| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

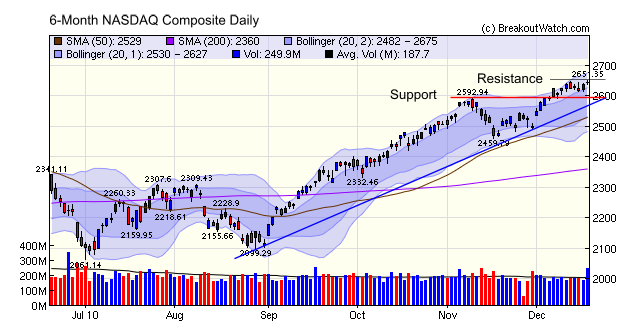

The NASDAQ Composite opened the week with a gap up to 2645 as it appeared after the weekend that the compromise to extend the tax cuts would pass. That was the high water mark for the week tested only briefly on Friday afternoon before the markets slipped back to close the week with only modest gains. The NASDAQ chart shows the trend is still upward but the failure of the index to breakthrough resistance at Monday's level is disturbing considering the massive stimulus being provided by the tax-cut compromise and the continuation of QE2, which was reconfirmed at the FOMC meeting on Tuesday.

The week's other economic news was also encouraging as US Retail Sales showed solid gains, the Philadelphia and NY Federal Reserve surveys showed continued expansion and initial unemployment claims continued to fall. So why did we not see a bigger gain for stocks?

Well, despite the intended goal of QE2 being to ease credit and keep long term interest rates low, the US consumer continues to deleverage their debt (the NY Times reported the use of credit cards over Thanksgiving weekend was the lowest in 27 years) and mortgage interest rates have climbed above 5% which threatens the housing market where we still have not hit bottom. So although the overall environment is bullish for stocks, and we expect the market will go higher in 2011, the markets will continue to climb a wall of worry over domestic economic prospects.

We wish all our subscribers and newsletter readers a safe and happy holiday season.

Thank you for your support in these difficult times.

Thank you for your support in these difficult times.

No new features this week

We are on vacation. This feature will return on January, 8, 2011

| Index | Value | Change Week | Change YTD | Trend | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | 11491.9 | 0.72% | 10.2% | Up | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 2642.97 | 0.21% | 16.47% | Up | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 1243.91 | 0.28% | 11.55% | Up | ||||||||||||||||||||||||||||||||||||

| Russell 2000 | 779.52 | 0.35% | 22.94% | Up | ||||||||||||||||||||||||||||||||||||

| Wilshire 5000 | 13143.5 | 0.29% | 14.32% | Up | ||||||||||||||||||||||||||||||||||||

1The Market Signal is derived from our proprietary

market model. The market model is described on the site. 2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

# of Breakouts |

Period Average1 |

Max. Gain During Period2 |

Gain at Period Close3 |

|

|---|---|---|---|---|

| This Week | 19 | 26.23 | 5.31% | 2.63% |

| Last Week | 18 | 27.46 | 5.41% | 1.98% |

| 13 Weeks | 382 | 28.46 | 17.76% |

9.85% |

2This represents the return if each stock were bought at its breakout price and sold at its intraday high.

3This represents the return if each stock were bought at its breakout price and sold at the most recent close.

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | FCH | FelCor Lodging Trust Incorporated | 93 |

| Top Technical | ZAGG | Zagg Inc | 90 |

| Top Fundamental | VMW | VMware, Inc. | 31 |

| Top Tech. & Fund. | VMW | VMware, Inc. | 31 |

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | REXI | Resource America, Inc. | 93 |

| Top Technical | REXI | Resource America, Inc. | 93 |

| Top Fundamental | CTSH | Cognizant Technology Solutions Corp. | 46 |

| Top Tech. & Fund. | INET | Internet Brands, Inc. | 52 |

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2010 NBIcharts, LLC dba BreakoutWatch.com.

All rights reserved.

"

BreakoutWatch," the BreakoutWatch.com "eye" logo, and the

slogan "tomorrow's breakouts today" are service marks of NBIcharts

LLC. All other marks are the property of their respective owners, and are

used for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or with Mr. William O'Neil.

Our site, research and analysis is supported entirely by subscription and is free from advertising.