| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

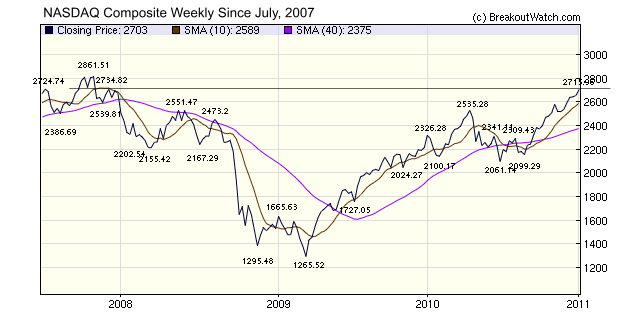

The new year is off to an impressive start with the NASDAQ Composite index leading the way with a gain of 1.9% since its December 31 close. At Friday's close of 2703 It is now just 32 points away from the final resistance level at 2735 before reaching its 2007 high of 2861.5.

Volumes for the week were higher than the 50 day average, which combined with rising prices, allowed us to report 24 confirmed breakouts - higher than the 13 week average.

Best performer of the week was BSQR which was one of three breakouts from a high tight flag pattern with a gain of 15.7%. CSII and BSFT were the other two which also made excellent gains of 5.8% and 7.3% respectively.

No new features this week.

Value of Industry Filter Confirmed

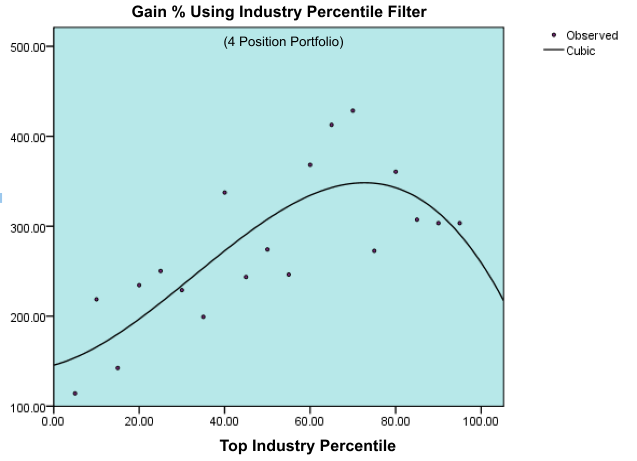

Just before the holidays, we introduced a new option in our cup-with-handle backtest which allowed you to limit the breakouts selected for the backtest to those in a particular top percentile of industry groups. We did some backtesting ourselves using just one portfolio position and found that the backtest gave the best returns if it was limited to stocks in industries that were in the top 60% of industry rankings. We described that finding in our December 10, 2010 Newsletter.

We have done some testing since then and have confirmed the result. This chart shows the returns for four portfolio positions when the backtest is run over the last five years for breakouts in the top 5%, 10% and so on industry ranking percentiles.

The chart shows that the best overall return is obtained by selecting stocks that are in the top 70% of industry rankings.

Based on these findings we are going to revise our MTC (Meets Target Criteria) designation to include stocks that are in industries that are in the top 70% of industry rankings. We will do this in the coming week and advise you of its status in next week's newsletter.

Based on these findings we are going to revise our MTC (Meets Target Criteria) designation to include stocks that are in industries that are in the top 70% of industry rankings. We will do this in the coming week and advise you of its status in next week's newsletter.

| Index | Value | Change Week | Change YTD | Trend | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | 11674.8 | 0.84% | 0.84% | Up | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 2703.17 | 1.9% | 1.9% | Up | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 1271.5 | 1.1% | 1.1% | Up | ||||||||||||||||||||||||||||||||||||

| Russell 2000 | 787.83 | 0.53% | 0.53% | Up | ||||||||||||||||||||||||||||||||||||

| Wilshire 5000 | 13428.9 | 1.05% | 1.05% | Up | ||||||||||||||||||||||||||||||||||||

1The Market Signal is derived from our proprietary

market model. The market model is described on the site. 2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

# of Breakouts |

Period Average1 |

Max. Gain During Period2 |

Gain at Period Close3 |

|

|---|---|---|---|---|

| This Week | 24 | 20 | 6.75% | 2.98% |

| Last Week | 7 | 21.85 | 7.77% | 3.57% |

| 13 Weeks | 304 | 23.23 | 16.1% |

8.2% |

2This represents the return if each stock were bought at its breakout price and sold at its intraday high.

3This represents the return if each stock were bought at its breakout price and sold at the most recent close.

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | GENT | Gentium S.p.A. (ADR) | 113 |

| Top Technical | AHD | Atlas Pipeline Holdings, L.P. | 51 |

| Top Fundamental | POL | PolyOne Corporation | 65 |

| Top Tech. & Fund. | FTNT | Fortinet, Inc. | 42 |

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | STAA | STAAR Surgical Company | 104 |

| Top Technical | OSUR | OraSure Technologies, Inc. | 91 |

| Top Fundamental | POL | PolyOne Corporation | 62 |

| Top Tech. & Fund. | POL | PolyOne Corporation | 62 |

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2011 NBIcharts, LLC dba BreakoutWatch.com.

All rights reserved.

"

BreakoutWatch," the BreakoutWatch.com "eye" logo, and the

slogan "tomorrow's breakouts today" are service marks of NBIcharts

LLC. All other marks are the property of their respective owners, and are

used for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or with Mr. William O'Neil.

Our site, research and analysis is supported entirely by subscription and is free from advertising.