| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

Our market trend signals for the S&P 500 and Wilshire 5000 turned positive this week. These signals are conservative and while these indexes can still move down in the short term, we expect that the long term trend is now firmly in place.

The change in trend for these indexes is now consistent with the underlying mood of investors which is that the worst is behind us and that the seeds of a recovery are in place. This is evidenced by increasing volume as a result of money coming in from the sidelines and pushing prices higher. The five major indexes we track all set new highs for the year this week. The positive mood was reinforced on Friday when a surprise downturn in the unemployment rate stoked a strong rally.

While our large cap trend indicators are conservative, our NASDAQ trend signal picked the rally quite early. The NASDAQ signal turned positive on March 25 and has risen 34% since then.

Breakouts showed particular strength this week as the table below shows. Almost half of the breakouts for the week gained more than 5% with several showing truly outstanding gains.

| Brkout Date | Symbol | Pattern | BoP | RS Rank | Gain to Friday Close | Intraday High |

|---|---|---|---|---|---|---|

| 8/4/2009 | HMIN | CwH | 17.81 | 88 | 41.72% | 45.09% |

| 8/5/2009 | GNW | CwH | 7.25 | 95 | 20.14% | 21.38% |

| 8/6/2009 | AGO | CwH | 15.39 | 85 | 14.10% | 21.83% |

| 8/5/2009 | DTG | HTF | 17.96 | 99 | 13.92% | 16.93% |

| 8/4/2009 | WMS | CwH | 37.69 | 82 | 12.50% | 13.05% |

| 8/7/2009 | BKD | CwH | 13.63 | 89 | 8.51% | 10.56% |

| 8/4/2009 | SVVS | CwH | 14.91 | 88 | 7.91% | 10.80% |

How to Use our Site if You Cannot Monitor the Market in Real Time

Living in Hawaii, we would have to get up at 3:30 to monitor the markets in real time and take advantage of our alerts. We hate to do that so we developed our Tradewatch service to tell us which stocks to buy at next day's open (the 'Buy at Open' list, or set a buy order that would be executed during the day (the 'Buy on Breakout' list.

To see how these two watchlists have performed, you can use our Tradewatch simulation tool

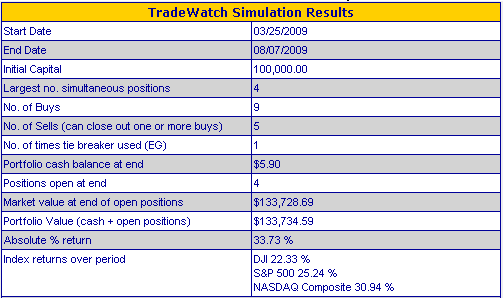

Using the default parameters for the simulation since March 25, 2009 you can see that using the Buy on Breakout list together with our Sell Assistant would have returned 33.7%.

| Index | Value | Change Week | Change YTD | Trend | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | 9370.07 | 2.16% | 6.76% | Down | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 2000.25 | 1.1% | 26.84% | Up | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 1010.48 | 2.33% | 11.87% | Up | ||||||||||||||||||||||||||||||||||||

| Russell 2000 | 572.4 | 2.82% | 14.61% | Up | ||||||||||||||||||||||||||||||||||||

| Wilshire 5000 | 10416.2 | 2.65% | 14.63% | Up | ||||||||||||||||||||||||||||||||||||

1The Market Signal is derived from our proprietary

market model. The market model is described on the site. 2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

# of Breakouts |

Period Average1 |

Max. Gain During Period2 |

Gain at Period Close3 |

|

|---|---|---|---|---|

| This Week | 19 | 14.77 | 12.48% | 7.06% |

| Last Week | 16 | 15.77 | 13.16% | 6.51% |

| 13 Weeks | 188 | 16.92 | 23.99% |

13.93% |

2This represents the return if each stock were bought at its breakout price and sold at its intraday high.

3This represents the return if each stock were bought at its breakout price and sold at the most recent close.

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | REXX | REX ENERGY CORPORATI | 121 |

| Top Technical | CKEC | Carmike Cinemas | 93 |

| Top Fundamental | NFLX | Netflix Inc | 49 |

| Top Tech. & Fund. | NFLX | Netflix Inc | 49 |

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | GLDD | GREAT LAKES DRG DOCK | 121 |

| Top Technical | DXCM | DexCom Inc | 110 |

| Top Fundamental | SLT | STERLITE INDUSTRIES (INDIA) LI | 79 |

| Top Tech. & Fund. | DXCM | DexCom Inc | 110 |

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2009 NBIcharts, LLC dba BreakoutWatch.com.

All rights reserved.

"

BreakoutWatch," the BreakoutWatch.com "eye" logo, and the

slogan "tomorrow's breakouts today" are service marks of NBIcharts

LLC. All other marks are the property of their respective owners, and are

used for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or with Mr. William O'Neil.

Our site, research and analysis is supported entirely by subscription and is free from advertising.