Flat Base Watchlist Methodology

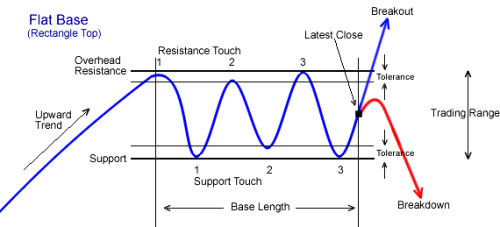

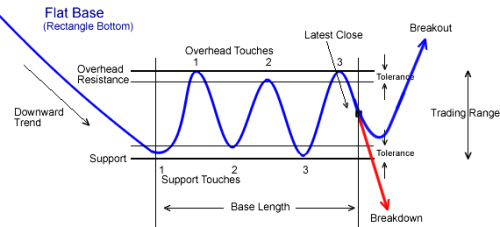

A flat base is a pattern in which a stock's price moves sideways while moving within a trading range marked by overhead resistance and support. The resistance and support lines must be touched at least twice over a period of several weeks, and there should be some alternation between the points where resistance and support are touched.

Volume is not an important feature in the recognition of the pattern, but will play an important role when the pattern breaks out or breaks down.

A 'Rectangle Top' is one in which the intermediate term trend is upwards before the flat base forms.

A 'Rectangle Bottom' is one in which the intermediate term trend is downwards before the flat base forms.

So that there is no confusion between a flat base and the handle of a cup with handle pattern, we screen first for a cup with handle pattern and then assign stocks to the flat base watchlist if they are not already on the cup with handle list.

Criteria for Selection for the Flat Base Watchlist

| Criterion | Definition | Required Value |

|---|---|---|

Upward Trend (Rectangle Top) |

The intermediate term price trend of the stock price

is upwards |

Positive slope to the 200 day moving average. |

| Downward Trend (Rectangle Bottom) |

The intermediate term price trend of the stock price is downwards. | Negative slope to the 200 day moving average. |

Latest Close |

The price at which the stock last closed |

>= $6.00 and average daily volume >= 30,000. |

Overhead Resistance |

The uppermost intraday high reached before reversing |

N/A |

Support |

The lowest intraday low reached before reversing |

N/A |

Trading Range |

The difference between the Overhead Resistance and

Support levels |

> 3% and <=10% of the Overhead Resistance price.

The 3% minimum range is designed to exclude merger/takeover candidates |

Tolerance |

The stock is considered to touch the Overhead Resistance

or Support lines if it is within the tolerance percent before reversing. |

1% |

Resistance Touch |

The intraday high is within tolerance of the Overhead

Resistance line |

Minimum of 2 |

Support Touch |

The intraday low is within tolerance of the Support

level |

Minimum of 2 |

Base Length |

The length of the pattern measured backwards from the

last close. |

At least 25 days. there is no maximum, but there must

have been at least the required number of touches within the last 60

days. |

Breakout |

The stock rises above the Overhead Resistance level

on strong volume |

Alert issued if intraday price is 1% above Overhead

Resistance on projected 1.5 times volume. |

Breakdown |

The stock rises drops below the Support

level on strong volume |

N/A |

© breakoutwatch.com 2025. All Rights Reserved.