| Market Summary | Weekly Breakout Report | Top Breakout Choices | Top 2nd Chances | New Features | Tip of the Week |

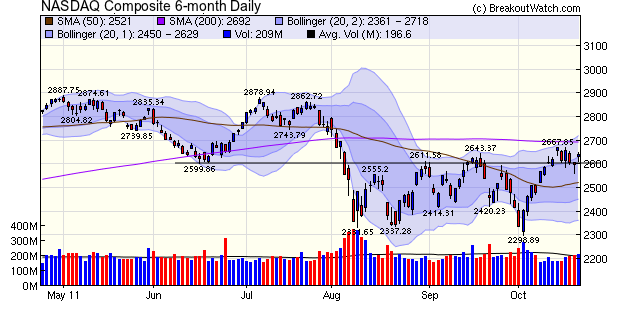

The NASDAQ Composite is struggling to hold above the 2600 level. While it broke out above that level at the end of last week and stayed above it for the earlier part of this week, it found resistance at that level on Thursday but then overcame it on Friday. Where we go from here is very much dependent on what happens in Europe where there are daily mood swings as leaders seem unable to get their act together. Meetings between France and Germany this weekend are a precursor to a summit next Wednesday which was postponed from this weekend. The markets have risen in the hopes of a resolution but this could well be a case of 'buy the rumor sell the news' as the difficulty of getting 17 sovereign countries to agree on a common financial solution is likely to produce a camel rather than a horse.

Volume rose each day this week providing three distribution days and two accumulation days. Those who are short the market are nervous and Friday was likely the result of a short squeeze a.k.a a bear market rally as the shorts hedged their positions before the weekend meetings.

The number of confirmed breakouts jumped to 17 this week but gains were mostly modest. I recommend caution until the outcome of the European summit is known.

No new features this week.

This feature will return in two weeks. We are still working on our trend reversal system for individual stocks and next week will be traveling so the newsletter will be briefer.

| Index | Value | Change Week | Change YTD | Trend | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dow | 11808.8 | 1.41% | 2% | Down | ||||||||||||||||||||||||||||||||||||

| NASDAQ | 2637.46 | -1.14% | -0.58% | Up | ||||||||||||||||||||||||||||||||||||

| S&P 500 | 1238.25 | 1.12% | -1.54% | Up | ||||||||||||||||||||||||||||||||||||

| Russell 2000 | 712.42 | -0.01% | -9.09% | Down | ||||||||||||||||||||||||||||||||||||

| Wilshire 5000 | 12908.9 | 0.98% | -2.87% | Down | ||||||||||||||||||||||||||||||||||||

1The Market Signal is derived from our proprietary

market model. The market model is described on the site. 2The site also shows industry rankings based on fundamentals, combined technical and fundamentals, and on price alone. The site also shows daily industry movements. |

||||||||||||||||||||||||||||||||||||||||

# of Breakouts |

Period Average1 |

Max. Gain During Period2 |

Gain at Period Close3 |

|

|---|---|---|---|---|

| This Week | 17 | 9.62 | 17.01% | 2.09% |

| Last Week | 4 | 11.15 | 1.93% | 0.66% |

| 13 Weeks | 233 | 11.92 | 7.38% |

-5.78% |

2This represents the return if each stock were bought at its breakout price and sold at its intraday high.

3This represents the return if each stock were bought at its breakout price and sold at the most recent close.

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | CRDB | Crawford and Company |

108 |

| Top Technical | CONN | Conns Inc. |

92 |

| Top Fundamental | CELL | Brightpoint Inc. |

67 |

| Top Tech. & Fund. | CELL | Brightpoint Inc. | 67 |

Category |

Symbol |

Company Name |

Expected Gain1 |

|---|---|---|---|

| Best Overall | WPP | Wausau Paper Corp. | 92 |

| Top Technical | CBST | Cubist Pharmaceuticals, Inc. | 48 |

| Top Fundamental | OPNT | Opnet Technologies inc. |

47 |

| Top Tech. & Fund. | OPNT | Opnet Technologies inc. | 47 |

If you received this newsletter from a friend and you would like to receive it regularly please go to the BreakoutWatch.com site and enter as a Guest. You will then be able to register to receive the newsletter.

Copyright © 2011 NBIcharts, LLC dba BreakoutWatch.com.

All rights reserved.

"

BreakoutWatch," the BreakoutWatch.com "eye" logo, and the

slogan "tomorrow's breakouts today" are service marks of NBIcharts

LLC. All other marks are the property of their respective owners, and are

used for descriptive purposes only.

BreakoutWatch is not affiliated with Investor's Business Daily or with Mr. William O'Neil.

Our site, research and analysis is supported entirely by subscription and is free from advertising.