| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

Market Summary

The Fed's decision to open the discount window to non-bank financial institutions has put a floor under the markets, at least for the time being. It is clear that there is now little risk that even a medium sized bank-like institution will be allowed to fail, let alone a large one, so the market volatility related to the risk of systemic financial system failure has abated. Debate rages about the wisdom, even legality, of the Fed's action, but it has restored confidence for now. This has allowed the S&P 500 to gain 9% from its intra-day low on March 17. Almost half of that (4.2%) was gained in the last week. The NASDAQ Composite has also seen an over 9% gain with a rise of 4.9% this week.

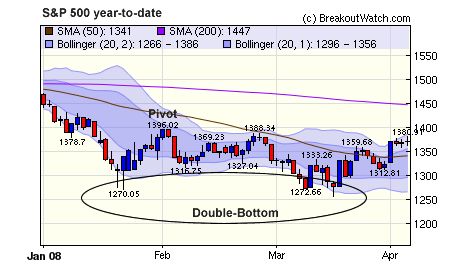

The markets seem to be trading on the implicit assurance that the Fed and the President's Working Group on the Financial Markets ("PPT") will support the markets in this election year (as we have predicted since last August 4) and are also relying on assurances that the economy will recover in the second half of this year. In this environment, technical analysis is of doubtful value but we note that the S&P 500 ( and other indexes also) have established a double-bottom and are approaching their pivot point. A breakout above 1396 for the S&P 500 would be bullish but the index must first overcome resistance at 1388.

While the market technicals are improving, the economic fundamentals are worsening. Friday's employment report showed a loss of 80,000 jobs in March and the third monthly decline. This number will probably be revised lower next month, just as February's were today. The figures include a gain in Government employment so the private sector loss was 93,000. Approximately an additional 100,000 are eligible to enter the work force each month so clearly unemplyment will rise beyond the 5.1% reported today. Paradoxically, this is good news for stocks because rising unemployment holds down wages. This improves a company's bottom line, as will the cost of debt servicing as interest rates fall. A further 05% cut in rates on April 30 will be more good news.

So in the short term, it seems probable stocks will rise but earnings season begins on Monday which will determine if the rally continues or sputters.

No New Features this Week

Investment Advisors Using our Service

TradeRight Securities, located in a suburb of Chicago, is a full services investment management company and broker/dealer. They have been a subscriber, and user, of BreakoutWatch.com for some time now. They practice CANTATA and use Breakoutwatch.com as a “research analyst”. You can learn more about TradeRight Securities at: www.traderightsecurities.com. If you’re interested in speaking to a representative, simply call them toll-free at 1-800-308-3938 or e-mail gdragel@traderightsecurities.com.

Note to advisors: If you would like to be listed here, please contact us. As a service to those who subscribe to us, there is no additional charge to be listed here.

Get a 14 day free

Trial of our premium 'Platinum' service and TradeWatch.

No Credit Card Required.

Click

Here for 14 Day Free Trial |

| Index | Value | Change Week | Change YTD | Market1 Signal |

||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | 12609.4 | 3.22% | -4.94% | enter | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 2370.98 | 4.86% | -10.61% | exit | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 1370.4 | 4.2% | -6.67% | enter | ||||||||||||||||||||||||||||||||||||

| Russell 2000 | 713.73 | 4.47% | -6.83% | N/A | ||||||||||||||||||||||||||||||||||||

1The Market Signal is derived from our proprietary

market model. The market model is described on the site. 2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone (similar to IBD). The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

# of Breakouts |

Period Average1 |

Max. Gain During Period2 |

Gain at Period Close3 |

|

|---|---|---|---|---|

| This Week | 10 | 12.85 | 5.35% | 3.58% |

| Last Week | 6 | 13.08 | 8.47% | 5.8% |

| 13 Weeks | 193 | 13.85 | 9.9% |

-0.42% |

Sector |

Industry |

Breakout Count for Week |

|---|---|---|

BANKING |

Regional - Mid-Atlantic Banks |

1 |

ELECTRONICS |

Semiconductor - Integrated Circuits |

1 |

FINANCIAL SERVICES |

Closed-End Fund - Equity |

1 |

HEALTH SERVICES |

Medical Instruments & Supplies |

1 |

HEALTH SERVICES |

Specialized Health Services |

1 |

MANUFACTURING |

Industrial Electrical Equipment |

1 |

RETAIL |

Home Furnishing Stores |

1 |

SPECIALTY RETAIL |

Specialty Retail, Other |

1 |

TRANSPORTATION |

Regional Airlines |

1 |

UTILITIES |

Foreign Utilities |

1 |

2This represents the return if each stock were bought at its breakout price and sold at its intraday high.

3This represents the return if each stock were bought at its breakout price and sold at the most recent close.

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | NGD | New Gold Inc | 102 |

| Top Technical | TUX | Tuxis Corporation | 80 |

| Top Fundamental | ADBL | Audible Inc | 67 |

| Top Tech. & Fund. | ADBL | Audible Inc | 67 |

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | VVUS | Vivus Inc | 107 |

| Top Technical | SBSI | Southside Bancshares Inc | 55 |

| Top Fundamental | POWI | Power Integrations Inc | 0 |

| Top Tech. & Fund. | POWI | Power Integrations Inc | 0 |

If you received this newletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2008 NBIcharts, LLC dba BreakoutWatch.com. All rights reserved.

" BreakoutWatch," the BreakoutWatch.com "eye" logo, and the slogan "tomorrow's breakouts today" are service marks of NBIcharts LLC. All other marks are the property of their respective owners, and are used for descriptive purposes only.