Factors Affecting Performance After Breakout

If you missed the articles we have run in the last few weeks, here

are links to each of them.

Part 1: The Influence of Breakout Day Volume

Part 2: The Influence of RS Rank

Part 3: Further Analysis of RS Rank

Part 4: The Influence of Fundamentals, Rank in Industry and Industry Rank

Part

5: The Influence of Specific Fundamental Factors and Conclusion

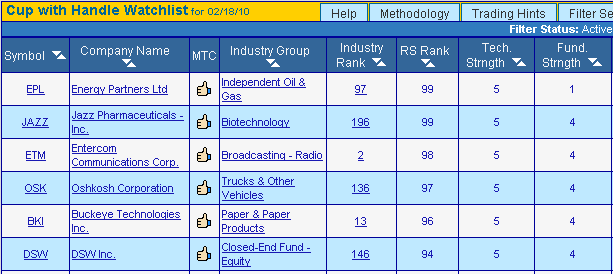

We want to emphasize that the criteria we have selected do not

guarantee that the performance of stocks after breakout will generate a

gain of at least 25%. As you can see from the scatter plots in our

articles, there is wide dispersion in the gains seen at every level of,

for example, RS Rank. While stocks meeting our criteria have a better

likelihood of delivering a 25% gain, they can also fail dramatically. Note that our analysis is based on using a stop loss of 8% and the results are only valid under that assumption.

I was asked in our support forum if, out of, say, four stocks with an

RS Rank of at least 92, one should always choose the higher RS ranked

stock. Here's my answer....

Remember the parable of the Thanksgiving Turkey - it gets fatter and fatter and life looks great until the day before thanksgiving*. I imagine Bear Sterns and Lehman had very high RS Ranks before their turkey-like demise.

So some due diligence is also necessary and use stop loss to help protect against Black Swan*

disasters.

Several subscribers have requested a backtest tool for all stocks in the CwH pattern similar to the Zacks Backtest tool. I'm working on it and hope to have it ready by next week.

* The Black Swan by N. N. Taleb cites the example of the turkey as showing that the future may be very different from the past.