| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

Market Summary

DJI Market Signal Goes to Exit

Our market signal went to exit for the DOW on Thursday as the DJI registered its 7th distribution day in eleven sessions. This was the first exit signal for the DOW since April 20, 2004 after which the index lost 5.8% before bottoming in October that year. That puts our market signal at exit for both the DJI and NASDAQ. These exit signals appear to be at odds with market conditions as all three indexes made strong gains for the week. The DJI rose by 2.11%, the NASDAQ Composite jumped 2.9% and the S&P 500 added 2.31%.

The market model almost reversed itself for the NASDAQ on Friday when the index gained 1.93% but just failed to deliver a follow-through day because volume was not higher than Thursday's. Market conditions are unusually turbulent with wild intra-day and between day swings. Our models are built on long term conditions and are not sensitive to such daily volatility.

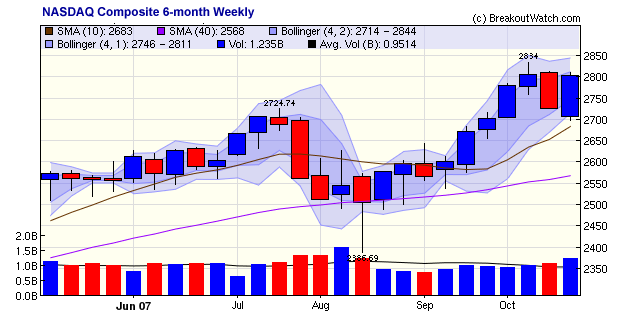

Weekly charts smooth out daily volatility and a look at the six-month weekly chart for the NASDAQ shows that it is still quite healthy, having almost fully recovered last week's losses and being only slightly below its recent highs. The NASDAQ remains the best performing index with a gain year-to-date of 16.1%, almost double the S&P 500's 8.25%. If the Fed cuts interest rates again next week, as expected, this will likely benefit the NASDAQ further as it will stimulate investment. If so, we can expect a test of resistance at 2834.

The DJI and S&P 500 are weighed down by the losses in the financial and homebuilders sectors and they are likely to underperform the NASDAQ until the husing market situation is resolved, which could take two years or more.

The number of successful breakouts more than doubled this week and made an average gain of 5.05% by Friday's close. Six stocks gained over 10% and 3 achieved intraday highs of over 20%. The table below shows the successful breakouts, their Friday close and their intra-day high following breakout. Note that all stocks had good technical strength ( that is they were in zone 4-x) - a major criterion for a successful breakout.

| B'out Date | Symbol | Base | B'Out Price |

B'out RS |

B'out CE Cell |

B'out CQ |

Last Close |

Current % off BOP |

% Gain at Intraday High |

Expected Gain % |

|---|---|---|---|---|---|---|---|---|---|---|

| 10/26/07 | URRE | CwH | 11.19 | 97.00 | 4-3 | 2.03 | 11.43 | 2.14% | 6.97% | 80 |

| 10/26/07 | SM | CwH | 41.95 | 81.00 | 4-4 | 1.67 | 42.21 | 0.62% | 1.88% | 24 |

| 10/26/07 | KMT | CwH | 89.52 | 87.00 | 4-3 | 1.41 | 89.75 | 0.26% | 1.52% | 45 |

| 10/26/07 | EGN | CwH | 61.23 | 83.00 | 4-3 | 0.47 | 61.92 | 1.13% | 1.5% | 36 |

| 10/26/07 | AEZ | CwH | 6.71 | 81.00 | 4-2 | 0.80 | 6.94 | 3.43% | 4.32% | 88 |

| 10/25/07 | AET | FB | 55.21 | 80.00 | 4-3 | 55.88 | 1.21% | 5.05% | N/A | |

| 10/25/07 | LYO | CwH | 47.27 | 92.00 | 4-3 | 0.09 | 47.25 | -0.04% | 0.47% | 43 |

| 10/25/07 | LTM | CwH | 64.56 | 82.00 | 4-4 | 0.17 | 64.52 | -0.06% | 0.82% | 42 |

| 10/25/07 | FCL | CwH | 43.20 | 82.00 | 4-2 | 0.42 | 44.83 | 3.77% | 4.63% | 42 |

| 10/25/07 | ETR | CwH | 117.00 | 80.00 | 4-3 | 0.25 | 119.49 | 2.13% | 2.27% | 34 |

| 10/25/07 | BTU | CwH | 54.40 | 85.00 | 4-3 | 0.51 | 57.93 | 6.49% | 8.31% | 44 |

| 10/25/07 | ABAX | CwH | 26.10 | 84.00 | 4-4 | 0.42 | 29.55 | 13.22% | 14.94% | 50 |

| 10/24/07 | CCE | FB | 24.74 | 75.00 | 4-2 | 25.3 | 2.26% | 2.91% | N/A | |

| 10/24/07 | AGG | FB | 101.00 | 60.00 | 3-3 | 100.78 | -0.22% | 0.2% | N/A | |

| 10/23/07 | TWI | CwH | 34.85 | 90.00 | 4-2 | 0.53 | 33.7 | -3.30% | 1.26% | 50 |

| 10/23/07 | PRSC | CwH | 32.00 | 83.00 | 4-3 | 0.46 | 30.9 | -3.44% | 4.69% | 51 |

| 10/23/07 | MIND | CwH | 21.17 | 93.00 | 4-4 | 0.29 | 21.7 | 2.50% | 3.73% | 56 |

| 10/23/07 | MICC | CwH | 94.18 | 85.00 | 4-4 | -0.96 | 107.23 | 13.86% | 15.98% | 47 |

| 10/23/07 | CBLI | CwH | 12.60 | 95.00 | 4-2 | 1.16 | 12.6 | 0.00% | 3.73% | 60 |

| 10/23/07 | BNT | CwH | 13.13 | 80.00 | 4-3 | 0.17 | 13.98 | 6.47% | 6.63% | 68 |

| 10/23/07 | ASIA | CwH | 10.00 | 84.00 | 4-3 | -0.10 | 12.05 | 20.50% | 28.3% | 88 |

| 10/23/07 | APOL | CwH | 68.10 | 92.00 | 4-4 | 0.22 | 75.22 | 10.46% | 13.8% | 44 |

| 10/22/07 | HMIN | CwH | 42.45 | 83.00 | 4-3 | 0.91 | 48.5 | 14.25% | 17.97% | 0 |

| 10/22/07 | DECK | CwH | 116.55 | 95.00 | 4-3 | 0.21 | 144.06 | 23.60% | 24.2% | 0 |

No new features this week.

CANTATA Evaluator (CE) Overview

The goal of our CANTATA Evaluator (CE) is to provide a method for evaluating stocks so those with the very best combination of timing, fundamental and technical attributes get the highest scores. To make the process transparent to our subscribers, and to allow them to give extra emphasis to timing, fundamentals or technicals depending on their personal preference, we divide the CE into three components. Each stock is assigned a timing score, technical score (CET) and a fundamental score (CEF) with the final score (CE) a combination of the CET and CEF scores. The timeliness score is based on stocks that are on our watchlists. Since the patterns we recognize are somewhat limited, we do not include the timeliness score in the overall score because it would not provide a sound basis for comparison of all stocks.

The CET and CEF scores are also used to assign stocks to "CE Zones". CE Zones provide a rapid method of evaluating a stock and will be covered in our next tutorial.

Timeliness Score - Maximum 2 points

The cornerstone of our methodology is the selection of stocks that provide a valid entry point. This is either on breakout, or shortly after while the stock is still within a buyable range. We assign a maximum of two points to our timeliness rating as follows:

- 1 point if currently listed on CwHwatch, FBwatch or DBwatch

- 1 point if it broke out in last 5 days and within 5% of BoP

Because a stock can form a second pivot within 5 days of breakout, it is possible for a stock to earn two points under this scheme.

Similarities to CAN SLIM®

Some of the CANTATA scorings represent a quantification of CAN SLIM® principles.

| CAN SLIM® | CANTATA Evaluator | ||

|---|---|---|---|

| C | Current Quarterly Earnings per Share |

CEF 1 | Quarter over Quarter Earnings Growth |

| CEF 2 | Positive Quarterly Earnings |

||

| CEF 3 | Quarterly Earnings Growth Acceleration |

||

| CEF 5 | Quarter over Quarter Sales Growth Rates |

||

| CEF 6 | Quarterly Sales Growth Rate Acceleration |

||

| CEF 7 | Forward Earnings Growth Rates |

||

| A | Annual Earnings Increases |

CEF 4 | Year over Year Earnings Growth Rates |

| CEF 9 | Return on Equity |

||

| CEF 10 | Cash Flow |

||

| CEF 11 | Net Margins |

||

| N | New Products, New Management, New Highs |

CET 1 | Price relative to 50 and 200 day moving averages; 50 day relative to

200 day moving average |

| CET 4 | Price relative to 52 week high |

||

| Not Quantified | IPO Date, Significant Developments, News |

||

| S | Supply and Demand |

CET 5 | Up/Down Ratio |

| L | Leader or Laggard |

CET 2 | Relative Strength Rank |

| CET 3 | Rank in Industry |

||

| I | Institutional Sponsorship |

CEF 8 | Institutional Ownership |

| M | Market Direction |

Not Quantified | Market Direction is not specific to an individual stock so is not quantified

as part of the CE. It is analyzed daily on our Market Analysis page |

CAN SLIM is a registered trademark of Data Analysis, Inc.

Technical Score (CET) - Maximum 7 points

In How to Make Money in Stocks, O’Neil describes the preferred technical condition of a stock at the time of a breakout, but does not provide a more general description of a 'technically healthy' stock. As the goal of the CET is to provide some means of determining the technical health of a stock whether or not it is setting up for a breakout, we assign a score based on objective measurements of the stock’s price/volume action over the intermediate to long term. Scores do not take into account very near term action of the stock such as a recent breakdown, reversal, a broken short-term trend etc.

For each criteria, if a stock meets the suggested minimum preferred value, we assign a full point. If the stock falls below the lowest acceptable value for the criteria, we assign zero points. If the stock falls between these two extremes, we assign a prorated score between zero and one.

1. Price Relative to 50 day Moving Average, Price Relative to 200 day Moving Average, 50 vs. 200 day Moving Average

As these three technical criteria are interdependent, scores are assigned from 0 to 3 points. If the price is above both the 50 and 200 day moving averages and the 50 day is above the 200 day moving average, 3 points. If the price is below both the 50 and 200 day moving averages and the 50 day is below the 200 day moving average, 0 points. Points are prorated for conditions between.

2. Relative Strength Rank (RSRank)

If the RSRank equals 99, 1 point. If the RSRank equals 1, 0 points. Points are prorated for RSRank values between 1 and 99.

3. Rank in Industry

Stocks wihin the industry are ranked in descending RSRank order, with the percent off the 52 week high used as a secondary sort. If the stock is ranked first in the industry, 1 point. If the stock is ranked last in the industry, 0 points. Points are prorated for ranks in industry between first and last.

4. Price Relative to 52 Week High

If the stock’s closing price is less than or equal to 15% off the 52 week high, 1 point. If the stock’s closing price is more than 60% off the 52 week high, 0 points. Points are prorated for percent off 52 week high between 15% and 60%.

5. Up/Down Ratio (U/D)

If the U/D is greater than or equal to 2.0, 1 point. If the U/D is less than 0.7, 0 points. Points are prorated for U/D values between 0.7 and 2.

Fundamental Score (CEF) - Maximum 11 points

The fundamental score (CEF) includes all CANTATA criteria which drive the stock’s price/volume action. Criteria here are derived from three sources. First, the historical fundamentals of the underlying business are used as an indication of management’s ability to effectively invest resources and generate profits over time. Second, forward estimates of growth are used to indicate there is an expectation growth will continue in the near future. Third, institutional ownership trends are used to show large investors’ willingness to invest in the company based on past and expected future trends.

For each criteria, if a stock meets the suggested minimum preferred value, we assign a full point. If the stock falls below the lowest acceptable value for the criteria, we assign zero points. If the stock falls between these two extremes, we assign a prorated score between zero and one. In cases where the measurement is a “go/no-go” (such as positive earnings vs. negative earnings), the score is either a one or zero. Note that for Exchange Traded Funds (ETF’s), Closed End Funds, and other stocks where fundamental data is unavailable will have a fundamental score of zero.

1. Quarter over Quarter (QoQ) Earnings Growth Rates

If the QoQ earnings per share (EPS) growth rates in the latest two quarters are greater than or equal to 18%, 1 point. If EPS growth rates in the latest two quarters are negative, 0 points. Points are prorated for growth rates between 0 and 18%. Slightly more weight is placed on the most recent quarter than on the previous quarter in order to derive a combined score for both quarters.

2. Positive Quarterly Earnings

If the earnings per share (EPS) in the latest two quarters is positive, 1 point. If the EPS in the latest two quarters is negative, 0 points. Slightly more weight is placed on the most recent quarter than on the previous quarter in order to derive a combined score for both quarters.

3. Quarterly Earnings Growth Rate Acceleration

QoQ EPS growth rates over the last four quarters are used to determine if the QoQ EPS growth rate in one quarter is greater than the QoQ EPS growth rate in the previous quarter. If the growth rate in the recent quarter is positive and greater than the previous quarter, 1 point. If the growth rate in the recent quarter is greater or equal to 25% but less than the previous quarter, 0.5 points. (This allows for deceleration down to a still very high level of growth.) If the growth rate in the recent quarter is less than 25% and less than the previous quarter, 0 points. Recent quarters are weighted slightly more than older quarters in order to derive a combined score for all four quarters.

4. Year over Year (YoY) Earnings Growth Rates

If the YoY EPS growth rates in the latest four completed fiscal years are greater than or equal to 25%, 1 point. If the YoY EPS growth rates are negative, 0 points. Points are prorated for growth rates between 0 and 25%. Recent fiscal years are weighted slightly more than older fiscal years in order to derive a combined score for all four fiscal years.

5. Quarter over Quarter Sales Growth Rates

If the QoQ sales growth rates in the latest two quarters are greater than or equal to 25%, 1 point. If sales growth rates in the latest two quarters are negative, 0 points. Points are prorated for growth rates between 0 and 25%. Slightly more weight is placed on the most recent quarter than on the previous quarter in order to derive a combined score for both quarters.

6. Quarterly Sales Growth Rate Acceleration

QoQ sales growth rates over the last four quarters are used to determine if the QoQ sales growth rate in one quarter is greater than the QoQ sales growth rate in the previous quarter. If the growth rate in the recent quarter is positive and greater than the previous quarter, 1 point. If the growth rate in the recent quarter is greater or equal to 25% but less than the previous quarter, 0.5 points. (This allows for deceleration down to a still very high level of growth.) If the growth rate in the recent quarter is less than 25% and less than the previous quarter, 0 points. Recent quarters are weighted slightly more than older quarters in order to derive a combined score for all four quarters.

7. Forward Earnings Growth Rates

If the forward EPS growth rate estimate is greater than or equal to 15% and greater than the EPS growth rate for the most recent quarter, 1 point. If the forward EPS growth rate estimate is greater than or equal to 15% but less than the most recent quarter, 0.5 points. If the forward EPS growth rate estimate is less than 15% or unavailable, 0 points.

8. Institutional Ownership

Points are equally weighted between two components of institutional ownership as reported in the most recent available quarter. First, if the number of institutional owners is greater than or equal to 5, 1 point. If the number of institutional owners is less than 1, 0 points. Points are prorated for the number of insitutional owners between 1 and 5. Second, if the number of net shares purchased by institutional owners is zero or positive, 1 point. If the number of net shares purchased by institutional owners is negative, 0 points.

9. Return on Equity (ROE)

If the ROE for the trailing twelve months (TTM) is greater than or equal to 17%, 1 point. If the ROE is negative, 0 points. Points are prorated for ROE values between 0 and 17%.

10. Cash Flow

Points are weighted between three components of operating cash flow. Half the weighting is placed on the relationship of operating cash flow to earnings. If the operating cash flow is greater than or equal to 20% more than the earnings, 1 point. If cash flow is less than 20% greater than earnings, 0 points. Twenty-five percent of the weighting is placed on operating cash flow in the most recent quarter. If the cash flow in the most recent quarter is positive, 1 point. If the cash flow in the most recent quarter is negative, 0 points. Twenty-five percent of the weighting is placed on operating cash flow over the trailing 12 months. If cash flow in the trailing 12 months is positive, 1 point. If the cash flow in the trailing 12 months is negative, 0 points.

11. Net Margins

Points are determined based on net margins over the three previously completed fiscal years. If the net margin in the most recent fiscal year is the maximum net margin over the previous three years, 1 point. If the net margin in the most recent fiscal year is the minimum net margin over the previous three years, 0 points. Points are prorated for net margin in the most recent fiscal year as a percentage of the maximum net margins over the previous three years. For example, if the most recent fiscal year net margin is 50% of the maximum net margin over the previous 3 fiscal years, 0.5 points are assigned.

CANTATA Score (CE) - Maximum 18 points

The sum of technical and fundamental scores, CET + CEF.

Investment Advisors Using our Service

TradeRight Securities, located in a suburb of Chicago, is a full services investment management company and broker/dealer. They have been a subscriber, and user, of BreakoutWatch.com for some time now. They practice CANTATA and use Breakoutwatch.com as a “research analyst”. You can learn more about TradeRight Securities at: www.traderightsecurities.com. If you’re interested in speaking to a representative, simply call them toll-free at 1-800-308-3938 or e-mail gdragel@traderightsecurities.com.

Note to advisors: If you would like to be listed here, please contact us. As a service to those who subscribe to us, there is no additional charge to be listed here.

Get a 14 day free

Trial of our premium 'Platinum' service and TradeWatch.

No Credit Card Required.

Click

Here for 14 Day Free Trial |

| Index | Value | Change Week | Change YTD | Market1 Signal |

||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | 13806.7 | 2.11% | 10.78% | exit | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 2804.19 | 2.9% | 16.1% | exit | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 1535.28 | 2.31% | 8.25% | enter | ||||||||||||||||||||||||||||||||||||

1The Market Signal is derived from our proprietary

market model. The market model is described on the site. 2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone (similar to IBD). The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

# of Breakouts

|

Period Average1

|

Max. Gain During Period2

|

Gain at Period Close3

|

|

|---|---|---|---|---|

| This Week | 23 | 14.31 | 7.58% | 5.64% |

| Last Week | 11 | 13.38 | 7.68% | 4.08% |

| 13 Weeks | 197 | 15.15 | 19.57% |

9.53% |

Sector

|

Industry

|

Breakout Count for Week

|

|---|---|---|

METALS & MINING

|

Industrial Metals & Minerals

|

3

|

ENERGY

|

Independent Oil & Gas

|

2

|

AUTOMOTIVE

|

Auto Parts

|

1

|

CHEMICALS

|

Specialty Chemicals

|

1

|

CONSUMER NON-DURABLES

|

Textile - Apparel Footwear & Accessories

|

1

|

DIVERSIFIED SERVICES

|

Education & Training Services

|

1

|

DIVERSIFIED SERVICES

|

Research Services

|

1

|

DRUGS

|

Drug Delivery

|

1

|

DRUGS

|

Diagnostic Substances

|

1

|

FINANCIAL SERVICES

|

Closed-End Fund - Equity

|

1

|

FOOD & BEVERAGE

|

Beverages - Soft Drinks

|

1

|

HEALTH SERVICES

|

Specialized Health Services

|

1

|

HEALTH SERVICES

|

Health Care Plans

|

1

|

INTERNET

|

Internet Software & Services

|

1

|

LEISURE

|

Lodging

|

1

|

LEISURE

|

Sporting Activities

|

1

|

TELECOMMUNICATIONS

|

Telecom Services - Foreign

|

1

|

UTILITIES

|

Gas Utilities

|

1

|

UTILITIES

|

Electric Utilities

|

1

|

WHOLESALE

|

Industrial Equipment Wholesale

|

1

|

2This represents the return if each stock were bought at its breakout price and sold at its intraday high.

3This represents the return if each stock were bought at its breakout price and sold at the most recent close.

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | EGO | El Dorado Gold Corp | 121 |

| Top Technical | DAR | Darling International | 80 |

| Top Fundamental | AOB | American Oriental Bioengineering Inc | 69 |

| Top Tech. & Fund. | MIND | Mitcham Industries Inc | 55 |

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | AEZ | American Oil & Gas Inc | 88 |

| Top Technical | MIND | Mitcham Industries Inc | 56 |

| Top Fundamental | MIND | Mitcham Industries Inc | 56 |

| Top Tech. & Fund. | MIND | Mitcham Industries Inc | 56 |

If you received this newletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2007 NBIcharts, LLC dba BreakoutWatch.com. All rights reserved.

" BreakoutWatch," the BreakoutWatch.com "eye" logo, and the slogan "tomorrow's breakouts today" are service marks of NBIcharts LLC. All other marks are the property of their respective owners, and are used for descriptive purposes only.