| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

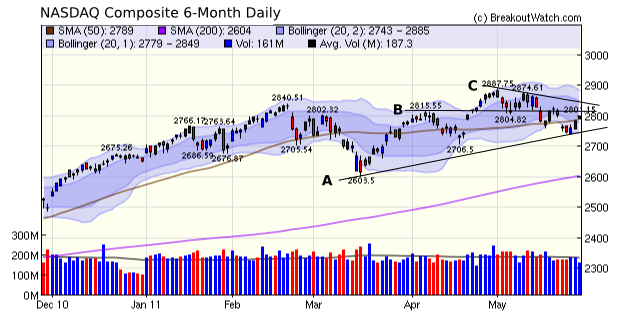

The NASDAQ Composite reversed its downward trend on Wednesday with an accumulation day and followed that with another accumulation day on Thursday. Volume was slightly lighter on Friday, but were it not for the approaching long weekend we may have seen more accumulation. However, the index remains constrained within an ascending triangle pattern. On the chart below, line A represents the ascending support line, while line B shows the next resistance level. If the index overcomes line B, then it will be in the descending triangle constained by line C. A breakout above line C would be bullish but a another breakdown below line A would be bearish.

Our trend indicator for the NASDAQ Composite reversed itself on Friday and now says that he index is in an uptrend. Our trend indicator for the more volatile Russell 2000 turned down on May 23 and has not yet reversed. The index closed above its 50 day moving average in Friday, so we can expect out trend indicator to reverse shortly if upward momentum is maintained.

We wish all our subscribers and readers a safe and happy memorial Weekend.

We have developed an app for facebook that gives a summary of the day's breakouts, breakdowns, and a small selection of the top breakout and breakdown prospects for the next session.

The app is still in prototype form and will be enhanced in the weeks to come.

You can access the app at https://apps.facebook.com/todaysbreakouts/

This feature wil return next week.

| Index | Value | Change Week | Change YTD | Trend | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | 12441.6 | -0.56% | 7.46% | Up | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 2796.86 | -0.23% | 5.43% | Up | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 1331.1 | -0.16% | 5.84% | Up | ||||||||||||||||||||||||||||||||||||

| Russell 2000 | 836.26 | 0.87% | 6.71% | Down | ||||||||||||||||||||||||||||||||||||

| Wilshire 5000 | 14089.7 | 0.02% | 6.02% | Up | ||||||||||||||||||||||||||||||||||||

1The Market Signal is derived from our proprietary

market model. The market model is described on the site. 2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

# of Breakouts |

Period Average1 |

Max. Gain During Period2 |

Gain at Period Close3 |

|

|---|---|---|---|---|

| This Week | 10 | 13.08 | 5.88% | 4.06% |

| Last Week | 9 | 12.77 | 8.15% | 5.77% |

| 13 Weeks | 204 | 13.62 | 12.82% |

1.72% |

2This represents the return if each stock were bought at its breakout price and sold at its intraday high.

3This represents the return if each stock were bought at its breakout price and sold at the most recent close.

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | CLFD | Clearfield, Inc. | 123 |

| Top Technical | BIOS | BioScrip Inc. | 82 |

| Top Fundamental | SWI | SolarWinds, Inc. | 52 |

| Top Tech. & Fund. | ZAGG | Zagg Inc | 85 |

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | GRT | Glimcher Realty Trust | 71 |

| Top Technical | MEAS | Measurement Specialties, Inc. | 46 |

| Top Fundamental | TNH | Terra Nitrogen Company, L.P. | 38 |

| Top Tech. & Fund. | TNH | Terra Nitrogen Company, L.P. | 38 |

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2011 NBIcharts, LLC dba BreakoutWatch.com.

All rights reserved.

"

BreakoutWatch," the BreakoutWatch.com "eye" logo, and the

slogan "tomorrow's breakouts today" are service marks of NBIcharts

LLC. All other marks are the property of their respective owners, and are

used for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or with Mr. William O'Neil.

Our site, research and analysis is supported entirely by subscription and is free from advertising.