| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

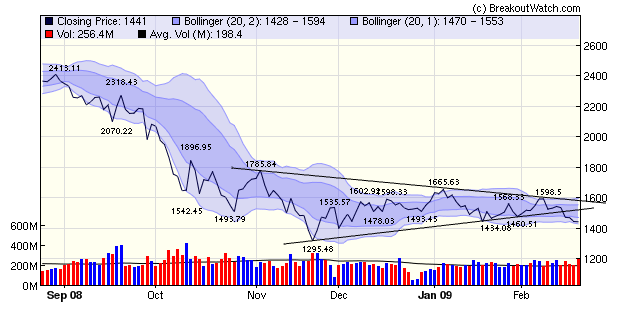

Over the past few weeks we have drawn attention to the bearish descending triangle pattern for the NASDAQ Composite. We have done so for two reasons: traditionally, the NASDAQ has been the best place to look for CAN SLIM style stocks and the NASDAQ has also been the best performing index of the year so far. Last week's newsletter was entitled 'Bearish outcome for the NASDAQ more likely' and this week we saw the index lose another 6% and breakdown below the lower triangle bound.

The DJI has already fallen below its low of last November and we expect the other indexes, including the NASDAQ to test their November lows also. However, technical analysis is of marginal value when there could be another Government intervention at any time.

Overall, this was a devastating week for the markets, culminating in much higher volume on Friday which provoked some speculation that Friday was the 'capitulation' day. We think not, and that the markets still have some way to go before we bottom.

| Index | Value | Change Week | Change YTD | Trend | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | 7365.67 | -6.17% | -16.07% | Down | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 1441.23 | -6.07% | -8.61% | Down | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 770.05 | -6.87% | -14.75% | Down | ||||||||||||||||||||||||||||||||||||

| Russell 2000 | 410.96 | -8.34% | -17.72% | Down | ||||||||||||||||||||||||||||||||||||

| Wilshire 5000 | 7802.27 | -6.96% | -14.14% | Down | ||||||||||||||||||||||||||||||||||||

1The Market Signal is derived from our proprietary

market model. The market model is described on the site. 2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

# of Breakouts |

Period Average1 |

Max. Gain During Period2 |

Gain at Period Close3 |

|

|---|---|---|---|---|

| This Week | 12 | 9.54 | 3.48% | 1.35% |

| Last Week | 6 | 9.08 | 7.35% | 4.35% |

| 13 Weeks | 109 | 9.69 | 14.61% |

-4.46% |

2This represents the return if each stock were bought at its breakout price and sold at its intraday high.

3This represents the return if each stock were bought at its breakout price and sold at the most recent close.

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | SWIM | thinkorswim Group Inc. | 105 |

| Top Technical | IWOV | Interwoven Inc | 50 |

| Top Fundamental | GMCR | Green Mountain Coffee Roasters | 62 |

| Top Tech. & Fund. | GMCR | Green Mountain Coffee Roasters | 62 |

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | BJRI | BJ's Restaurants Inc | 81 |

| Top Technical | HMSY | Hms Holdings Corp | 48 |

| Top Fundamental | ICUI | Icu Medical Inc | 52 |

| Top Tech. & Fund. | HMSY | Hms Holdings Corp | 48 |

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2009 NBIcharts, LLC dba BreakoutWatch.com.

All rights reserved.

"

BreakoutWatch," the BreakoutWatch.com "eye" logo, and the

slogan "tomorrow's breakouts today" are service marks of NBIcharts

LLC. All other marks are the property of their respective owners, and are

used for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or with Mr. William O'Neil.

Our site, research and analysis is supported entirely by subscription and is free from advertising.