| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

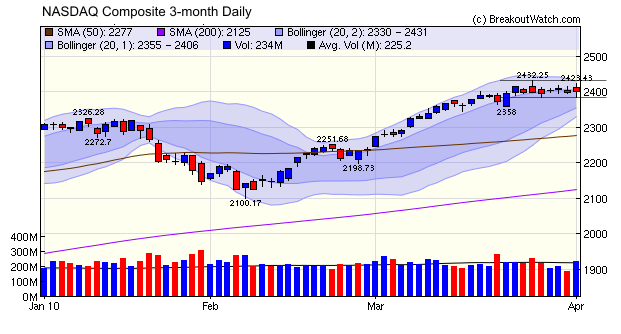

The NASDAQ Composite has continued to consolidate in a flat base pattern. This is also reflected in the tightening Bollinger Bands which is a result of less volatility (lower variance) in the index. Breakouts from a flat base can be to the upside or downside and considerable evidence of an improving economy (increased industrial production, positive job growth) indicate that the most likely outcome is a further move to the upside. There are different points of view though, and one warning is contained in this link Dow 12 Month Rate-of-Change Sends Warning Signal.

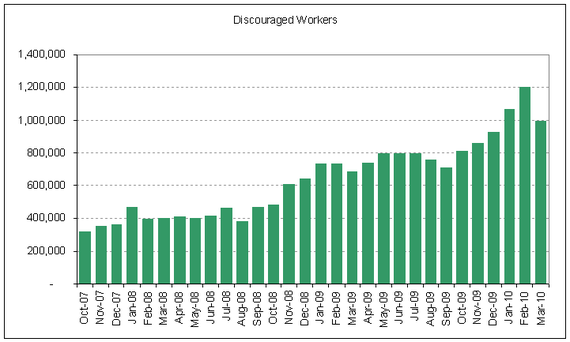

Of many promising aspects to Friday's labor report, it was very encouraging to see a huge 17% reduction in the number of discouraged workers as mounting consumer confidence is essential to a strong recovery.

source: Daniel Indiviglio

The flat base pattern produces fewer breakouts and we saw the number drop to six this week from twenty-five last week. Should the breakout be to the upside, then we can expect the number of breakouts to jump up again.

Special 'Easter Eggs' for Newsletter Readers

Normally reserved for our site subscribers only, these 'eggs' could make you some money. The following stocks are rated 'MTC' on our cup-with-handle watchlist (for an explanation of MYC and more MTC stocks, see below):

Symbol |

Brkout Price |

Brkout Volume |

Company Name |

|---|---|---|---|

| WAC | 16.81 | 241931 | Walter Investment

Management Corp. |

| CVGI | 7.89 | 220280 | Commercial Vehicle Group

Inc. |

| CAR | 12.26 | 5025336 | Avis Budget Group - Inc. |

| HGSI | 33.13 | 4773135 | Human Genome Sciences Inc. |

| CITP | 17.63 | 997995 | COMSYS IT Partners - Inc. |

| GCI | 17 | 7768946 | Gannett Co. - Inc. |

| CAAS | 25.1 | 1720502 | China Automotive Systems

Inc. |

| SAH | 12.62 | 999050 | Sonic Automotive Inc. |

| AXL | 11.36 | 4543422 | American Axle &

Manufacturing Holdings Inc. |

| OSK | 41.78 | 2278452 | Oshkosh Corporation |

| UIS | 40.41 | 852503 | Unisys Corporation |

| CNO | 6.63 | 6984113 | Conseco Inc. |

| CYD | 18.67 | 596142 | China Yuchai International

Limited |

| MTW | 13.74 | 4099805 | Manitowoc Co. Inc. |

| SGY | 18.79 | 1473968 | Stone Energy Corp. |

| MOD | 11.97 | 380862 | Modine Manufacturing

Company |

| MEOH | 26.79 | 538898 | Methanex Corp. |

| CBI | 25 | 1512420 | Chicago Bridge &

Iron Company N.V. |

| TTI | 13.5 | 951971 | TETRA Technologies Inc. |

| CTB | 21.08 | 1571436 | Cooper Tire &

Rubber Co. |

No new features this week but we are working on a site redesign that will correct some broken menu links for users of Internet Explorer. The changes will (hopefully) be transparent and should go into effect early next week.

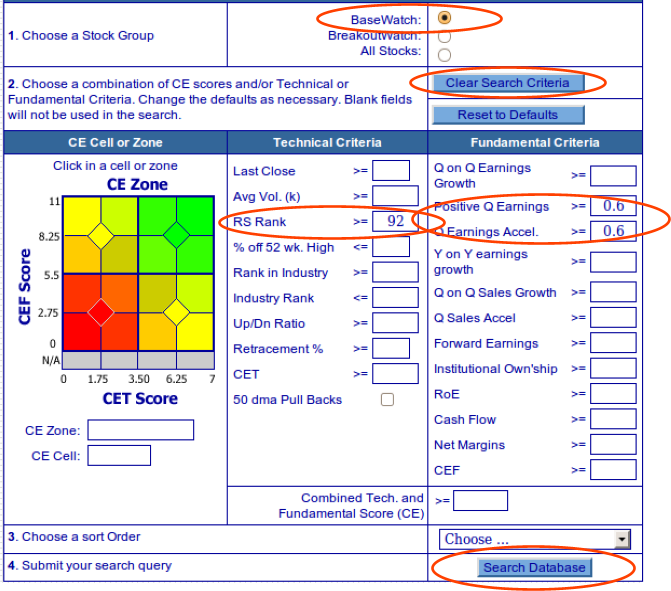

Early Detection of our Target Criteria Stocks

Earlier this year we undertook an analysis to determine the factors that were most likely to cause a stock to rise by at least 25% after breakout (you can read it here). We now indicate the stocks that meet these criteria with a thumbs-up icon  on our watchlists.

on our watchlists.

Platinum subscribers can get an early wake-up as to which stocks meet these criteria and are in the process of building their base, but which do not yet meet all the criteria for listing on a our watchlists. They do so by going to Mine for Candidates >Database Search and making selections as follows:

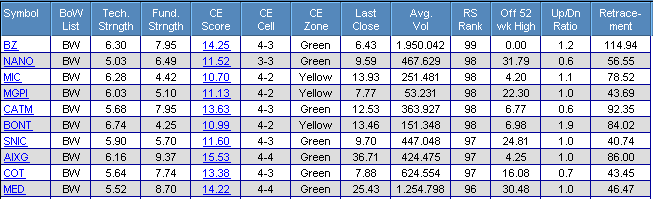

As of Thursday evening, this search produced these stocks to look out for (top ten only):

| Index | Value | Change Week | Change YTD | Trend | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | 10927.1 | 0.71% | 4.79% | Up | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 2402.58 | 0.31% | 5.88% | Up | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 1178.1 | 0.99% | 5.65% | Up | ||||||||||||||||||||||||||||||||||||

| Russell 2000 | 683.98 | 0.74% | 7.87% | Up | ||||||||||||||||||||||||||||||||||||

| Wilshire 5000 | 12250.7 | 0.97% | 6.55% | Up | ||||||||||||||||||||||||||||||||||||

1The Market Signal is derived from our proprietary

market model. The market model is described on the site. 2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

# of Breakouts |

Period Average1 |

Max. Gain During Period2 |

Gain at Period Close3 |

|

|---|---|---|---|---|

| This Week | 6 | 17.85 | 5.91% | 4.24% |

| Last Week | 25 | 17.69 | 7.34% | 1.41% |

| 13 Weeks | 251 | 18.15 | 14.37% |

7.7% |

2This represents the return if each stock were bought at its breakout price and sold at its intraday high.

3This represents the return if each stock were bought at its breakout price and sold at the most recent close.

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | AEA | Advance America, Cash Advance Centers Inc. | 112 |

| Top Technical | CITP | COMSYS IT Partners, Inc. | 35 |

| Top Fundamental | FIRE | Sourcefire, Inc. | 63 |

| Top Tech. & Fund. | CAAS | China Automotive Systems Inc. | 77 |

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | LOCM | Local.com Corp. | 110 |

| Top Technical | PL | Protective Life Corp. | 54 |

| Top Fundamental | AIXG | Aixtron Aktiengesellschaft | 58 |

| Top Tech. & Fund. | PL | Protective Life Corp. | 54 |

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2010 NBIcharts, LLC dba BreakoutWatch.com.

All rights reserved.

"

BreakoutWatch," the BreakoutWatch.com "eye" logo, and the

slogan "tomorrow's breakouts today" are service marks of NBIcharts

LLC. All other marks are the property of their respective owners, and are

used for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or with Mr. William O'Neil.

Our site, research and analysis is supported entirely by subscription and is free from advertising.