| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

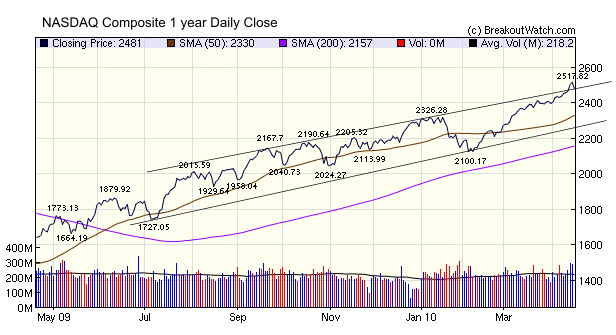

The markets showed excessive exuberance this week as earnings season got underway, so a sharp reaction following the announcement of the SEC's civil suit for fraud against Goldman Sachs, disappointing earnings from Google and lower than expected consumer confidence, is not surprising. We showed last week that the NASDAQ Composite was hitting a resistance level and a correction was due. The index comfortably broke through resistance with three successive accumulation days at the beginning of the week but has now reverted to the point where former resistance may become support.

Volume levels for the large cap stocks rose almost to panic levels on Friday but the NASDAQ, although dipping 1.4%, avoided a distribution day. The overall outlook for technology stocks looks healthy so while we may see some continued selling on Monday, we may see the NASDAQ weather the storm in better shape than the broader markets.

The question for the financial sector is will the prosecutions stop with this one instance or are there other shoes to drop? Its unlikely that GS was the only firm indulging in the behavior cited by the SEC, so other law suits could follow. The SEC is presumably eager to show its teeth after the Madoff scandal, and it would certainly be in the political interests of the administration to pursue more action given public anger at Wall Street and the Republican's opposition to financial reform. If more prosecutions emerge then financial stocks will fall further. We saw in the case of Lehman Brothers and Bear Stearns how quickly things can go bad once confidence is lost so we could be in for another rough ride.

On the other hand, it is not in the Administration's interest to provoke another collapse of the markets as the recovery teeters along.

Bottom line? Its anyone's guess where we go from here.

As an aside, as I usually try to avoid politics, I'm reminded that when LTCM was on the verge of collapse, Greenspan rounded up 20 or so of the major financial institutions and persuaded them to put up capital so LTCM could be wound down in an orderly way and a financial panic was avoided. It seems to me that that is the nature of what is proposed in the current financial legislation which asks for the major institutions to buy into a fund that will be used for the orderly wind-up of an institution that poses a systemic risk. Attempts to label this proposal as perpetuating too big to fail reeks of political grandstanding without regard for the health of the country. If it was OK for Greenspan then, and demonstrably worked, why isn't it good for this Administration also?

Welcome to New Subscribers

The move up earlier this week brought us several new subscribers, so we would like to welcome you to our site. For your benefit, we are repeating some advice given earlier this year in our 'Top Tip' of the week.

Revised CwH Trading Hints

An alert subscriber pointed out an inconsistency in our recommendations so I have revised our Trading Hints page for the cup-with-handle watchlist.

The revised page is here: CwH Trading Hints

While these revised trading hints are generally applicable, we also have some more specific recommendations which will further increase your chances of success:

1. Before the market opens, identify stocks on our CwH watchlist with an RS Rank of 92 or better (you can set a filter to select these for you)

2. Check the CANTATA Evaluator for these stocks and select those with CEF2 >= 0.6 and CEF3 >= 0.6.

3. Buy any of these stocks if we issue a breakout alert on them as close to the alert price as possible.

4. Set a hard sell stop 8% below the alert price immediately after purchase.

| Index | Value | Change Week | Change YTD | Trend | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | 11018.7 | 0.19% | 5.66% | Up | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 2481.26 | 1.11% | 9.35% | Up | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 1192.13 | -0.19% | 6.91% | Up | ||||||||||||||||||||||||||||||||||||

| Russell 2000 | 714.62 | 1.66% | 12.7% | Up | ||||||||||||||||||||||||||||||||||||

| Wilshire 5000 | 12451.4 | 0.03% | 8.3% | Up | ||||||||||||||||||||||||||||||||||||

1The Market Signal is derived from our proprietary

market model. The market model is described on the site. 2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

# of Breakouts |

Period Average1 |

Max. Gain During Period2 |

Gain at Period Close3 |

|

|---|---|---|---|---|

| This Week | 18 | 16.08 | 7.76% | 3.48% |

| Last Week | 23 | 16.54 | 8.5% | 3.58% |

| 13 Weeks | 231 | 18.08 | 16.56% |

9.59% |

2This represents the return if each stock were bought at its breakout price and sold at its intraday high.

3This represents the return if each stock were bought at its breakout price and sold at the most recent close.

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | THM | International Tower Hill Mines Ltd. | 109 |

| Top Technical | WAC | Walter Investment Management Corp. | 52 |

| Top Fundamental | CAAS | China Automotive Systems Inc. | 78 |

| Top Tech. & Fund. | CAAS | China Automotive Systems Inc. | 78 |

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | GTE | Gran Tierra Energy, Inc. | 114 |

| Top Technical | PL | Protective Life Corp. | 51 |

| Top Fundamental | MELI | Mercadolibre, Inc. | 55 |

| Top Tech. & Fund. | PL | Protective Life Corp. | 51 |

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2010 NBIcharts, LLC dba BreakoutWatch.com.

All rights reserved.

"

BreakoutWatch," the BreakoutWatch.com "eye" logo, and the

slogan "tomorrow's breakouts today" are service marks of NBIcharts

LLC. All other marks are the property of their respective owners, and are

used for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or with Mr. William O'Neil.

Our site, research and analysis is supported entirely by subscription and is free from advertising.