Breakoutwatch Weekly Summary 03/28/2024

You are receiving this email because you are or were a

BreakoutWatch.com subscriber, or have subscribed to our weekly

newsletter.

To read this newsletter on the site, click here: Newsletter

.

Market Summary

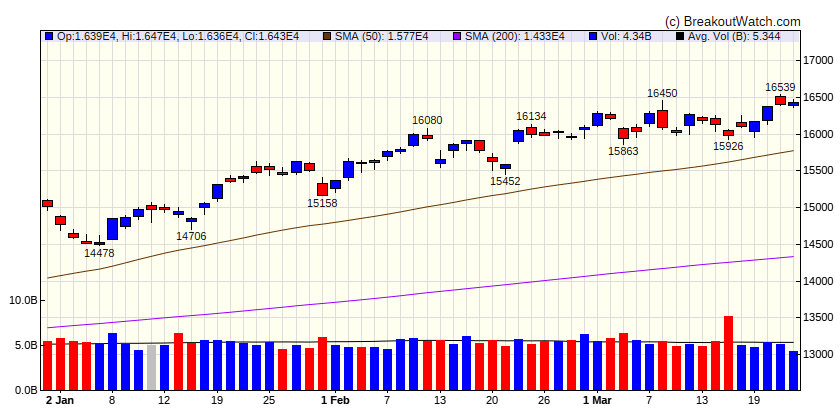

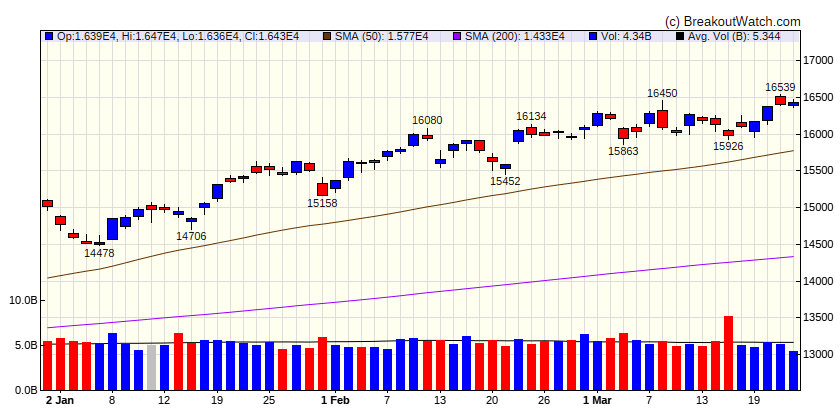

Stocks close out strong quarter with gains

Most of the major indexes advanced over the shortened trading week to end a quarter of strong gains. The S&P 500 Index recorded new closing and intraday highs to end the week. The market’s advance was notably broad, with an equal-weighted version of the S&P 500 Index gaining 1.64%, well ahead of the 0.39% increase in the more familiar market-weighted version. Small-caps also easily outperformed large-caps, and the Russell 1000 Value Index gained 1.79%, in contrast with the 0.60% decline in its growth counterpart. Markets were closed on Friday in observance of the Good Friday holiday but were scheduled to reopen on Monday in advance of many international markets. [more...]

Major Index Performance

| Dow Jones

|

| Last Close

| |

| Wk. Gain

| NAN % |

| Yr. Gain

| -100 % |

| Trend

| Up |

|

| S&P 500

|

| Last Close

| |

| Wk. Gain

| -100 % |

| Yr. Gain

| -100 % |

| Trend

| Up |

|

| NASDAQ Comp.

|

| Last Close

| |

| Wk. Gain

| -100 % |

| Yr. Gain

| -100 % |

| Trend

| Up |

|

| Russell 2000

|

| Last Close

| |

| Wk. Gain

| -100 % |

| Yr. Gain

| -100 % |

| Trend

| Up |

|

Performance by Sector

| Sector |

Wk. Change % |

Yr. Change % |

Trend |

| Consumer Discretionary |

1.16 |

4.82 |

Up |

| Consumer Staples |

0.92 |

7.26 |

Up |

| Energy |

1.93 |

11.65 |

Up |

| Finance |

1.77 |

11.6 |

Up |

| Health Care |

1.5 |

8.34 |

Up |

| Industrials |

0.77 |

11.55 |

Up |

| Technology |

0.06 |

9.69 |

Up |

| Materials |

2.04 |

8.3 |

Up |

| REIT |

2.16 |

-1.78 |

Down |

| Telecom |

0.17 |

12.21 |

Up |

| Utilities |

2.59 |

4.57 |

Up |

Breakouts This Week Still Within 5% of Breakout Price (Limit 20 top C Score)

| Watchlist |

Symbol |

Company |

Industry |

C Score* |

% Gain |

| CWH |

BWMX |

Betterware de Mexico, S.A.P.I. de C.V. |

Specialty Retail |

77.5 % |

4.1 % |

| SQZ |

VIRC |

Virco Manufacturing Corporation |

Biotechnology |

77.1 % |

2.6 % |

| SQZ |

OSG |

Overseas Shipholding Group, Inc. |

Healthcare Plans |

76.6 % |

3.2 % |

| CWH |

IGIC |

International General Insurance Holdings Ltd. |

Insurance - Diversified |

75.3 % |

1.3 % |

| SQZ |

VVI |

Viad Corp |

Specialty Business Services |

75 % |

4.9 % |

| SQZ |

GEOS |

Geospace Technologies Corporation |

Restaurants |

73.7 % |

0.8 % |

| SQZ |

RRR |

Red Rock Resorts, Inc. |

Restaurants |

71.1 % |

0.3 % |

| CWH |

FIS |

Fidelity National Information Services, Inc. |

Information Technology Services |

70.8 % |

2.5 % |

| SQZ |

BPOP |

Popular, Inc. |

Banks - Regional |

70.1 % |

3.4 % |

| SQZ |

NET |

Cloudflare, Inc. |

Software - Infrastructure |

68.5 % |

0.4 % |

| SQZ |

WAL |

Western Alliance Bancorporation |

Banks - Regional |

67.2 % |

4.1 % |

| HTF |

JSPR |

Jasper Therapeutics, Inc. |

Biotechnology |

64.7 % |

4.9 % |

| SQZ |

DBRG |

DigitalBridge Group, Inc. |

Real Estate Services |

64.7 % |

3.5 % |

| SQZ |

MATX |

Matson, Inc. |

Marine Shipping |

63.2 % |

3.3 % |

| SQZ |

NXE |

Nexgen Energy Ltd. |

Uranium |

52.8 % |

2.2 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. |

Breakdowns within 5% of Breakdown Price

| Watchlist |

Symbol |

Company |

Industry |

C Score* |

% Loss |

| SS |

HOLI |

Hollysys Automation Technologies, Ltd. |

Recreational Vehicles |

72.2 % |

-0.1 % |

| SS |

PARR |

Par Pacific Holdings, Inc. |

Entertainment |

68.7 % |

-0 % |

| SS |

PRDO |

Perdoceo Education Corporation |

Medical Devices |

65.9 % |

-0.3 % |

| SS |

MNTX |

Manitex International, Inc. |

Shell Companies |

63 % |

-3.9 % |

| SS |

PBYI |

Puma Biotechnology Inc |

Biotechnology |

62.9 % |

-3.1 % |

| SS |

KOS |

Kosmos Energy Ltd. |

Telecom Services |

58.2 % |

-0.8 % |

| SS |

LPTH |

LightPath Technologies, Inc. |

Electronic Components |

57.8 % |

-4.8 % |

| SS |

ROIV |

Roivant Sciences Ltd. |

Biotechnology |

50.5 % |

-2.2 % |

| SS |

TDUP |

ThredUp Inc. |

Internet Retail |

48.6 % |

-1 % |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. |

| There were no CWH stocks meeting our breakout model criteria |

| *C score is our assessment of a Stock's correlation to CAN SLIM principles. It combines a stock's Technical and Fundamental merits and is expressed as a percentage. |

Cup and Handle Chart of the Week

There were no cup and handle stocks meeting our breakout model criteria this week.