Breakoutwatch.com Analysis of Cup and Handle

Trading Results for 2018

Looking back at the suggested trading strategies for 20181

it is easy to see now that the parameters proposed for trading cup and

handle pattern stocks were too conservative.

Results Using 2018 Suggested Strategies

Buy on Breakout Alert

Buy on Breakout Alert

The Buy on Alert Strategy would have returned 27.5%. Note that the

strategy recommended not trading while the market trend indicators were

negative which conserved profits from mid-September on. During the same

time period the S&P 500 gave up all its gains for the year.

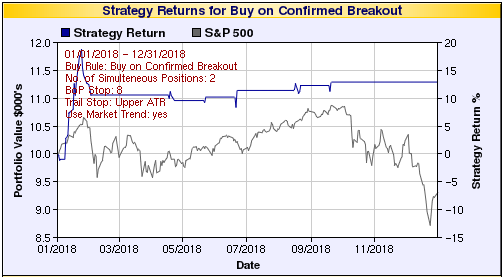

Buy on Confirmed

Breakout

Buy on Confirmed

Breakout

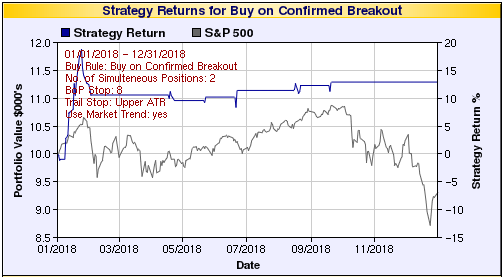

The Buy at Open strategy would have returned 12.9%. Similarly the

strategy recommended not trading while the market trend indicators were

negative which conserved profits from mid-September on. During the same

time period the S&P 500 gave up all its gains for the year.

With the benefit of hindsight, it is clear that a much less

restrictive set of criteria could have produced vastly superior results.

I'm grateful to a subscriber who took advantage of the cup and handle

backtest tool to discover these alternative strategies.

Buy on

Breakout Alert

Buy on

Breakout Alert

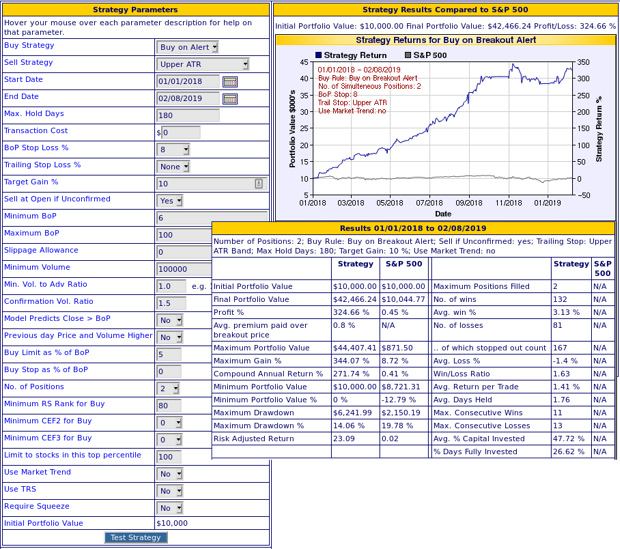

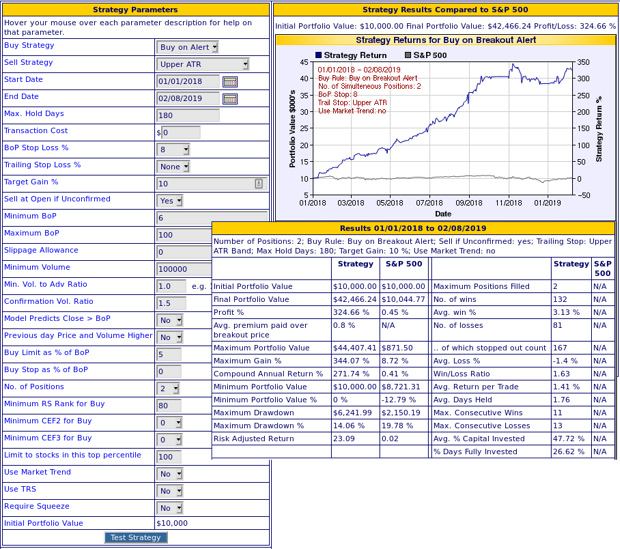

The composite image at right (click for full size) shows backtest

results for 2018 with a significantly different set of parameters. The

key differences to the parameters used in the Buy on Breakout Alert

results above are:

- maximum BoP: $100

- Minimum Volume: 100K

- Use market trend: No

This backtest shows a profit of 324%!

Interestingly, trading did not stop while the market signals were

negative. Although there were small losses, continued trading delivered

further profits.

Buy on Confirmed

Breakout

Buy on Confirmed

Breakout

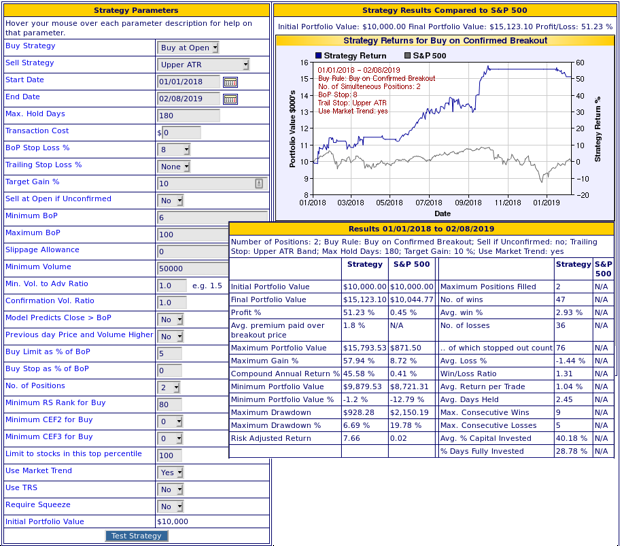

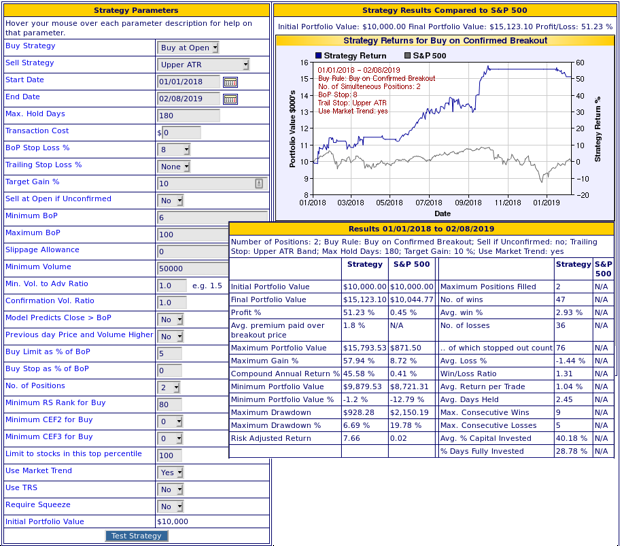

The composite image at right shows an alternative strategy for buying

at the next open when a breakout is confirmed, based on 2018 data. The

advantage of this strategy is that all trading orders can be placed

either after the market closes or before it opens.

The key differences to the parameters used in the Buy on Confirmed

Breakout results above are:

- maximum BoP: $100

- Minimum Volume: 100K

- Use market trend: Yes

- Confirmation Volume Ratio: 1.0

- Minimum RS: 80 (cf. 92)

Conclusion

The analysis above goes to prove the adage "past performace is no

guarantor of future results". The suggested strategies for 2018 were

based on market performance in 2017. Market volatility that year was

extremely low with only a 2% average daily trading range. We recognized

a change in volatility in late March 2018 and adjusted our suggested

strategies to use ATR rather than trailing stops but did not broaden the

scope of the other parameters resulting in a narrower selection of

stocks to consider.

Buy on Breakout Alert

Buy on Breakout Alert

Buy on Confirmed

Breakout

Buy on Confirmed

Breakout