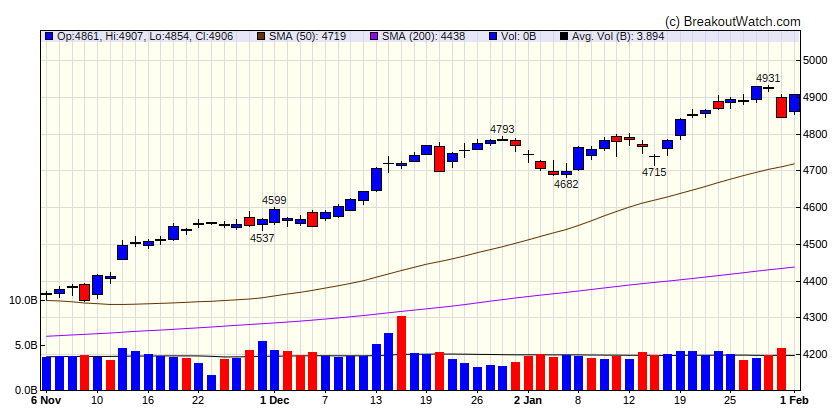

| S&P 500

|

| Last Close

| 4906.19 |

| Wk. Gain

| 0.27 % |

| Yr. Gain

| 3.4 % |

| Trend

| Up |

|

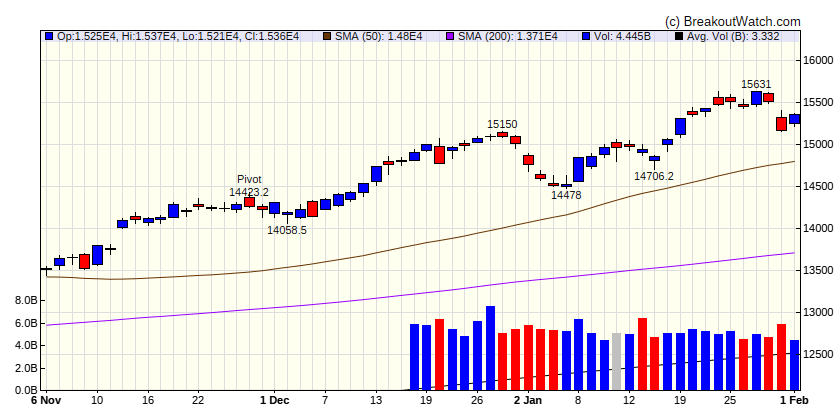

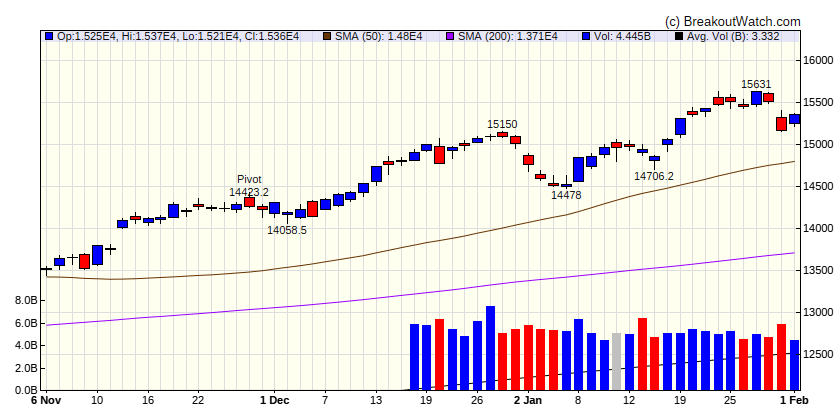

| NASDAQ Comp.

|

| Last Close

| 15361.6 |

| Wk. Gain

| -0.71 % |

| Yr. Gain

| 3.28 % |

| Trend

| Up |

|

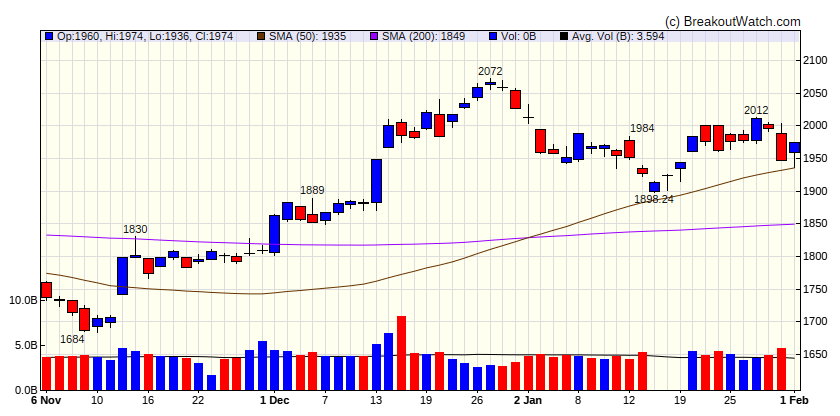

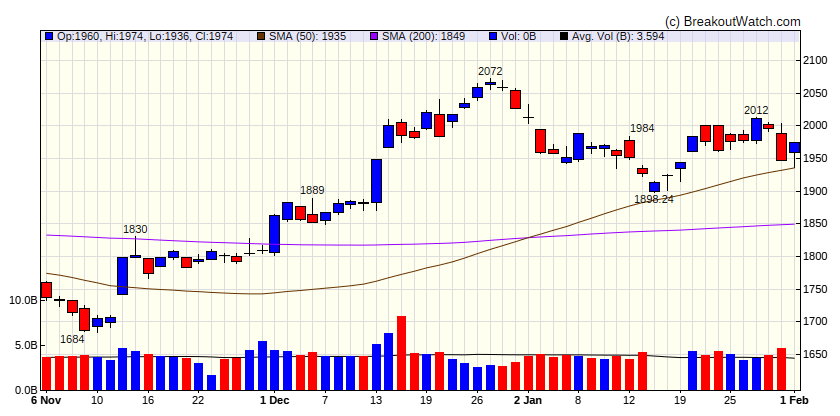

| Russell 2000

|

| Last Close

| 1974.42 |

| Wk. Gain

| -0.18 % |

| Yr. Gain

| -1.92 % |

| Trend

| Up |

|

Performance by Sector

| Sector |

Wk. Change % |

Yr. Change % |

Trend |

| Consumer Discretionary |

0.94 |

-1.6 |

Down |

| Consumer Staples |

2.08 |

3.3 |

Up |

| Energy |

-1.03 |

-1.46 |

Down |

| Finance |

0.21 |

2.49 |

Up |

| Health Care |

1.84 |

4.12 |

Up |

| Industrials |

1.49 |

1.31 |

Up |

| Technology |

-0.84 |

4.66 |

Up |

| Materials |

1.16 |

-1.89 |

Down |

| REIT |

0.58 |

-3 |

Down |

| Telecom |

-1.51 |

5.63 |

Up |

| Utilities |

2.27 |

-0.83 |

Down |

Breakouts This Week Still Within 5% of Breakout Price (Limit 20 top C Score)

| Watchlist |

Symbol |

Company |

Industry |

C Score* |

% Gain |

| SQZ |

TGS |

Transportadora de Gas del Sur SA TGS |

Broadcasting |

80.2 % |

1.6 % |

| SQZ |

PAM |

Pampa Energia S.A. |

Utilities - Independent Power Producers |

79.2 % |

0.9 % |

| SQZ |

LRN |

Stride, Inc. |

Biotechnology |

78.5 % |

2.1 % |

| CWH |

LLY |

Eli Lilly and Company |

Drug Manufacturers - General |

77.9 % |

2.6 % |

| CWH |

MFIN |

Medallion Financial Corp. |

Credit Services |

77.5 % |

0.2 % |

| SQZ |

FCNCA |

First Citizens BancShares, Inc. |

Banks - Regional |

76.3 % |

0.1 % |

| CWH |

MIXT |

MiX Telematics Limited Am |

Software - Application |

75.6 % |

0.8 % |

| SQZ |

TEX |

Terex Corporation |

Biotechnology |

75.3 % |

1.9 % |

| SQZ |

EDN |

Empresa Distribuidora Y C |

Utilities - Regulated Electric |

73.9 % |

0.4 % |

| SQZ |

CSL |

Carlisle Companies Inco |

Solar |

73.3 % |

1.6 % |

| SQZ |

NX |

Quanex Building Products Corporation |

Auto Manufacturers |

68.9 % |

0.5 % |

| CWH |

ASND |

Ascendis Pharma A/S |

Biotechnology |

68.4 % |

1.2 % |

| SQZ |

WIRE |

Encore Wire Corporation |

Shell Companies |

68.3 % |

4.6 % |

| SQZ |

OC |

Owens Corning Inc |

Banks - Regional |

66.1 % |

2.3 % |

| SQZ |

GEO |

Geo Group Inc |

Restaurants |

64 % |

0.1 % |

| SQZ |

CRESY |

Cresud S.A.C.I.F. y A. |

Conglomerates |

62.6 % |

2.3 % |

| SQZ |

LEN |

Lennar Corporation Class A |

Residential Construction |

62 % |

2.9 % |

| SQZ |

CELC |

Celcuity Inc. |

Biotechnology |

51.2 % |

0.8 % |

| SQZ |

IDT |

IDT Corporation Class B |

Telecom Services |

36.5 % |

1.3 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. |

Breakdowns within 5% of Breakdown Price

| Watchlist |

Symbol |

Company |

Industry |

C Score* |

% Loss |

| SS |

UDMY |

Udemy, Inc. |

Telecom Services |

69.9 % |

-2.3 % |

| SS |

HAL |

Halliburton Company |

Packaged Foods |

59.9 % |

-3 % |

| SS |

ULBI |

Ultralife Corporation |

Real Estate Services |

59.9 % |

-2.2 % |

| SS |

TRDA |

Entrada Therapeutics, Inc. |

Biotechnology |

56.6 % |

-0.7 % |

| SS |

VTLE |

Vital Energy, Inc. |

Biotechnology |

51.9 % |

-2.8 % |

| SS |

ROIV |

Roivant Sciences Ltd. |

Biotechnology |

50 % |

-1.4 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. |

| There were no CWH stocks meeting our breakout model criteria |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. |

Cup and Handle Chart of the Week

There were no Cup and Handle Stocks meeting my Chart of the Week criteria this week.