50 DMA Breakdown Watchlist Methodology

The watchlist is compiled by selecting stocks that meet a specific set of criteria. These criteria are based on the guidelines offered in How to Make Money Selling Stocks Short by William O'Neil with Gil Morales, with additional requirements and constraints of our own.

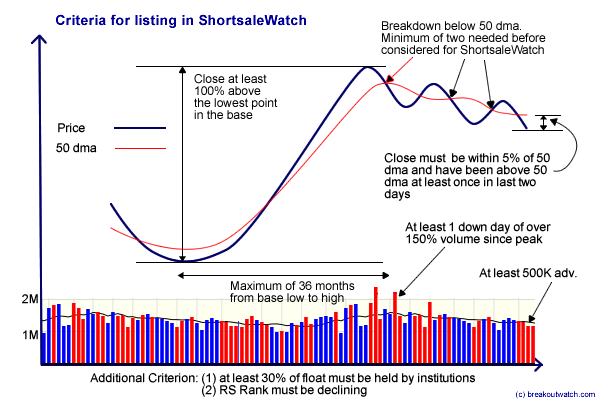

The criteria for adding a stock to the 50 DMA Breakdown watchlist are:

|

50 DMA Breakdown

Criteria

|

Commentary

|

|

1. At least 30% of the share float

must be held by institutions. There is no minimum share price now.

|

When institutions unload a stock,

they

can significantly increase supply which will drive down the price.

The best shorting candidates will have a significant percentage of

their share float held by institutions.

|

|

2. The average daily volume must

be

at least 500,000

|

Stocks with greater liquidity are

less

likely to make sudden moves creating a short squeeze. (NB. O'Neil

recommends at least 1 million shares - we go lower to allow some

freedom of choice)

|

|

3. The stock must have closed at

least

100% above the lowest point in its base in the last 36 months.

|

We want stocks that have made

significant

gains, and have a deep base to fall into to give a good return on

the short sale

|

|

4. The technical strength of the

stock

must be deteriorating relative to the overall market strength

|

This is important because although

the stock price may be falling, it could still be outperforming the

overall market. We want to find stocks that are weakening compared

to the rest of

the

market.

|

|

5. The stock must be below its

peak

of the last 6 months and have begun to oscillate around its 50 day

moving average. A minimum of two crosses to the downside of the 50

day moving average are required.

|

Failing stocks tend to use the 50

day

moving average as a support/resistance line while under- and

over-shooting

it.

|

|

6. There must have been at least

one day of heavy

selling (at least 1.5 times average daily volume) since the stock

peaked.

|

This indicates weakness and that

the stock may

about to become under heavy distribution.

|

|

7. The stock must have closed

above

its 50 day moving average in at least one of the last two sessions.

|

This requirement ensures that the

stock

may be about to break below the 50 dma, or may have just done so.

An alert will be sent on either of these two days if the projected

volume exceeds 1.5 times average daily volume.

|

|

8. The stock must have closed within 5% of its 50 day moving average

|

We want to exclude stocks that are too far above the 50 dma or are already too far below it.to be probable shorting candidates. |

© breakoutwatch.com 2015. All Rights Reserved.