| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

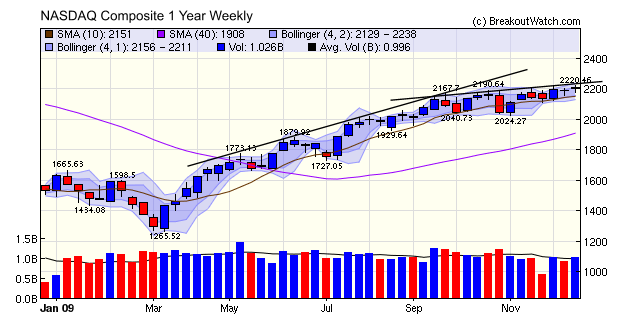

The trend for growth stocks continues to be upwards, but at a slower pace as shown by the trend lines on the chart below. The NASDAQ Composite and Russell 2000 made modest gains for the week while the large cap stocks represented by the DJI and S&P 500 closed the week with a loss. The NASDAQ weekly chart shows volume improved this week but that improvement can be explained by unusually heavy volume on Friday when a 'quadruple witching' day coincided with changes to the composition of the S&P 500 causing ETF 's and mutual funds that track the index to sell stocks leaving the index and buy those entering it.

Breakouts for the week more than

doubled to fifteen. The best performer was SNIC, another High Tight

Flag breakout.

We wish all our subscribers the merriest of Christmases, or whatever holiday you celebrate.

We enhanced our Zacks Strong Buy watchlist by adding a link to the Zacks report on each watchlist stock.

You must be a Zacks subscriber to view the watchlist and get the link to the report. You can get a 30 day free trial to the Zacks Premium service, and then access our ZSB watchlist by clicking the Zacks logo below. Subscribers to Zacks also get an alert when a Zacks breakout occurs, or a Zacks breakout has lost its strong buy rank.

Read our white paper describing the ZSB strategy in detail.

Learn more about the Zacks

rank and get a 30-day free trial by clicking their logo:

The kids are on school vacation which limits the time available for writing this section. It will return in the New Year

| Index | Value | Change Week | Change YTD | Trend | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | 10328.9 | -1.36% | 17.69% | Up | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 2211.69 | 0.98% | 40.24% | Up | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 1102.47 | -0.36% | 22.06% | Up | ||||||||||||||||||||||||||||||||||||

| Russell 2000 | 610.57 | 1.7% | 22.25% | Up | ||||||||||||||||||||||||||||||||||||

| Wilshire 5000 | 11355.1 | 0.09% | 24.96% | Up | ||||||||||||||||||||||||||||||||||||

1The Market Signal is derived

from our proprietary market model. The market model is described on the

site.

2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

|

# of Breakouts

|

Period Average1

|

Max. Gain During Period2

|

Gain at Period Close3

|

|

|---|---|---|---|---|

| This Week | 15 | 8.23 | 7.05% | 5.01% |

| Last Week | 7 | 9.92 | 12.92% | 7.73% |

| 13 Weeks | 125 | 10.85 | 15.61% |

2.66% |

2This represents the return if each stock were bought at its breakout price and sold at its intraday high.

3This represents the return if each stock were bought at its breakout price and sold at the most recent close.

|

Category

|

Symbol

|

Company Name

|

Expected Gain1

|

|---|---|---|---|

| Best Overall | SCSS | Select Comfort Corp | 104 |

| Top Technical | GMK | Gruma Sa De Cv Ads | 94 |

| Top Fundamental | PEGA | Pegasystems Inc | 46 |

| Top Tech. & Fund. | PEGA | Pegasystems Inc | 46 |

|

Category

|

Symbol

|

Company Name

|

Expected Gain1

|

|---|---|---|---|

| Best Overall | NOX | Neuberger Berm Inc Opportunity | 94 |

| Top Technical | CRNT | Ceragon Networks Ltd | 66 |

| Top Fundamental | CRNT | Ceragon Networks Ltd | 66 |

| Top Tech. & Fund. | CRNT | Ceragon Networks Ltd | 66 |

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2009 NBIcharts, LLC dba BreakoutWatch.com. All

rights reserved.

" BreakoutWatch," the BreakoutWatch.com "eye" logo, and the slogan

"tomorrow's breakouts today" are service marks of NBIcharts LLC. All

other marks are the property of their respective owners, and are used

for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily

or with Mr. William O'Neil.

Our site, research and analysis is supported entirely by subscription

and is free from advertising.