Conclusion

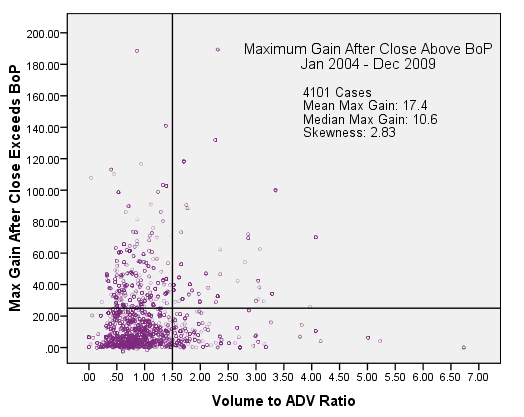

The maximum mean return from breakouts from a cup with handle

base is 17.6% using an 8% stop-loss without considering breakout day

volume as an additional criteria for selection. This shows that

breakouts from a cup-with-handle base can be highly profitable.

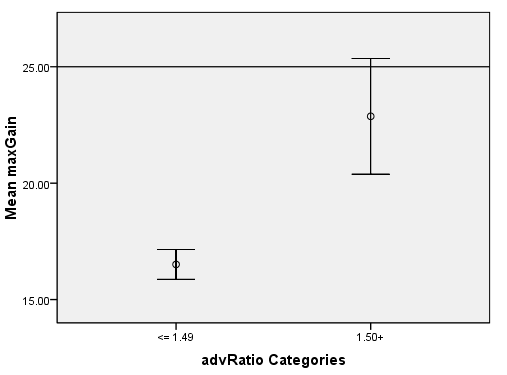

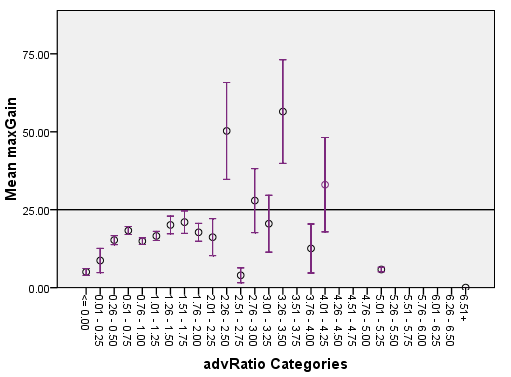

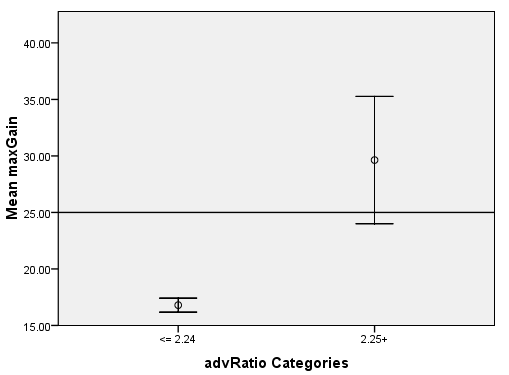

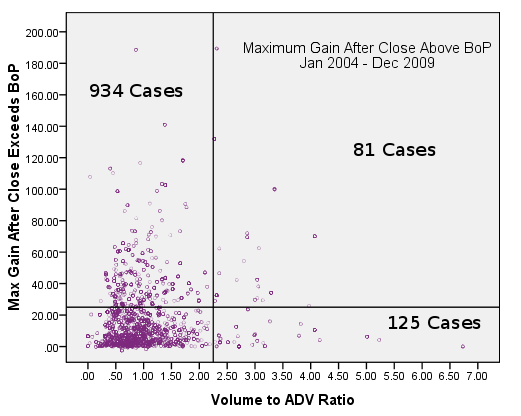

There is evidence that there is a relationship between breakout day

volume and subsequent price performance. However, this relationship is

a weak one and at least for cup-with-handle bases, a close above the

breakout price on a volume threshold of 1.5 times average daily volume

is not sufficient to conclude that the breakout can go on to make

significant gains. A volume threshold of 2.25 times adv gives a mean

return above 25% but even then the number of losing cases would

significantly outweigh the number winning cases. Moreover, such a

threshold, and the 1.5 times adv threshold also, would lead to a lot of

highly profitable investment opportunities being missed.

Next time, we will look at other factors that can improve our

return from cup-with-handle breakouts.