| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

Market Summary

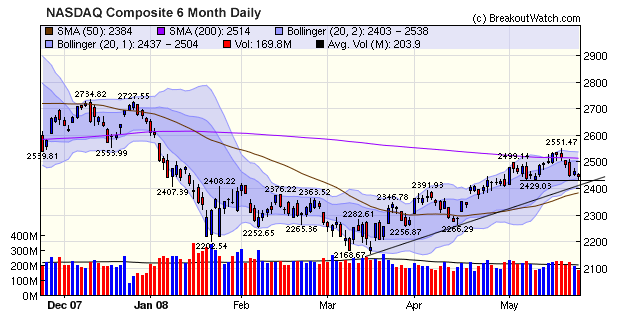

NASDAQ Finds Support While S&P 500 Collapses

A change of position by the Federal Reserve sent the market reeling on Wednesday and only low volume on Friday ahead of the long weekend saved it from a hammering on Friday. The minutes of the last FOMC meeting showed there was only weak support for further interest rate cuts as committee members feared that the risks of inflation were now equal to the risks of a weakening economy. This alarmed investors who have been happy to see lower rates and an expanding money supply even if it does lead to inflation because asset prices rise while debts are reduced in value. The NASDAQ rebounded from its primary support level (horizontal line on chart) on Friday and has yet to fall to the lower trend channel, but we can expect a test of that level at the lower Bollinger Band early next week.

The S&P 500 has already fallen through its primary support level and lower trend line and we can expect it to move downward further as consumption contracts under the weight of higher energy costs, tighter credit and falling house prices.

Although it appears the recent rally was a bull trap as we feared, I don't discount the possibility that the Treasury or Fed will come up with something new to forestall a test of the March low. Tuesday's action could be grim as investors return from the long weekend, and if so some intervention on Tuesday or Wednesday is possible.

The financial sector is weakening again and the next shoe to drop could be Countrywide. The prospects of the merger with Bank of America proceeding are looking slimmer and a bankruptcy by Countrywide would send new shock waves through the sector.

There were fewer breakouts this week as the contraction took the momentum out of the markets, but they still showed a profit by week's end whereas the major indexes tumbled more than 3%.

Finally, we wish all our subscribers a safe and happy holiday weekend.

No New Features this Week

Get a 14 day free

Trial of our premium 'Platinum' service and TradeWatch.

No Credit Card Required.

Click

Here for 14 Day Free Trial |

| Index | Value | Change Week | Change YTD | Market1 Signal |

||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | 12479.6 | -3.91% | -5.92% | enter | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 2444.67 | -3.33% | -7.83% | enter | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 1375.93 | -3.47% | -6.29% | enter | ||||||||||||||||||||||||||||||||||||

| Russell 2000 | 724.1 | -2.3% | -5.47% | N/A | ||||||||||||||||||||||||||||||||||||

1The Market Signal is derived from our proprietary

market model. The market model is described on the site. 2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone (similar to IBD). The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

# of Breakouts |

Period Average1 |

Max. Gain During Period2 |

Gain at Period Close3 |

|

|---|---|---|---|---|

| This Week | 12 | 22.31 | 6.11% | 1.34% |

| Last Week | 39 | 22.23 | 6.52% | -0.53% |

| 13 Weeks | 300 | 23.15 | 18.19% |

4.37% |

Sector |

Industry |

Breakout Count for Week |

|---|---|---|

ENERGY |

Oil & Gas Drilling & Exploration |

3 |

COMPUTER HARDWARE |

Networking & Communication Devices |

1 |

ELECTRONICS |

Scientific & Technical Instruments |

1 |

FOOD & BEVERAGE |

Meat Products |

1 |

FOOD & BEVERAGE |

Beverages - Brewers |

1 |

HEALTH SERVICES |

Home Health Care |

1 |

MANUFACTURING |

Diversified Machinery |

1 |

METALS & MINING |

Industrial Metals & Minerals |

1 |

TRANSPORTATION |

Railroads |

1 |

UTILITIES |

Diversified Utilities |

1 |

2This represents the return if each stock were bought at its breakout price and sold at its intraday high.

3This represents the return if each stock were bought at its breakout price and sold at the most recent close.

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | NLS | Nautilus Group Inc (the) | 114 |

| Top Technical | UTEK | Ultratech Inc | 58 |

| Top Fundamental | RICK | Rick's Caberet Intl | 77 |

| Top Tech. & Fund. | EGLE | Eagle Bulk Shipping Inc | 55 |

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | PSEM | Pericom Semiconductor Cp | 68 |

| Top Technical | PSEM | Pericom Semiconductor Cp | 68 |

| Top Fundamental | KEG | KEY ENERGY SVCS INC | 57 |

| Top Tech. & Fund. | PSEM | Pericom Semiconductor Cp | 68 |

If you received this newletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2008 NBIcharts, LLC dba BreakoutWatch.com. All rights reserved.

" BreakoutWatch," the BreakoutWatch.com "eye" logo, and the slogan "tomorrow's breakouts today" are service marks of NBIcharts LLC. All other marks are the property of their respective owners, and are used for descriptive purposes only.