| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

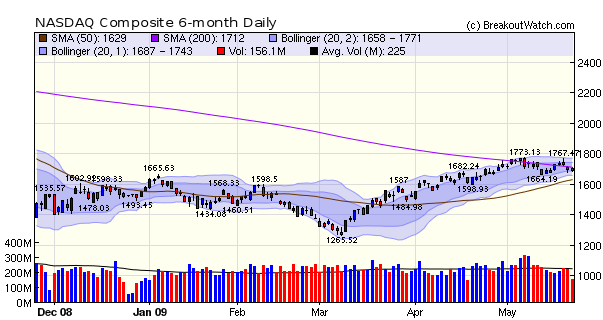

The major indexes closed higher again this week but momentum is falling as the impetus from a better than expected earnings season fades and the still struggling economy regains the focus of traders and investors. The NASDAQ Composite, which along with the Russell 2000, has been one of the main beneficiaries of the rally, has met resistance at the 5-day moving average level as the chart shows. In fact, the index has now slipped below the 50 dma twice which would be sufficient to put it on our Short Sale watchlist were it an individual stock. Although the sense of free-fall experienced last Fall has abated, it is clear that we are not yet in recovery and the market appears to be sensing that the anticipated third quarter gain in GDP may not materialize. Also weighing on the market is the falling dollar value against the Yen and Euro and talk of the US losing its AAA credit rating.

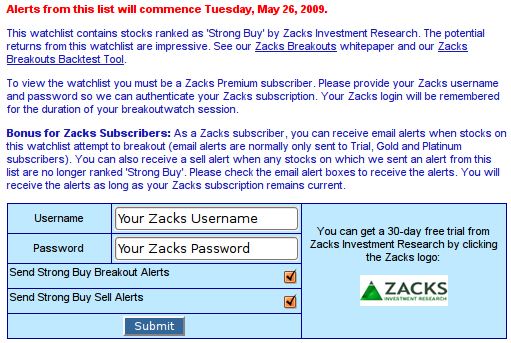

Beginning Tuesday, May 26, we will start sending email alerts from the Zacks Strong Buy watchlist. These email alerts will go to breakoutwatch.com Trial, Silver, Gold and Platinum subscribers who have joined the Zacks Premium Service and have indicated they wish to receive the email alerts.

We will send two kinds of email alert:

- an intraday breakout alert when the stock meets the breakout price and projected volume requirements. These alerts will be clearly marked as coming from the Zacks Strong Buy Watchlist in the subject line.

- a sell alert when a stock on which we previously issued an alert has lost its Strong Buy ranking. We update the rankings overnight by 5:30 am Eastern time and you will receive the sell alert at approximately that time. This will allow you to sell the stock at the open if you choose to do so.

To receive the emails, you should check the boxes (see image below) when you enter your Zacks username and password when first accessing the Zacks Strong Buy watchlist. Your choice will be remembered and displayed each time you access the watchlist for the first time in future.

Email alerts from this watchlist will only be sent while your Zacks subscription is current.

Future enhancements planned for this watchlist service are:

- a real time alert monitor similar to that implemented for our other watchlists

- a list of current sell alerts

- an end-of-day report for Zacks Strong Buy Breakouts

- a performance report

Because the Zacks 'Strong Buy' rank is proprietary to Zacks you must have a Zacks Premium account to access this watchlist. You can get a 30-day free trial from Zacks Investment Research by clicking the Zacks logo:

Zacks Breakouts White Paper

We completed our white paper on the new strategy this week and it includes detailed backtesting results and analysis including the optimum portfolio management parameters.

Apart from the exceptional profits that the strategy displayed in backtesting, one the most interesting results was how quickly these stocks appreciate between the issuance of an alert and the next session's open. The backtest showed that by waiting for breakout confirmation and buying at the open you paid a premium of over 6%.

The volatile market we have seen since October 2007 has not been kind to followers of a growth stock investment strategy. Even the rally we have seen since March 9 has not been easy to participate in due to the volatility which has produced several strong breakouts but also a high failure rate due to market gyrations.

The markets are presently more suited to traders rather than investors which is why we are very attracted to the Zacks Strong Buy strategy at this time.

In developing the Zacks Strong Buy strategy, we had access to another Zacks tool called the Research Wizard (RW). This tool allows you to build and test your own investment strategy. The tool allows you to build quite complicated stock selection rules and then to backtest them over many years. There are other tools that do this also, of course, but the RW is surprisingly easy to use considering its sophistication when compared to competing products. The tool comes with many 'canned' scenarios and more are being added each week.

We developed our own CAN SLIM™ screen and will be delighted to share it with you if would like to try the RW for yourself. You can get a no obligation 14-day free trial of the RW by clicking the RW logo..

| Index | Value | Change Week | Change YTD | Trend | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | 8277.32 | 0.1% | -5.69% | Down | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 1692.01 | 0.71% | 7.29% | Up | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 887 | 0.47% | -1.8% | Down | ||||||||||||||||||||||||||||||||||||

| Russell 2000 | 477.62 | 0.37% | -4.37% | Up | ||||||||||||||||||||||||||||||||||||

| Wilshire 5000 | 9068.67 | 0.71% | -0.2% | Down | ||||||||||||||||||||||||||||||||||||

1The Market Signal is derived from our proprietary

market model. The market model is described on the site. 2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

# of Breakouts |

Period Average1 |

Max. Gain During Period2 |

Gain at Period Close3 |

|

|---|---|---|---|---|

| This Week | 23 | 13.92 | 9.13% | 0.52% |

| Last Week | 6 | 12.92 | 17.63% | 5.01% |

| 13 Weeks | 171 | 14.54 | 21.57% |

6.01% |

2This represents the return if each stock were bought at its breakout price and sold at its intraday high.

3This represents the return if each stock were bought at its breakout price and sold at the most recent close.

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | MCCC | Mediacom Communication A | 129 |

| Top Technical | EC | Engelhard Corp | 55 |

| Top Fundamental | CFSG | CHINA FIRE & SEC GRP | 81 |

| Top Tech. & Fund. | CFSG | CHINA FIRE & SEC GRP | 81 |

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | SMSI | Smith Micro Software Inc | 88 |

| Top Technical | SMSI | Smith Micro Software Inc | 88 |

| Top Fundamental | LEAP | Leap Wireless International Inc | 51 |

| Top Tech. & Fund. | SMSI | Smith Micro Software Inc | 88 |

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2009 NBIcharts, LLC dba BreakoutWatch.com.

All rights reserved.

"

BreakoutWatch," the BreakoutWatch.com "eye" logo, and the

slogan "tomorrow's breakouts today" are service marks of NBIcharts

LLC. All other marks are the property of their respective owners, and are

used for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or with Mr. William O'Neil.

Our site, research and analysis is supported entirely by subscription and is free from advertising.