| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

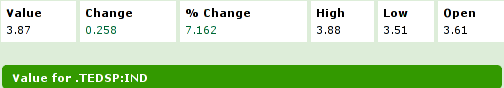

It would be the height of conceit if we thought we had anything to add to the debate raging on the economy. There are already ample views expressed and some of the best are on the RGE monitor and Big Picture. We merely note that the market registered its opinion on the bailout plan by plunging on Friday on a classic "buy the rumor sell the news" play. Moreover, the TED spread actually increased on Friday indicating that the perceived risk of default on inter-bank loans is increasing. This could be an early sign that the Paulson plan will not achieve the results that were advertised!

Source: Bloomberg

Indications are that the markets will continue to dive until the TED spread returns to normal values. There are rumors that there will be a coordinated rate cut by the Fed and European Banks announced over the weekend. Whether or notthis will have the desired effect we don't know.

Eventually there will be a bottom, however. It may come next week for all we know if the TED spread does indeed narrow, so it's essential to maintain your watchlists of stocks that you would buy on breakout . Our tip this week shows you how you can build and maintain those watchlists. Think of us as an investment Cialis so you can be ready when the time is right!

No new

features this week.

This tip is no longer available.

| Index | Value | Change Week | Change YTD | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | 10325.4 | -7.34% | -22.16% | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 1947.39 | -10.81% | -26.58% | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 1099.23 | -9.4% | -25.14% | ||||||||||||||||||||||||||||||||||||

| Russell 2000 | 619.4 | -12.12% | -19.14% | ||||||||||||||||||||||||||||||||||||

1The

Market Signal is derived from our proprietary

market model. The market model is described on the site.

2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

|||||||||||||||||||||||||||||||||||||||

|

# of Breakouts

|

Period Average1

|

Max. Gain During Period2

|

Gain at Period Close3

|

|

|---|---|---|---|---|

| This Week | 6 | 24.31 | 4.26% | -4.93% |

| Last Week | 3 | 24.85 | 4.72% | 0.38% |

| 13 Weeks | 344 | 25.31 | 12.69% |

-11.13% |

2This represents the return if each stock were bought at its breakout price and sold at its intraday high.

3This represents the return if each stock were bought at its breakout price and sold at the most recent close.

|

Category

|

Symbol

|

Company Name

|

Expected Gain1

|

|---|---|---|---|

| Best Overall | FXEN | Fx Energy Inc | 95 |

| Top Technical | NDN | 99 Cents Only Stores | 70 |

| Top Fundamental | EZPW | Ezcorp Inc Cl A | 56 |

| Top Tech. & Fund. | EZPW | Ezcorp Inc Cl A | 56 |

|

Category

|

Symbol

|

Company Name

|

Expected Gain1

|

|---|---|---|---|

| Best Overall | SH | ProShares Short S&P500 ETF | 43 |

| Top Technical | SH | ProShares Short S&P500 ETF | 43 |

| Top Fundamental | SH | ProShares Short S&P500 ETF | 43 |

| Top Tech. & Fund. | SH | ProShares Short S&P500 ETF | 43 |

If you received this newletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2008 NBIcharts, LLC dba BreakoutWatch.com.

All rights reserved.

"

BreakoutWatch," the BreakoutWatch.com "eye" logo, and the

slogan "tomorrow's breakouts today" are service marks of NBIcharts

LLC. All other marks are the property of their respective owners, and

are

used for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business

Daily or with Mr. William O'Neil.

Our site, research and analysis is supported entirely by subscription

and is free from advertising.